I love finding small-cap ideas with big growth potential.

The next big buying opportunity for small-cap cryptos (altcoins) arrives sometime next month.

But right now, I see an undervalued growth opportunity that trades right on the NYSE.

You can buy it in just about any brokerage or retirement account.

Even better, it’s an opportunity you can jump on today.

And I’m thrilled to deliver it as your fourth Weissgiving gift!

First, here’s why 2026 should be a vibrant year for select stocks …

And why the one you’ll get today should really shine.

This Indicator Has Never Failed

2026 should see strength because of how the market is ending 2025.

Rarely does the S&P 500 fall more than 10% at any point in a calendar year …

Like it did back in April …

And still finish positive …

Like it’s set to do this Wednesday, New Year’s Eve.

Before this year, this happened only six times.

Every single time, the following year delivered a positive return, averaging 18%.

The table below shows each of those periods and what followed.

The takeaway is not that history guarantees outcomes.

Rather, it suggests that markets tend to price in the next cycle … well before it becomes obvious.

With this bullish setup, I went looking for an undervalued powerhouse of a stock.

And I found a literal powerhouse of a stock!

Power for the AI Age

AI is one of the globe’s hottest sectors.

But successful AI companies need support to succeed.

And one of the most overlooked constraints of AI, cloud computing and data centers is not software or chips.

It is power.

Reliable, always on, baseload power.

That brings us to today’s unconventional small-cap idea.

Its Stock Ticker Tells Its Story

NuScale Power (SMR) is one of the earliest companies to move small modular reactor, or SMR, technology through the U.S. nuclear regulatory process.

Instead of building massive, custom nuclear plants, NuScale designs standardized reactor modules.

These are manufactured in factories and assembled on site.

Each module produces 77 megawatts of electricity.

A typical NuScale VOYGR plant would consist of four to 12 modules, depending on customer needs.

One of Those Customers? The U.S. Government!

In May 2025, the White House issued four executive orders aimed at modernizing and ramping up the domestic nuclear fuel supply chain.

That same month, NuScale received approval from the U.S. Nuclear Regulatory Commission for its uprated 77-megawatt reactor design.

This is a meaningful milestone.

It allows potential customers to move beyond conceptual studies …

And into detailed licensing and construction planning.

Why This Matters Now

Electricity demand is changing in both scale and reliability requirements.

AI-driven data centers require massive amounts of continuous, 24-hour power.

Yet, policymakers continue to push for more clean and renewable energy alternatives.

So, even as power demand grows, coal plants continue to retire across the U.S. and Europe.

NuScale wants to meet our power needs in this AI age.

NuScale’s approach is to deliver low-carbon power in smaller, more flexible increments than traditional nuclear plants.

Its reactors rely on passive safety systems.

These are designed to simplify operations and reduce emergency planning requirements.

Plus, they can be built on existing industrial locations …

Including former coal plant sites.

Market Expectations and Reality

NuScale is unlikely to have fully operational reactors before 2030.

But that does not mean the stock will wait until 2030 to move.

Remember, equity markets are forward-looking. They often price in future outcomes.

Sometimes years in advance.

