|

| By Sean Brodrick |

We're in a tumultuous market roiled by inflation, Russia's invasion of Ukraine, the subsequent upheaval in global commodity markets and the end of the firehose of easy money from global central banks.

At the same time, coming out of a two-year pandemic means people have money to spend, and this is what's keeping the economy chugging along.

The market sold off all year as investors braced for the Federal Reserve to hike the benchmark interest rate in an attempt to subdue inflation.

That changed last week. The Fed hiked rates by another 75 basis points. Afterward, Fed Chair Jerome Powell said that the Fed would be data dependent.

Just the hint that the Fed may slow its pace of rate hikes had traders buying with both hands. It seemed to confirm the market bottom that happened in mid-June.

But not so fast!

This week, San Francisco Fed President Mary Daly said the Fed is "nowhere near" done with its efforts to tamp down on inflation. And Cleveland Fed President Loretta Mester echoed this, saying she wants to see "very compelling evidence" that prices are moderating before declaring inflation is whipped.

That sent markets lower on Tuesday, further proving my working theory that anticipation of the Fed's moves — not earnings or the economy — is the biggest driver of today's stock market.

Considering that the Fed can't control major inputs of inflation, including oil prices, we could see interest rates rise for longer than Wall Street is anticipating.

What About Recession?

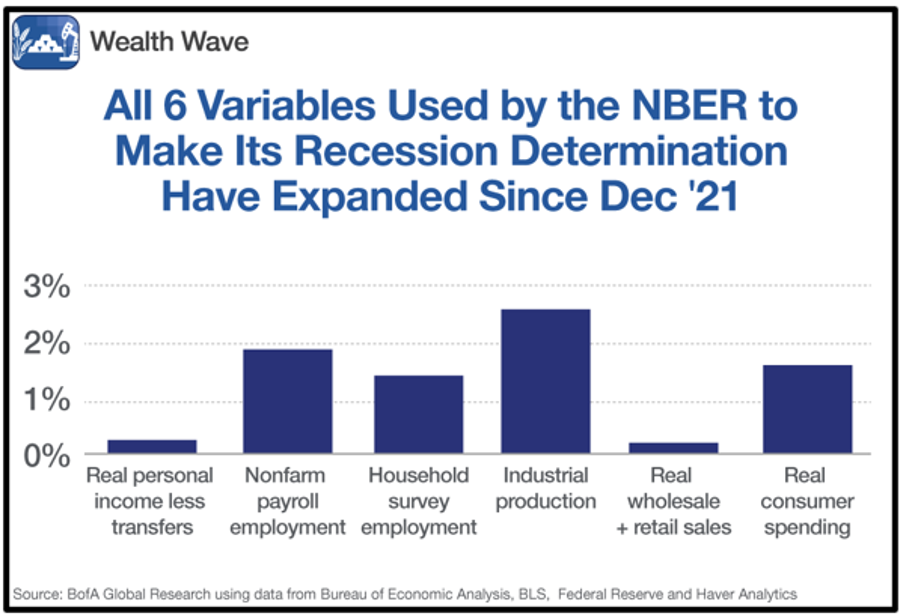

Many of the loudest voices in the market say we're already in recession, even though the six variables used by the National Bureau of Economic Research to declare official recessions have actually gone up since the start of the year!

So, you can see why there's confusion.

However, two of those NBER indicators are employment-related. While unemployment is still near 50-year lows, we're starting to see cracks:

- Job openings hit a nine-month low in June. The U.S. Department of Labor's Job Openings and Labor Turnover Survey dropped for the third consecutive month.

- At the same time, a four-week average of initial jobless claims increased by 79,000 (46%) to its highest level of the year.

Now, maybe this is happening because the Fed's tightening is having the effect that Powell is looking for … or maybe, just maybe, a recession is around the corner.

If so, some high-flying tech stocks could be in for another drubbing. In that case, you should look for a place to hide.

Growth vs. Value

Rates are rising, and it looks like Wall Street was premature in thinking the Fed would end those hikes sooner than later.

