|

| By Jon Markman |

During the past two weeks, one of the largest companies in the world transformed into a nimble startup, and investors rewarded the business with billions in shareholder value.

Executives at Microsoft (MSFT) announced Tuesday that the Redmond, Washington-based company will formally incorporate AI into its internet search business. Shares jumped 4.2%.

Investors should take another look at Microsoft.

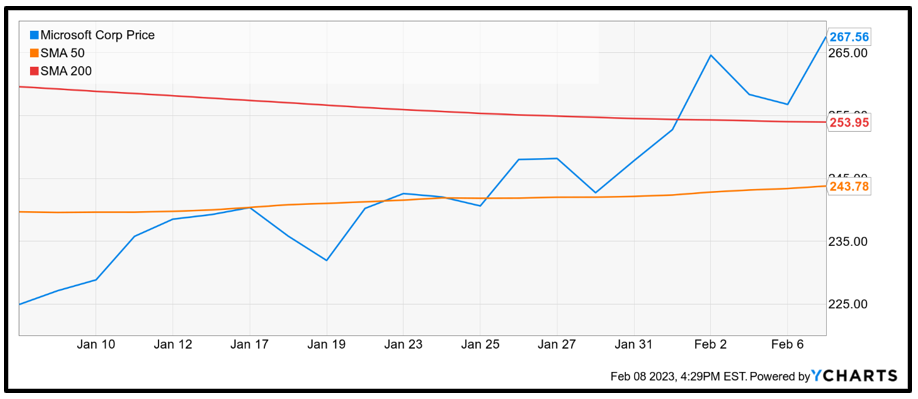

Click here to view full-sized image.

The gains on Tuesday are only the latest surge in what has become a terrific two weeks for shareholders. Microsoft stock is up 10.3% since the company announced on Jan. 23 that its partnership with OpenAI was being extended.

The $10 billion agreement will bring OpenAI tools to Microsoft software products — including Bing, its internet search engine. Shareholders have earned a cool $186 billion since the formal announcement.

Objectively, the math does not add up.

AI is not new, OpenAI is not best-in-class technology and Bing is not even in the same galaxy as Google Search. According to a report at StatCounter, Bing commands only 3% of the internet search engine market, while Google Search holds 92%.

The Force Multiplier

Indeed, the force multiplier in all this is Microsoft, with its deep pockets and considerable scale.

Investors have suspended disbelief.

None of this is an accident. It’s all a masterful sleight of hand to distract attention away from weakness in enterprise spending, the genesis of Microsoft's core business.

CEO Satya Nadella said in January that enterprises are refocusing their workloads in an effort to cut spending. This process is expected to last at least two more quarters and should keep revenues during Q3 in the range of $50.5 billion–$51.5 billion, implying growth of only 3%, which is far below earlier forecasts.

By contrast, ChatGPT — the OpenAI chatbot coming to Bing — is full of promise. The technology has been endlessly hyped by the media as the next great breakthrough.

Analysts at UBS said last week that ChatGPT is on track to reach 100 million monthly active users in only two months. This is a faster trip to that milestone than that of TikTok, the social media sensation.

The appeal of ChatGPT — or Chat Generative Pre-Trained Transformer — is its ability to have human-like conversations. The software uses AI to train extremely large language models culled from the internet. That data is then manipulated into human-like conversations, with surprisingly complex answers. ChatGPT feels like the future on information gathering.

Nadella claims that all computer interaction in the future is going to be mediated with these helping agents, which he calls “co-pilots.” Investors see them as big earnings drivers.

Chatbots and AI systems, in general, use a lot of computing power. Thankfully, Microsoft has a solution. Its Azure cloud computing business is the fastest-growing large cloud operator in the world.

Its partnership with OpenAI ensures that all those chat queries will happen inside Microsoft cloud data centers, mostly alongside Microsoft digital ads. It’s the calculus that is driving the share price higher.

Now, some of this is hype.

Many new technologies have come and gone since the pandemic. From leisure space travel to decentralized finance, the ideas have been big, yet too far off in the future to make economic sense. AI is different. It is not new or radical. In short, the time for AI has come.

This is mostly due to the massive investment in infrastructure by firms like Amazon.com (AMZN), Alphabet (GOOGL) and Microsoft. They are spending billions every year to build supercomputers and storage facilities in the cloud. These facilities are the brains behind AI — and they are lucrative businesses.

Microsoft cloud revenue is on a $110 billion annual run rate. And Azure, a key component, is growing 31% year over year.

At around $272 at the time of writing, shares trade at 25x forward earnings and 9.9x sales. While these are lofty ratios, they are reasonable given the near-term hype over AI.

Microsoft shares could easily trade to $285 in the near term and $315 by the end of the year. The giant software business is behaving like a startup. Higher prices will follow.

That’s it for today. I’ll have more for you real soon.

Thanks for reading,

Jon D. Markman

P.S. The Federal Reserve’s actions should have investors concerned for their financial well-being.

Starting as soon as May 2023, their insidious “Fed Control” powers could go live, which means that any accounts linked with the U.S. banking system could soon be at risk for surveillance of all transactions … or worse.

Investors who want to take action to protect their money should click here for four steps to take now to stay safe and grow their wealth.