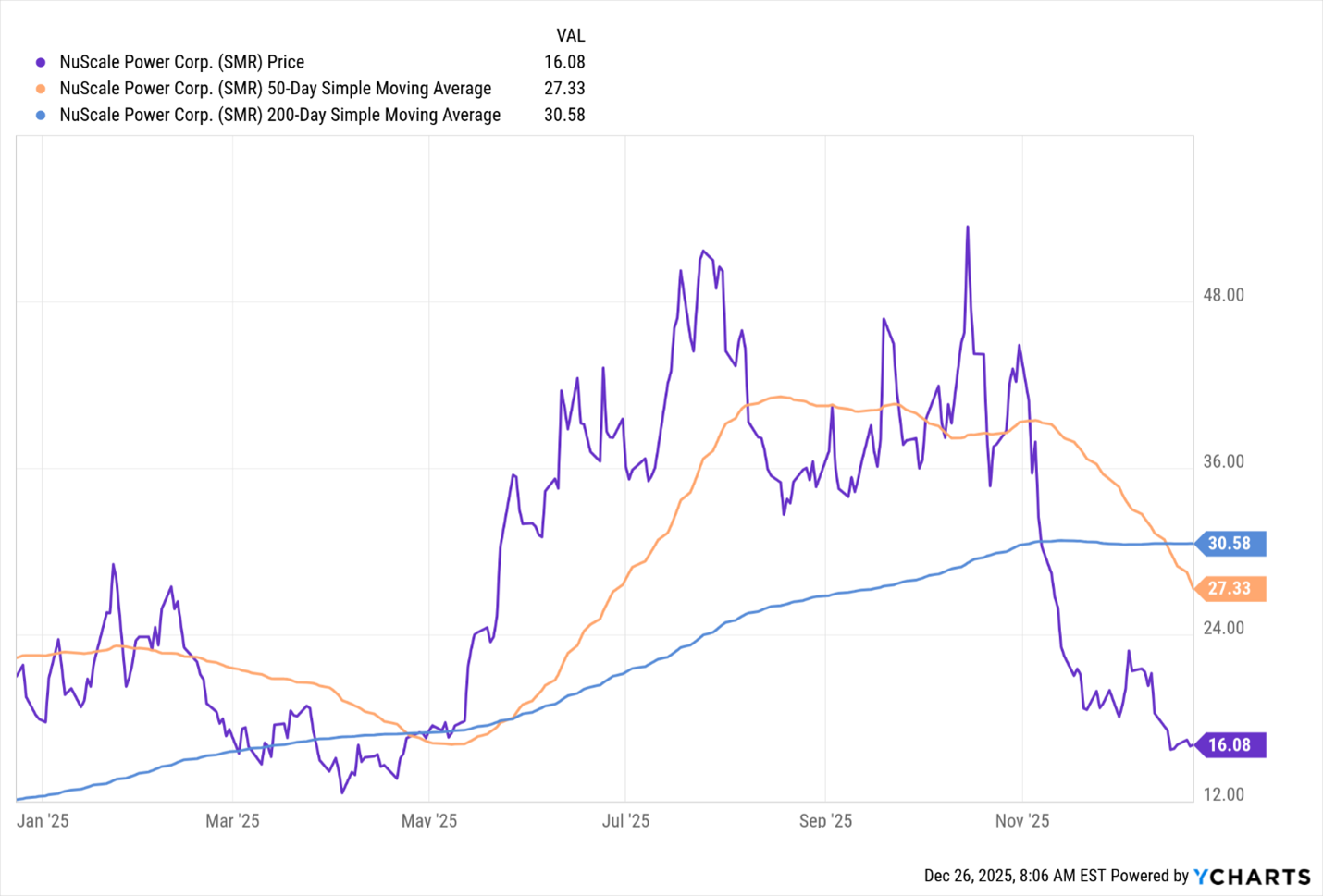

That dynamic helps explain NuScale’s history of sharp rallies followed by repeated drawdowns in the 60%-70% range.

Expectations rise.

Reality sets in.

Sentiment resets.

This is not a near-term earnings story.

Rather, it’s a speculative, long-duration investment idea.

One driven by narrative, policy support and project milestones.

Why I’m Personally Scaling into NuScale

As mentioned, SMR shares have seen steep corrections after strong rallies.

For full transparency, I have already accumulated a small position on the latest correction.

But its current price action suggest the stock could move deeper into my preferred accumulation range.

If NuScale fits your investment strategy, a gradual entry approach makes sense given the volatility.

Its chart suggests this is a patience-driven setup.

Based on prior trading ranges and historical support …

The $8-$14 area represents a reasonable zone to consider scaling in.

That said, small-cap growth opportunities are still volatile assets. Sharp moves in both directions should be expected.

Bottom Line

NuScale has moved beyond the concept stage, but it remains years away from commercial validation.

This setup gives you a unique opportunity to enter as SMR trades at a discount with a strong year for the broad market likely ahead.

Over the next 12 to 24 months, performance will likely be driven by policy developments, project milestones and the narrative around AI-related power constraints.

As those themes persist, NuScale could revisit or even exceed prior highs …

And it could do so, well before reactors come online.

Speaking of coming online, your sixth Weissgiving gift arrives in your inbox bright and early tomorrow.

Nilus Mattive, your Safe Money expert, has a critical mineral play that the U.S. government also has a vested interest in.

He also owns a substantial position in that stock.

You won’t want to miss Nilus’ note. Stay tuned for that.

Best wishes,

Mark Gough

Editor

Next Crypto Superstars

P.S. I have another idea with a small price tag for you …

It’s a price tag of zero, actually!

From now through Wednesday, we’re giving away one FREE month of Weiss Ratings Plus!

It’s the ultimate data-driven investment tool. That’s because it’s the key to unlocking Weiss’ 10+ terabyte financial database.

Like with NuScale, though, time is a factor in this decision.

That’s because, when you sign up today, you lock in our lowest monthly price ever … $10 … for February …

And for the life of your membership!

The price of Ratings Plus goes up to $19 on Jan. 1.

While our team believes Ratings Plus is worth even more than that …

I’d rather see you get in at a discount.

Claim your free month today AND lock in our monthly low price of $10 for the AI Age … and beyond.