|

| By Sean Brodrick |

The drone revolution can add some healthy buzz to your portfolio.

Commercial drones are delivering on their promised potential.

Meanwhile, global defense budgets are surging, and Washington is shoveling billions into unmanned systems.

Result: The drone market is taking off at a double-digit growth rate.

Let’s start with commercial drones, which is the bigger market.

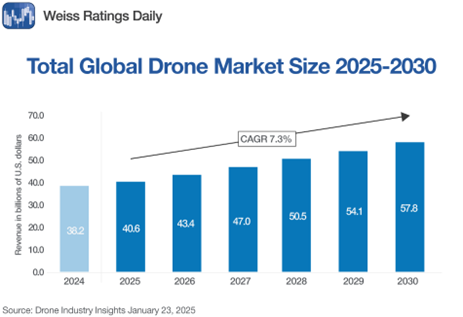

Industry specialist Drone Industry Insights predicts the market will increase from approximately $40.6 billion in 2025 to around $57.8 billion by 2030.

That works out to a ~7.3% compound annual growth rate (CAGR) in that six-year period.

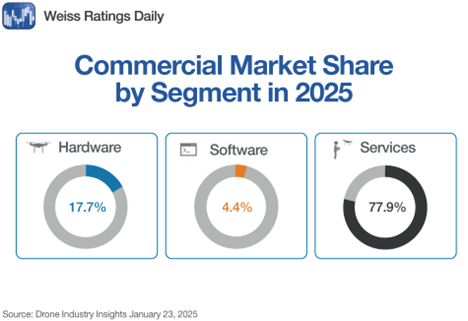

Meanwhile, Drone Industry Insights also breaks down the commercial drone market by segment …

The largest segment of the commercial drone market is the commercial service market. It is expected to generate $29.4 billion this year.

The fastest-growing segment is commercial hardware, valued at $6.7 billion in 2025.

The commercial software segment lags behind and is expected to reach sales of $1.7 billion by 2025.

What’s Powering Commercial Drone Growth

Four concepts are taking off right now:

Beyond Visual Line of Sight (BVLOS): Regulators are moving toward routine BVLOSapprovals.

This opens up opportunities for economies of scale in infrastructure inspection, logistics, agriculture and public safety.

The FAA’s 2025 BVLOS proposal and program extensions are pivotal.

Remote ID: This acts as a digital license plate for drones.

It broadcasts a drone’s identity, location and operator information while in flight. That way, authorities and other airspace users can know who is flying what and where. Europe has its own version of this called U-space.

In any case, it enables more drones to fly in the skies because digital traffic services can handle them.

More Boom for the Zoom: Drones cut cost and risk in energy & utilities, construction, mining, agriculture, insurance and public safety.

Autonomy + AI: This enables route automation and large-fleet operations, which is key for recurring inspections & security.

That’s all well and good.

However, in my premium Supercycle Investor publication, we’re targeting select drone stocks as part of our next-generation defense tech portfolio.

Why? Two reasons:

A One-Two Punch of Profit Potential

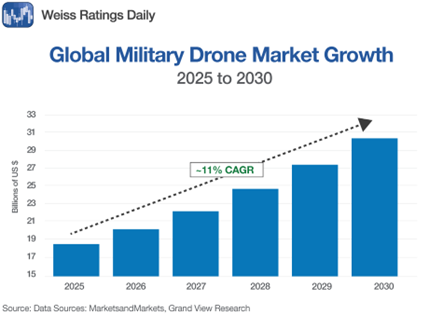

First, while the commercial drone market is growing at ~7.3% per year, the defense-sector drone market is growing at ~11% per year.

Second, the War Cycle is driving defense spending higher.

I’ve told you about the War Cycle many times (here’s an example) and how it’s ratcheting higher.

More conflict means countries, including the U.S., spend more money on weapons.

Recently, we saw the White House’s FY 2026 discretionary budget request allocate $1.01 trillion for defense spending, a 13% increase over 2025 levels.

Washington is pouring billions into the technologies that will define the next decade of warfighting, including drones.

That is what is helping the military drone market take wing.

A middle-of-the-road estimate of the compound annual growth rate in the military drone market is 11%.

It’s fueled by rising defense budgets, technological advancements in AI and autonomy and increasing geopolitical tensions.

The U.S. is 39% of the military drone market — for now — and the race is on as various powers vie to be “top gun” when it comes to military drones.

After all, Ukraine showed us how easy it is to destroy a tank costing millions of dollars — or an oil depot costing tens of millions of dollars — with a $1,000 drone.

And more conflicts are brewing all the time — around Taiwan, across the Middle East and more.

In 2025, the U.S. military's drone budgets reached $13.7 billion. That number is forecast to more than double by 2030, blasting past $28 billion.

That’s a 12.9% compound annual growth rate, one of the fastest in the entire defense sector.

New legislation, such as the “One Big Beautiful Bill Act,” signed in July, poured another $33 billion into drones and AI systems.

The Air Force’s Collaborative Combat Aircraft program alone is gobbling up nearly $9 billion between now and 2029, building fleets of “loyal wingman” drones to fly alongside F-35s and the Next-Gen Air Dominance fighter.

What’s driving the surge?

- AI autonomy: Next-gen drones are taking off, navigating and executing missions with minimal human oversight.

- Swarm tactics: Networked drones that fly in formation to overwhelm defenses have proved terrifyingly effective and are moving from lab demos into procurement pipelines.

- New thinking on designs: The Pentagon wants cheap, expendable kamikaze drones by the thousands. This is a direct lesson pulled from Ukraine’s battlefield. A fresh $1 billion in funding is earmarked for scaling exactly that.

- Counter-Unmanned Aircraft Systems: In other words, these technologies and programs are designed to detect and neutralize hostile drones.

- Domestic production: Tariffs and procurement rules now box out foreign suppliers. If it’s not American-made, it doesn't make the cut. Luckily, I have a great list of domestic drone manufacturers.

That’s rocket fuel for investors.

How to Play This

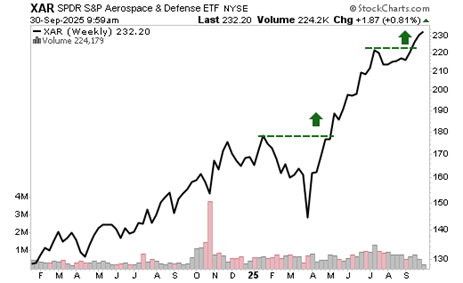

My recommendation to play this trend is the SPDR S&P Aerospace & Defense ETF (XAR).

Check it out — this thing is taking off.

After breaking out in April, XAR rose 25% before taking a breather again.

It’s breaking out again — who knows how high it will go?

XAR holds a basket of defense and aerospace stocks.

Its top holding is Kratos Defense & Security Solutions (KTOS).

And Kratos is currently racking up a 100.9% open gain for Supercycle Investor readers. Not bad for a position we added in June!

You could also do the hard work of researching individual drone stocks.

That’s what I’ve done for a slew of recommendations for Supercycle Investor. All those drone picks are flying high.

But you know what? They — and funds like XAR — will fly much higher.

All the best,

Sean

P.S. I’m not done scouring this booming market for opportunities.

If you want to join my readers on this path toward more triple-digit gains, click here.