|

| By Sean Brodrick |

America’s economic growth isn’t being powered by factories, shoppers or homebuilders anymore.

It’s being powered by data centers.

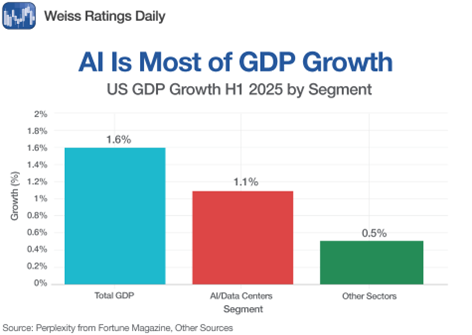

In the first half of 2025, Harvard economist Jason Furman calculated that 92% of U.S. GDP growth came from the technology sector — mainly AI infrastructure and data-center investment.

Strip that away, and the broader economy staggered along — posting roughly half a percent growth at best.

That means nearly all of America’s economic momentum now flows through a single pipeline: AI spending.

A One-Trick Economy

Total real GDP grew at an annualized 1.6% in early 2025. But 1.1% came from information-processing equipment, software and data-center investment.

Fortune, Bloomberg and JPMorgan all confirm the same story …

The AI buildout — from hyperscaler campuses to the chips that feed them — is propping up an otherwise stagnant economy.

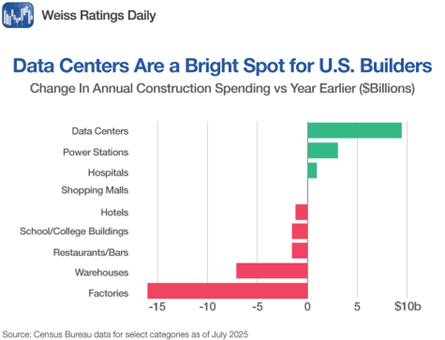

Meta, Microsoft and Alphabet alone spent $78 billion on capital projects in one quarter, sparking a construction boom in what Bloomberg calls the new “giant sheds” of the American landscape.

Private-sector data-center construction hit an annualized pace of $41 billion by midsummer — less than 5% of all private construction.

Yet, it delivered one of the biggest boosts to GDP in the nation.

Corporations are projected to plow $400 billion into AI technologies this year.

And the Big Tech titans now make up nearly one-third of total U.S. market capitalization.

That concentration of power — and economic dependence — is unlike anything since the Dot-Com Bubble.

The Wealth Effect

One of the upsides of AI is that it is driving a massive wealth effect.

JPMorgan analysts estimate that a basket of 30 AI-linked stocks generated over $5 trillion in new paper wealth in the past year, boosting consumer spending by an estimated $180 billion.

That’s roughly one-sixth of total consumption growth.

However, it’s built on tech-stock exuberance, not wage gains.

If AI enthusiasm ever fades, that tailwind turns into a downdraft.

The U.S. would lose both its investment engine and its consumer wealth effect — a dangerous double-hit.

When the Boom Meets the Pink Slip

Behind the glitter of trillion-dollar valuations lies a darker truth: AI is accelerating corporate layoffs.

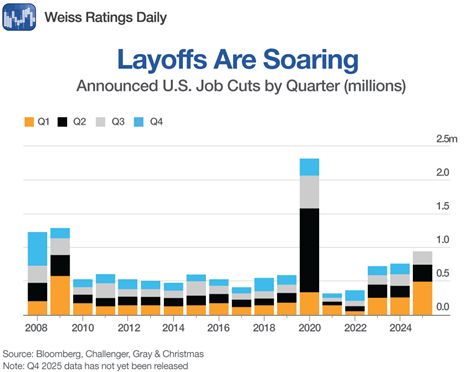

Challenger, Gray & Christmas counted 950,000 U.S. job cuts through September — the highest since 2020.

Amazon (14,000 jobs), Target (1,800) and Starbucks (900) all announced layoffs this year, many citing efficiency gains from automation.

Retailers are hiring fewer people than at any time since the Great Recession.

Seasonal hiring plunged 75% — only 100,800 holiday jobs were announced versus 401,850 last year.

Economists say companies are losing their fear of firing, convinced AI can pick up the slack.

A Stanford study found early-career professionals in AI-exposed fields have seen a 13% drop in employment since 2022.

Nearly 37,000 layoffs this year were directly attributed to AI automation.

Goldman Sachs estimates full adoption could ultimately displace 6% to 7% of the U.S. workforce — roughly 9 million jobs.

Outside of the pandemic layoffs of 2020, the first three quarters of 2025 already had more layoffs than any year since the Financial Crisis.

The Sum of All Fears

Some believe the transition will be much worse.

Anthropic CEO Dario Amodei warns that half of entry-level white-collar jobs could disappear within five years, pushing unemployment into double digits unseen since the Great Depression.

Others, like futurist Roman Yampolskiy, go even further — envisioning a world where automation replaces nearly every occupation, causing the labor market to collapse.

Even if that proves too apocalyptic, the direction of travel is clear: AI investment is booming, while human employment is flattening.

America’s new growth engine could soon start running without most of its drivers.

The Bottom Line

AI has become both the lifeblood of U.S. growth and a looming threat to its workforce.

It’s adding about a whole percentage point to GDP — and eroding job security.

If this imbalance persists, the “AI revolution” could look less like a productivity miracle and more like a profit-driven restructuring of the entire labor market …

A boom that creates prosperity for capital, but peril for workers.

In short: AI is keeping America’s economy alive — but it might be killing the jobs that once sustained it.

Protect Yourself & Profit

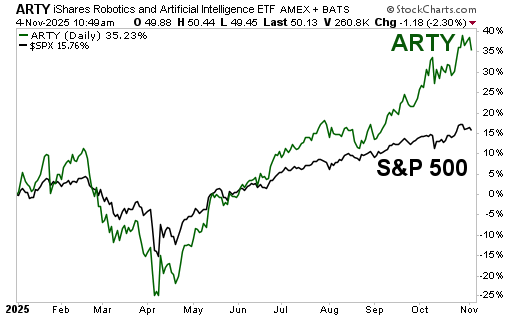

The iShares Future AI & Tech ETF (ARTY) provides exposure to AI and leading-edge technology.

It has plenty of volume and an expense ratio of 0.47%.

And it’s kicking the S&P 500’s shiny behind, more than doubling the leading index’s performance this year.

ARTY’s portfolio is tightly focused on companies crucial to the AI value chain, including infrastructure, hardware and software.

Its top holdings are a blend of AI leaders and enablers, including Vertiv Holdings (VRT), Advanced Micro Devices (AMD), Super Micro Computer (SMCI) and Nvidia (NVDA).

We don’t know precisely what AI will do to the jobs market, though it doesn’t look good.

We do know that AI investment is booming, and AI stocks are along for the ride.

You’d be wise to ride that bull while it lasts and use the profits to protect you against potential hard times to come.

All the best,

Sean

P.S. There’s a third threat for investors, specifically. We have a massive retirement income problem.

That’s why I joined my fellow analysts last week to find out how to get a large income from places you don’t normally associate with income …

Including the very AI and tech stocks held by ARTY.

Unfortunately, the replay will soon go offline. This might be one of your last chances to see what we found out.