|

| By Jon Markman |

Most investors are doing it wrong. They are so busy searching for the next hot stock trend that they miss the bigger picture.

Good investing is about buying good businesses, not trends.

The best way to show you what that means is to look at one of the best businesses out there in its field …

Executives at Stryker (SYK) reported last week that Q2 sales grew above forecast and that the outlook for its hip and knee replacement business continues to brighten as the population grows older and more obese.

Stryker is a terrific business with undeniable secular tailwinds.

Innovation and vision are in the corporate DNA at Styker.

As a student in 1939 at the University of Michigan, Homer Stryker invented the walking heel, a rubber insert for hard plaster casts.

Click here to see full-sized image.

Earlier, he developed the Wedge Turning Frame, a special gurney that allowed caregivers to easily turn patients with serious back injuries.

By the time Stryker was a practicing surgeon in Kalamazoo, he had a research lab in the basement of his home and a profitable side business designing tools to make his day job easier.

That business was incorporated in 1946, and more practical innovations followed.

Despite his ambition, the company’s namesake would be amazed at how far his methodical streak of invention and solving health demands would take his venture.

Stryker’s Core Business Is in High Demand

Kevin Lobo became chief executive officer in 2012.

Within the first two years, his team completed seven major acquisitions. These included Pivotal Medical, a hip arthroscopy business; Small Bone Innovations, a Pennsylvania-based firm that specialized in small bone and tissue repair; and Mako Surgical, a fast-growing manufacturer of robotic arms used by orthoepic surgeons for hip and knee replacement surgery.

The buyouts gave Stryker vertical integration in orthopedics, a valuable competitive advantage.

The Kalamazoo, Michigan, company made the implants, developed the software that made hip and knee replacement surgeries cost effective and built the hardware surgeons used to install the artificial joints.

The strategy was prescient. Knees and hips are the largest joints in the human body. They support body weight and — as Americans are becoming more obese — the number of chronic problems is on the rise.

The American Joint Replacement Registry Annual Report includes data on2.8 million hip and knee procedures that occurred in the United States and District of Columbia in 2022. That’s up 14% year over year.

Lobo was interviewed last week on CNBC following his company’s Q2 financial results. He wanted to tell the story of Stryker’s secular tailwinds. But that’s not what the interviewer had in mind.

During the quarter, the company had spectacular momentum in its trauma, knee, hip and spine divisions. Sales came in at $766 million, $562 million, $393 million and $296 million, respectively — all double-digit increases from a year ago.

However, the CNBC interviewer only wanted to talk about what was coming next, perhaps in artificial intelligence, which is the current hot trend.

This is a mistake made by most investors.

Why Focusing on Hot Trends Misses the Point

Too often, investors and the financial press are concerned only about capturing the current hot trends. In the process, they miss the key, longer-term drivers of the business.

AI is definitely an important concept, and the proliferation of innovative technologies will trickle down to every sector of the economy.

Today, Stryker is investing in AI to help surgeons with patient scans. In the future, Lobo sees AI as a component of virtual and augmented reality headsets worn by surgeons as they perform delicate procedures.

AI will help Stryker improve margins and give physicians and patients better outcomes.

That’s all true … yet it is not the reason investors should be buying shares.

Secular trends persist over time. Replacing hips and knees is a secular trend because the American population is growing older, as the baby boomer generation becomes elderly.

Sadly, changes to diet and exercise regimes over time have led to an obesity crisis that shows no sign of abating.

Obesity in the U.S. grew to 41.9% in 2017, up from 30.5% in 1999-2000, according to the Centers for Disease Control and Prevention.

During the same time frame, instances of severe obesity increased from 4.7% to 9.2%.

Stryker is the clear leader in the medical devices sector, with gross margins of 63% and a solid 8.5% return on invested capital.

That’s the story. Yes, AI will contribute … likely in a big way to future margins and profits.

However, the company’s core business — solving key, inevitable problems in millions of patients lives — is why you should look at the company today.

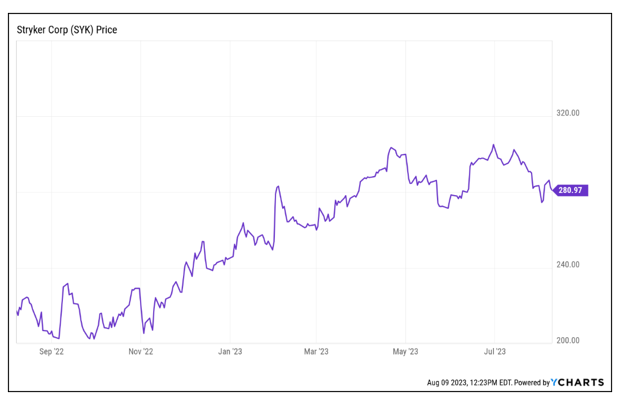

Stryker stock trades at 24.6 times forward earnings and 5.6 times sales.

Click here to see full-sized image.

That’s cheap — despite recent price increases — given that executives have put the company in position to profit from a wave of future joint replacements.

This is a company that profits because of its chief business and product suite. A hot trend like AI might be a subject that gets better ratings for CNBC. But that only adds to the real reason Stryker will continue to thrive.

All the best,

Jon D. Markman

P.S. Media’s focus on hot trends is a problem for more than just well-built businesses. Major disasters like “America’s Great Income Emergency” lack coverage too. To fill you in on that, I urge you to click here to see what the media hasn’t told you.