|

| By Sean Brodrick |

One of the most interesting things about today’s volatile, even explosive, silver market is that tomorrow’s leaders will be companies you haven’t heard about … yet.

The good news is I’m going to introduce you to one of those companies today.

This company is part of the "Next Generation" of Mexico’s silver producers.

It is sitting on a massive high-grade resources and moving rapidly toward a construction decision.

This is a stock I’ve already recommended to my Resource Trader subscribers.

You can decide if you want to buy it. Just remember that if you’re not a Resource Trader subscriber, you won’t be alerted when I think it’s time to sell.

Silver Tiger Metals Is Ready to Roar

I had the chance to sit down with Glenn Jessome, President and CEO of Silver Tiger Metals (SLVTF), at the Vancouver Resource Investment Conference to get the latest info on his company.

Glenn brought a massive update to the conference.

The big news for 2026 is that Silver Tiger has officially transitioned into the "permitted and de-risked" category.

Silver Tiger recently received the first new mining permit in Mexico since 2020.

With a newly released Preliminary Economic Assessment (PEA) for its underground project and an updated Pre-Feasibility Study (PFS) for the Stockwork Zone, the economics are staggering.

At current silver prices, the Stockwork Zone alone shows a recent after-tax NPV of $1.2 billion.

Glenn’s focus is now on the "30-month race" to production.

Construction of roads and water wells is already underway, and the company is moving toward a 2,500-tonne-per-day operation.

The surface mining is only half the story.

Last month, the company released a PEA for underground mining.

This PEA showed high-grade resources that run an extraordinary 331.7 grams per tonne silver equivalent.

While operating costs are higher underground, the grade makes it even more sensitive to rising silver prices.

You can get the scoop yourself in my interview with Glenn at the VRIC …

Sure, the price of silver is volatile.

There is a rocky road ahead.

But I’m very bullish on the metal.

And this miner is leveraged to it.

Dirt Cheap Silver & Gold Miner

Let me show you how dirt cheap this stock is if recent gold and silver prices hold.

To be sure, I believe prices are going much higher longer term.

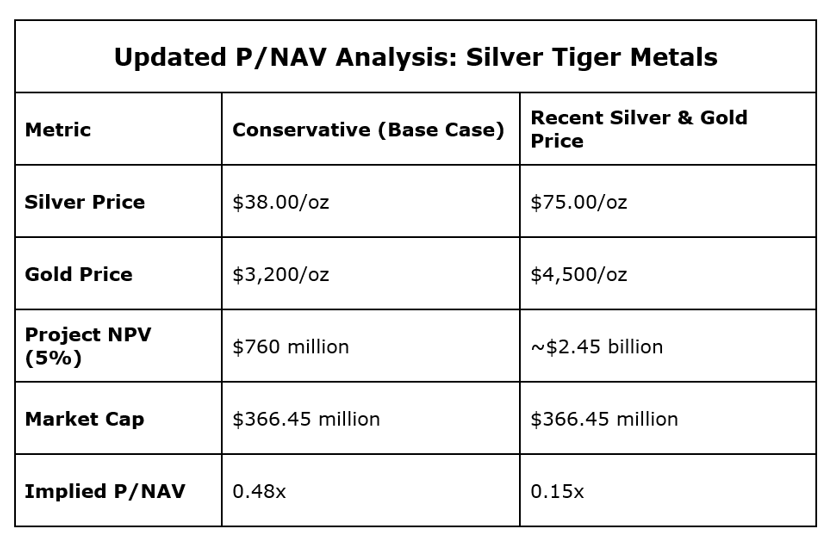

But let’s use recent numbers to calculate a new P/NAV (Price to Net Asset Value).

P/NAV is a critical metric used to determine if a mining company is undervalued or overvalued.

Net Asset Value is the sum of the Net Present Value (NPV) of all the company's individual mining projects, plus cash on hand, minus any debt.

It functions similarly to the Price-to-Book (P/B) ratio used in traditional finance. But it is specifically tailored to the life cycle of a mine.

A P/NAV of 1 means a mining stock is fairly valued.

Using outdated, too-low gold and silver prices, Silver Tiger is already cheap, with a P/NAV of 0.48 …

Because El Tigre is a high-grade, dual-metal project, adjusting to $75 silver and $4,500 gold dramatically increases the Net Asset Value.

And that gives Silver Tiger a recent P/NAV of just 0.15.

At these prices, nearly every ounce of metal produced after the initial $14 to $24 All-In Sustaining Cost (AISC) is pure profit.

I have many other miners that are also trading at ridiculous discounts to their NAV.

To get those and more, check out my latest gold prediction here.

All the best,

Sean