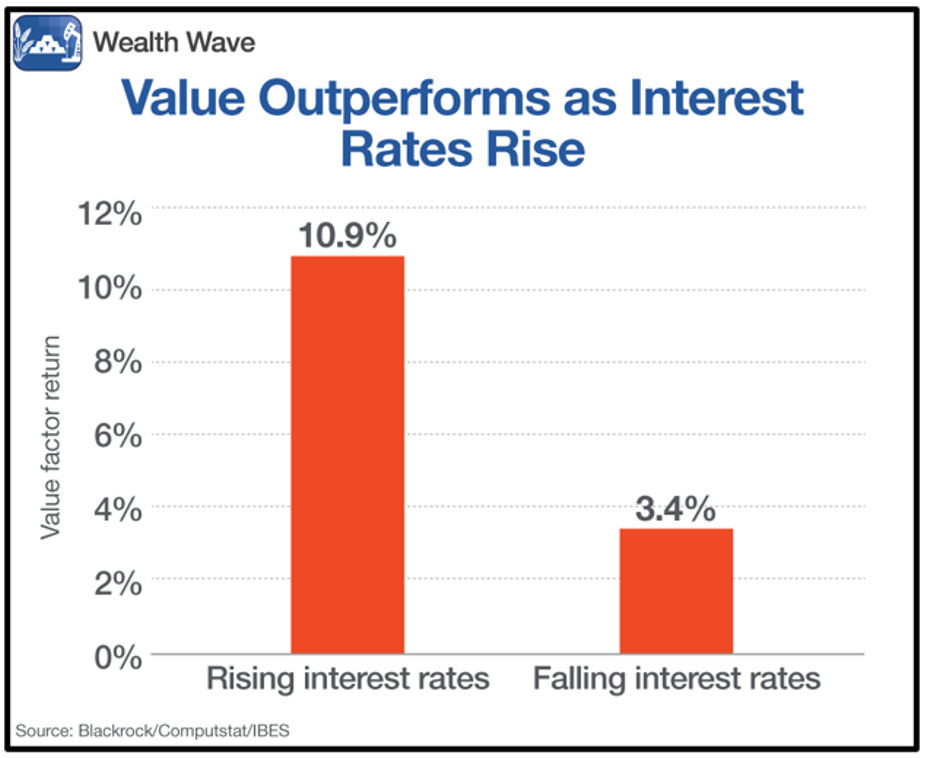

Here's something interesting … over the past 40 years, a sizable portion of value returns has come during periods of rising interest rates, as this chart made based on BlackRock data demonstrates:

As you can see, value stocks perform better when interest rates are going up, as compared to when interest rates are falling. That's probably because the cash flow of value stocks looks more attractive in a rising-rate environment.

And sure enough, we've seen value stocks outperform growth stocks until recently. Thinking that the Fed would end hikes early, traders began buying growth stocks again, but growth stocks are still way too high on a price-to-earnings basis compared to value stocks.

The forward P2E ratio of the S&P 500 growth index is way out of whack compared to the S&P 500 value index.

While that might be justified when interest rates are low, it makes little sense as rates go higher. Many growth stocks must borrow money to keep the lights on while value stocks are cash-flow machines.

Growth stocks got knocked down all through last year and the early part of this year. However, they started to climb compared to value stocks, as the market started to hope that the Fed would slow or stop its interest rate hikes.

I'd say that expectation is in for a dose of cold water, and odds are rising that growth stocks will see another leg down … so value stocks would be the place to hide.

If you want to buy an exchange-traded fund of value stocks, the iShares Core High Dividend ETF (HDV) is a good choice. It's up 3.19% for the year compared to a 13.26% loss for the S&P 500. HDV has an expense ratio of 0.08%, and its recent dividend yield was 3.16%.

But if you want the potential outperformance in individual stocks, you'll have to roll up your sleeves and do your homework … or you can check out the next issue of my Wealth Megatrends newsletter. It'll hit inboxes on Aug. 19 and will include two hot new picks in gold and robotics, both of which are in bullish cycles.

And heck, members are already sitting on double-digit percentage gains on an auto manufacturer, a consumer cyclicals stock and more! Plus, all of those positions pay hefty dividends.

Remember, if the market sells off hard again, a broad market panic will bring all stocks down. On the bright side, dividends act as a cushion and reduce the damage. Also, those big dividends get bigger as the stocks get cheaper, making them look even more attractive to prospective buyers.

While it may be a scary market, looking for a safe harbor in stocks that pay you to own them could be the smartest move you can make.

Last thing: If you'd like my tailored picks in safe-haven sectors, consider joining my service, Wealth Megatrends. Members are currently sitting on open gains of over 15% and 12% while getting paid heavy dividends.

Best wishes,

Sean