|

| By Gavin Magor |

If you thought the run on banks, closures and bailouts were over, I have some bad news for you …

Nov. 3 marked the fifth U.S. bank to go into FDIC receivership this year, and its symbolism is a big deal.

However, it wasn’t publicized much. That’s probably because it was a privately-held small one in Sac City, Iowa, with little perceived impact on the overall industry — very much unlike the failure of Silicon Valley Bank earlier this year.

Some investors, though, took it very seriously and sold regional bank stocks. I’ve been untrustful of bank stocks for some time. So, this news hasn’t affected my personal portfolio. But banks play such a huge role in our economy and our day-to-day lives that it’s important to track what’s happened.

Here’s how a handful of them performed on the Monday after the latest bank shutdown:

- Truist Financial (TFC) -1.44%

- M&T Bank (MTB) -1.01%

- First Horizon (FHN) -2.28%

- Western Alliance (WAL) -2.71%

- Zions Bancorporation (ZION) -1.67%

Compared to the big, bold headlines when Silicon Valley Bankwent under in February — this hardly made a splash. So, I wanted to make sure to call the bank’s closure to your attention for two reasons.

One, because it illustrates perfectly why diversification is so important. And two, I wanted to shine the spotlight on yet another risk for banks — and potentially, the economy.

The Iowa Division of Banking closed state-chartered and privately-owned Citizens Bank due to a large number of bad loans focused on the commercial and industrial industries.

All of its deposits and $66 million in assets were assumed by Iowa Trust & Savings Bank, but not the bad loans. The FDIC estimated at the time of its closing that the bank had losses of $14.8 million due to these loans.

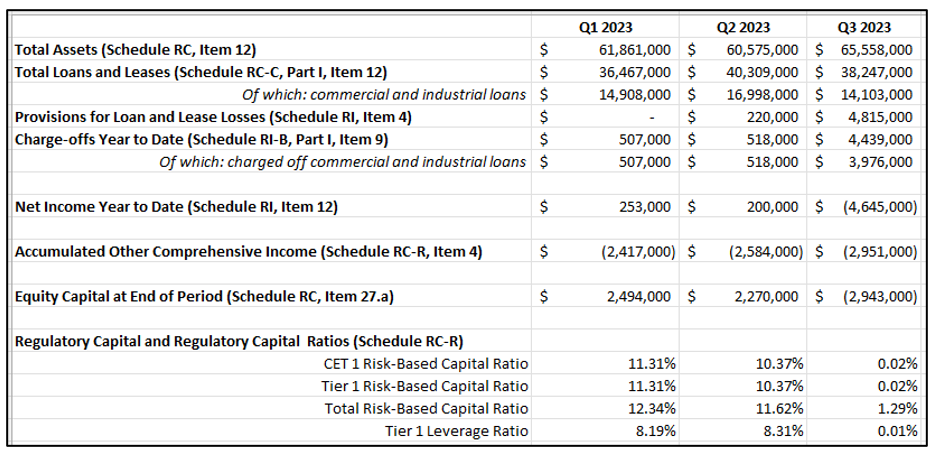

Take a look at Citizens Bank’s quarterly financial figures. As you can see, in all three quarters of 2023, its loans-to-total-assets ratio stood around 70%! I call that financial suicide.

During initial examinations, regulators didn’t discover who took out the loans because they were unreported by the bank. However, a third-party loan consultant identified the culprit in short order: the commercial trucking industry.

Makes perfect sense to me: A small bank — overextended by “out-of-territory and out-of-state loans” to one industry that’s in a cyclical decline — is seized by regulators.

That’s not so different than SVB and other regional banks that failed earlier in the year due to high exposure to technology startups, already flailing as borrowing costs rose. It’s one thing to be a niche provider of loans — it’s a whole different story to only provide loans to one industry.

That’s akin to property and casualty insurance providers only writing policies in hurricane-prone Florida. Or farmers only raising pigs when foot-and-mouth disease is running rampant. Or auto dealers only selling Rolls Royces in the poorest part of town.

Or, most importantly, investors putting all their money in one asset class.

Diversification, above all, is key to performance and managing risk.

Citizens Bank’s decision to loan to such a narrow swath makes me question why they did so … and if other banks may be at risk for doing the same thing.

Sac City’s population is just over 2,000 people. The population of Iowa is only about 3.2 million people. Citizen Bank’s assets were only $66 million.

Prices for new Class 8 trucks in 2023 vary by brand, as well as by the number and type of features and equipment. However, they are expensive — prices range between $150,000 for basic models to over $220,000 for models with custom features.

How — or why — a small state-charted bank in the very small town of Sac City, Iowa, was making loans on expensive trucks is unknown. But doing so seems highly speculative.

Banks and speculative don’t belong in the same sentence.

Of course, if they granted the loans during the COVID-19 pandemic, defaults were nearly non-existent. Interest rates were near zero, and the trucking industry flourished. However, the last two years have been brutal with too many trucks chasing too little freight. Plus, shipping rates are at or below 2019 levels.

You might recall a stalwart of trucking, Yellow, went out of business earlier this year. That was just one of many — both large and small companies — to do so in the industry. No surprise that brokerages that cater to funding the industry are experiencing layoffs and closures, too.

Not only does this make me wonder how many other banks are highly exposed to loans for commercial trucks (and car loan defaults, which are on the rise) … it makes me question what this means for the economy moving forward.

There’s a direct correlation with slowdowns in freight demand and recessions — as in it’s almost always a precursor to one.

It’s easy to connect the dots from the massive post-COVID-19 consumer spending to cracks in the economy’s armor today.

Fortunately, our Weiss Bank Ratings will alert you if trouble is on the horizon for your bank, so be sure to frequent that section of our website.

That’s all for today. Have a great week.

Cheers!

Gavin Magor

P.S. Diversification is key to portfolio strength. However, many investors simply ignore some pretty obvious assets they can use to both diversify their portfolio AND position themselves for huge gains. Dr. Martin Weiss just put together a presentation to address this. Click here to see it.