|

| By Gavin Magor |

Do you believe the banks or the bots? That’s the billion-dollar question today.

Before I attempt to answer it though, let me first acknowledge that I’ve been talking quite a lot lately about our brand-new AI-infused technology and its use in picking stocks for our Weiss Intelligence Portfolio, or WIP for short.

So, I apologize to you if you’re tired of my mug. I just can’t help myself when it comes to this stuff.

AI is really just now raising the interest of consumers, but my team of researchers and analysts have been intimately familiar with the technology for some time. In fact, they spent eight years back-testing the use of AI in conjunction with Weiss’ already successful investment models.

Our goal was to see if and how much AI could boost our portfolio performance. The results didn’t disappoint. The testing concluded that by adding our brand-new AI Performance Booster, as we like to call it, to our current model’s performance, it improved by 2.077 times.

And we wasted little time in putting AI to work in selecting stocks that can best grow and protect subscribers’ assets. It’s only been applied in the WIP service for a little over a week now, so we can’t boast about enhanced gains just yet — but I’m convinced it won’t take long.

While we’re waiting for boasting rights on WIP gains, I decided to turn to AI for help in identifying which sectors would outperform the S&P 500 over the next 90 days.

The answer threw me for a loop, and I bet you’ll agree.

AI’s suggestions are completely contrary to what CEOs from some of the biggest banks are saying as Q3 earnings announcements began in earnest a little over a week ago.

With very few exceptions, bank after bank reported great earnings. Yet, instead of boasting about all the money that’s rolling in, they focused equally on all the money that’s rolling out.

Their warnings were clear as day …

Deposits Are Falling

That’s right, and this time the decrease in deposits is not for the same reasons customers yanked assets after three regional banks failed early this year.

Back then, balances were transferred to less-vulnerable banks with capital-intensive balance sheets capable of handling massive withdrawals.

That’s no longer the case, and falling deposits aren’t just problems for small- and mid-sized banks.

Deposits across the board continue to decline, and unsettling consumer behaviors suggest there’s trouble on the horizon.

Consumers are finally feeling the pain from higher borrowing costs and high prices. The most obvious result has been dwindling and depleted savings accounts. It also looks like Americans are turning to plastic more often, having racked up more than $1 trillion in credit card debt.

Now they’re burning through their pandemic savings — the $814 billion in COVID-19 financial relief that the U.S. government doled out to impacted households in 2020-2021. That’s on top of extended and increased unemployment checks, a temporary stoppage of student loan payments and protection against eviction for renters who can’t pay landlords … to name a few benefits.

And a Fed study recently warned that the “excess savings” accumulated as a result of all of the above could run out by the end of Q3, or Sept. 30. While the September retail report continued to show strong consumer spending for the month, October and beyond could paint a much duller picture.

Consumer spending is the backbone of a flourishing economy. So, any substantial shift in confidence could take the wind out of the economy’s sails and blow it way off course.

That’s precisely what banks are warning us about. So, if you believe the banks’ scenario, which includes a severe downturn in the economy, you’d assume that defensive, non-cyclical stocks would outperform the market over the next 90 days.

However, that’s contrary to what our AI modeling suggests will happen over the same period.

When we asked AI to determine the sectors likeliest to outperform the broad market over the next 90 days, the industrials and consumer discretionary sectors wound up first and second, respectively.

Thirty-nine out of 106 stocks, or 37%, fell into the industrials category while 18 out of 106 or 20% were consumer discretionary stocks.

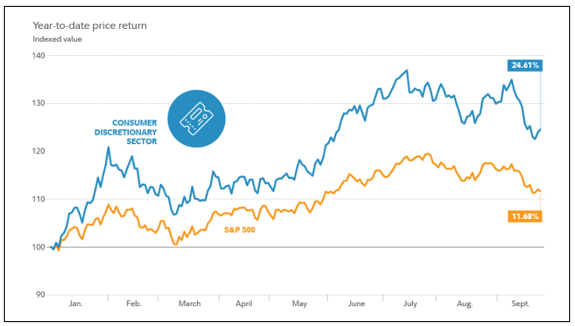

Both sectors usually perform best when the economy is strengthening with consumer discretionary, which is up big-time already this year — a great example of what an odd year 2023 has been so far for the stock market.

As its name suggests, the sector encompasses companies that sell nonessential goods and services to consumers — think “wants,” not “needs” — like clothes, new cars and cruise trips. Because these are precisely the types of goods and services that customers tend to cut back on first in a pinch, the sector typically lags when the economy slows, and recession risks are high.

Yet instead of lagging, the sector has surged, gaining about twice as much as the S&P 500 year to date through late September.

Click here to see full-sized image.

Looking ahead, if the economy were to slow further or enter a recession, the sector could struggle.

On the other hand, a recession could set the sector up for outperformance during an eventual recovery. After all, consumer discretionary stocks have historically tended to lead the market when the economy shows the first signs of improvement.

And it’s also possible that this unusual market cycle will continue to buck expectations and historical patterns. On a more fundamental level, these companies do face some near-term challenges. Like I said, consumers remain pressured by persistent inflation and high interest rates.

Top Names in Both Sector

Our AI model identified these stocks as likely outperformers: Tractor Supply (TSCO), e.l.f. Beauty (ELF), Ulta Beauty (ULTA), Dick's Sporting Goods (DKS) and Academy Sports and Outdoors (ASO).

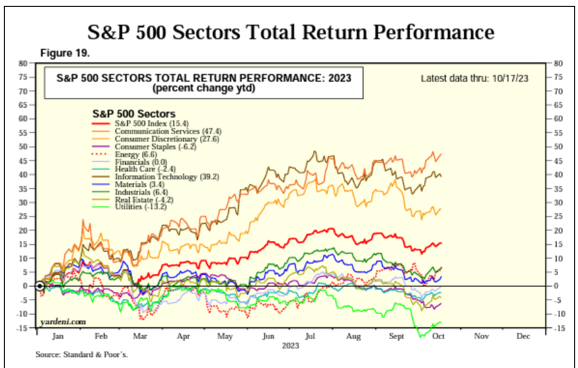

The same outperformance premise holds true for industrials, which unlike the consumer discretionary sector, has underperformed the S&P 500 thus far in 2023.

While an economic downturn would not bode well for stocks in this sector, there may be strong enough tailwinds for them to buck trends moving forward.

These include the move toward sustainability and the energy transition from fossil fuels to green alternatives. The shift presents significant opportunities for some U.S. manufacturers.

Another positive factor is the adoption of digitization. Around the world, manufacturers are investing in technologies they believe will enhance their competitiveness. These include advanced robotics, artificial intelligence, cloud computing and the Internet of Things.

Finally, during the pandemic, U.S. companies learned hard lessons about relying on faraway places for important components. Across many industries — notably automobile manufacturing — companies were forced to curb production due to a lack of essential parts.

Today, companies are increasingly making plans to diversify and reinforce their supply chains and bring them closer to home, meaning more manufacturing facilities built in the United States, Mexico and Canada. There could be significant potential opportunities for industrial companies behind these efforts.

Our AI model identified Waste Management (WM), Deere & Company (DE) and Snap-on (SNA) as three potentially hot stocks in the industrials sector over the next 90 days.

As you can see, I don’t have a definitive answer to my question about believing the banks or the bots. All I can say is that we should have more clarity about the economy and its impact on the market as the year winds down.

I’ll be sure to keep you posted.

Until next time,

Gavin