|

| By Nilus Mattive |

For the past several years, I’ve been preaching the idea of true diversification — embracing the entire range of unique assets and investments that are now available to everyday investors.

Today, I’m going to give you a few recent real-world examples that demonstrate why that’s such a critical step to take.

And I’m going to give you a full list of the major asset classes as I currently see them along with simple ways to participate in each and every one of them.

But let’s start with a simple question … can a portfolio lose eight out of 10 times and still be safe?

A lot of professional investors — especially if they invest in more speculative things — would say yes.

The key is how well the winners do.

Consider a simple portfolio of 10 investments where:

- Three investments lose ALL of their value …

- Four more lose HALF of their value …

- And two more lose a QUARTER of their value!

Is that something you want to have money in?

The typical investor would say no.

Heck, nine of the 10 positions have lost extreme amounts of money!

Even if I said investment no. 10 was a huge winner — making 1,000% — you might be inclined to avoid this portfolio without taking out a calculator.

But here’s the actual math assuming you had invested equal amounts in all 10 investments …

As you can see, one 10x winner more than makes up for nine very bad investments — bringing the entire portfolio’s return up to a very solid 35%.

What does this have to do with the real world? Plenty.

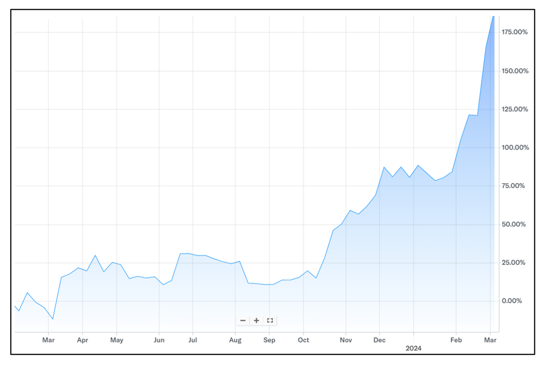

Consider my decision to recommend a “risky” asset like Bitcoin (BTC, “A”) for the Safe Money Portfolio back in February of 2023 — roughly 13 months ago.

Here’s how it has performed since then …

As you can see, this relatively new asset has soared 189% over the past 13 months.

And because of the specific recommendations I made in Safe Money Report — including a well-timed switch from BTC itself into the Grayscale Bitcoin Trust (GBTC) — we are tracking much bigger cumulative gains than that in our own model portfolio.

I’m talking about 240% in little more than a year’s time!

But the bigger, more important point is that allocating some money to Bitcoin has made a massive difference to our larger portfolio’s performance.

To illustrate it very simply …

If a portfolio has 10 stocks that go up an average of 10% each, its return is 10%.

If you substitute one of those stocks with Bitcoin, and the latter goes up 200%, the same portfolio’s return is now 29% — almost three times more!

Meanwhile, if Bitcoin went to zero instead?

The portfolio’s return would have still been 9%!

This is why it can pay to put a “risky” — i.e., an unproven or volatile — asset into a safety-oriented portfolio.

Indeed, if you aren’t investing in a wide range of different assets, you could be greatly hindering your portfolio’s performance.

Worse, you could be exposing it to far more risk in the process.

The Critical Concept of Correlation

Stocks have largely been going up recently. Bitcoin has simply been going up much more. But let’s also remember that things can go down … QUICKLY.

And the reality is that when the stock market really plunges, most stocks fall.

At the same time, other types of assets can hold their ground or even go up while that’s happening.

This is what we mean by non-correlated assets.

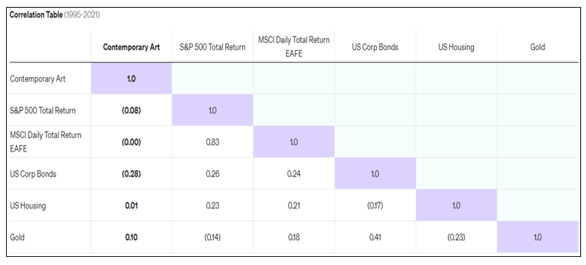

Take a look at this table, which shows how different asset categories moved in relation to each other between 1995 and 2020 …

A positive number shows a positive correlation. A negative number shows an inverse correlation.

Thus, even when the stock market was losing ground, things like contemporary art and gold were still going up.

These are just averages, of course.

But they illustrate another reason why a safety-oriented portfolio should invest in more types of assets than just stocks and bonds.

So, what are the major asset classes?

Admittedly, it’s getting harder and harder to draw clear lines.

For example, a stock market index might include investments linked to real estate, energy and precious metals.

Or somebody might consider crypto to be an asset class rather than breaking out Bitcoin, Ethereum and other tokens as separate categories.

There’s no need to split hairs for today’s discussion.

Let’s just do a quick rundown of some major types of investments with a simple exchange-traded fund that targets each …

- Stocks — Vanguard Total Stock Market ETF (VTI)

- Bonds — Vanguard Total Bond Market ETF (BND)

- International stocks — Vanguard FTSE All-World ex-US ETF (VEU)

- International bonds — Vanguard Total International Bond ETF (BNDX)

- Real estate — Vanguard Real Estate ETF (VNQ)

- Gold — SPDR Gold Shares ETF (GLD)

- Silver — iShares Silver Trust (SLV)

- Commodities — Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC)

- Bitcoin — Grayscale Bitcoin Trust (GBTC)

- Private investments and early stage companies — Invesco Global Listed Private Equity Portfolio (PSP)

If you simply allocated some money to each of these ETFs, you would have a very diversified portfolio.

Collectibles and fine art are really the only other major assets that would still be missing.

Although there isn’t really a good ETF option for those categories yet, there are other investor-friendly ways to get exposure now including platforms like Masterworks and Rally.

Obviously, it’s also possible to go much further still.

For example, inverse ETFs are a great way to profit from outright declines in stocks, bonds, real estate and other major markets.

During the financial collapse in the fall of 2008, I recommended two different positions in the ProShares UltraShort Dow30 ETF (DXD) in my dividend newsletter.

We banked gains of 43.7% and 65.4% by the end of that year, just a few months later.

And we currently have one inverse ETF position in Safe Money Report that is designed to rise as stocks fall.

Likewise, I’m currently recommending a very specialized investment that targets Ethereum, and it’s already up 182% in just five months.

I could keep going even deeper.

But the most important takeaway is that adding different types of investments — even things that are risky on their own — can greatly improve a larger portfolio’s performance, as well as its ability to weather difficult times.

Best wishes,

Nilus Mattive

P.S. If you want the details on a specific investment with very substantial profit potential, then I encourage you to watch this video from my friend and colleague Chris Graebe right now.

As you’ll see, Chris has uncovered a private company that’s applying AI to the oil and gas industry — exactly the kind of unique asset that can bring more diversification to any traditional portfolio.

But fair warning: This is a private company offering a limited number of shares, so there’s a good chance the deal could fill up quickly once it goes live on Thursday, March 14. So, if you’re interested, I recommend clicking here and getting all the details ahead of the launch.