|

| By Gavin Magor |

Happy Labour Day!

The U.S. markets are closed in honor of workers and their contributions.

But if you have some time to do some investment research today, you’ll be pleased to know our ratings never sleep.

That means the 3,944 insurers; 4,488 banks; 4,724 credit unions; 311 digital currencies; 12,646 stocks; 2,938 ETFs and 24,328 mutual funds we proudly rate are always up to date.

In volatile market times, such as we clearly have now, having a sound rating for your investments is paramount.

But your search for safety doesn’t mean you have to sacrifice the potential for profitability.

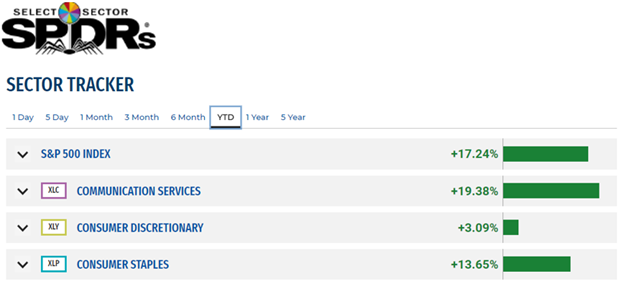

Just look at the sector that historically has performed better than most: consumer staples.

Staples are one of the best performers as a sector this year.

These are companies that produce goods like food, household products and other essential goods and services.

No matter what the market does — whether it flails in an economic downturn or thrives in a robust economy — staples are relatively stable.

If you’re in the market for both, the Weiss Ratings Stock Screener can help you shop for stocks that fit the bill.

Find a Sparkling New Smile

for Your Portfolio

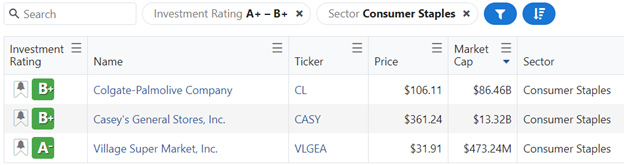

Within a few easy clicks, I was able to generate a list of stocks with “A” through “B+” ratings and then zero in on just those in the consumer staples sector.

Three names came up: Village Super Market, Casey’s General Store and Colgate-Palmolive.

All are certainly worthy of your attention. Today, the name I really want to talk about is Colgate-Palmolive (CL).

The name has been within our “Buy” range since Feb. 20.

For context, out of those 12,646 stocks, only 50 currently have a rating with our “A” through “B+” range.

Since Colgate-Palmolive was awarded its last “Buy” rating, shares are up 27%, and that’s not even including its solid dividend, which is currently yielding 1.85%.

It’s about as “consumer staples” as you can get as the stock has famously made its toothpastes, mouthwashes, toothbrushes and soaps, among many other products, since 1806.

Let’s take a look at its one-year chart from the Weiss Stock Screener page:

What we can see above is a steady and stable price progression over the past year. That is one sign of a “safe” name in a highly volatile market.

So, if Colgate-Palmolive seems like a potential fit for your investing needs, I encourage you to further explore the name.

And as you can see in the above image, you have a plethora of investment research just one click away.

Things like our full ratings history, dividend history, similar stocks, pricing, key stats, full profile and even financials are all right there!

So, don’t be scared, just get to it. Doing your own investment research with the Weiss Ratings data’s wind behind your sails will benefit you greatly.

Whilst it’s a holiday and the markets are closed, it is perhaps a good day to start doing just that if you have the time.

The next major step for what I would call “safe money” stocks is by taking a look at my colleague Nilus Mattive’s Safe Money Report.

Triple Digit Gains with

Safe Money Strategies

If somebody told me it’d be possible to achieve impressive triple-digit gains within six months on two different trades, I would say sign me up immediately.

Well, that’s exactly what Nilus was able to achieve with his savvy investment strategies and well-balanced investment recommendations.

So, even though the Weiss Ratings stock screener is an amazing tool, also inquiring about our more tailored investing strategies for a helping hand can go a long way.

I urge you to check out Nilus’ Safe Money Report by clicking here.

Enjoy the holiday. And I’ll see you again next week.

Cheers!

Gavin