With volatility as a hallmark of the market this year, consider alternative investments to achieve high, sustainable returns in your portfolio.

In this segment, I speak with Investment Analyst Grant Wasylik — an expert on conservative, income-generating assets — about different asset classes with both profit potential and safety, and what makes them viable for the retail investor.

You can watch the video here or continue reading for the full transcript.

Jessica Borg (narration): He’s been analyzing financial markets for two decades.

Grant Waszlik now contributes ideas and research to Weiss Ratings.

JB: Grant, tell us about your background in the investing world and how it all started.

Grant Wasylik: Shortly after college, I basically began a short career path as a stockbroker.

I worked for a discount broker, where I headed up the margin department, and then I moved over to the trading desk and supervised some traders.

Then I moved out to Arizona and worked for Charles Schwab (SCHW). Uniquely, I was the first-ever outside hire there to a specialized risk department.

And from there, I came back to Pennsylvania and ended up working for a large RIA, (registered investment adviser). I was a wealth manager.

We had a really small firm but had a lot of money under management — over a billion dollars — and we did really well for our clients, with a conservative approach.

JB (narration): Grant then started writing for financial publications.

JB: You’re a big fan of diversification in portfolios. How should investors approach diversification right now?

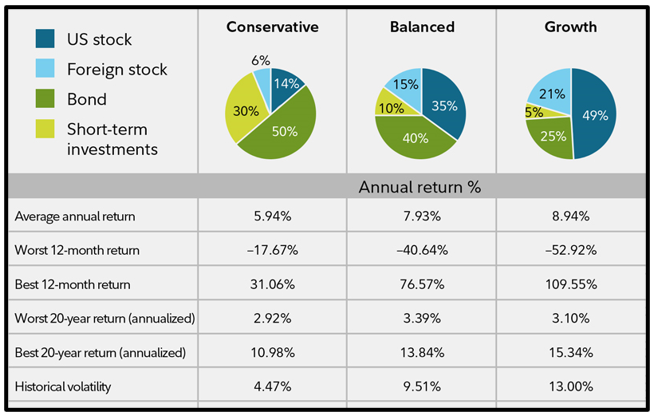

GW: Most investors would do well having a diversified portfolio.

That may sound boring, but you should have exposure to large-cap stocks, exposure to small-cap stocks, to bonds … even though everybody hates bonds, lately; although rates have been rising, so that sentiment is going to turn.

A starting core block could be having some exchange-traded funds that are low-expense ratio ETFs that have broad coverage of the markets.

JB (narration): And he’s big on finding alternative investments outside of stocks and bonds.

GW: For almost my entire time in the industry, I have just been interested in finding exciting new ideas that could generate very good returns and do it conservatively, for the most part.

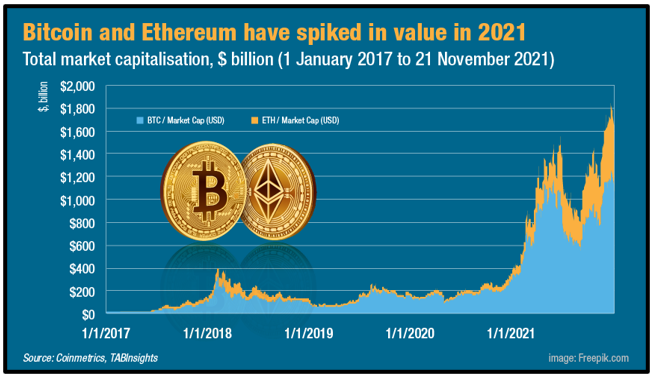

Probably around 2017, I first started researching and writing about Bitcoin (BTC), blockchain and other cryptocurrencies — altcoins.

Cryptocurrencies are not conservative, obviously, but I believe in position sizing smaller cryptocurrencies so that they don’t affect your total net worth if at the end of the day they go to zero.

I believe Bitcoin, as digital gold, has staying power. Ethereum (ETH) has staying power due to its smart-contract abilities.

And I think we’ll continue to see more funds introduced for the crypto space. They’re being introduced all the time.

JB (narration): Right now, in the U.S., there’s the ProShares Bitcoin Strategy ETF (BITO), a Bitcoin futures ETF, but there isn’t a spot Bitcoin ETF based on the actual price of Bitcoin.

GW: We’ve been waiting for a spot Bitcoin ETF. I think when that comes, that’ll really help out the market, and we should see a lot of money come into that ETF.

JB (narration): He sees consolidation in the future of the thousands of cryptos in the market now, with opportunities expanding around the metaverse.

GW: I think it has a huge reach. There are constant announcements.

A lot of the large companies are having to go toward the metaverse, or at least they’re thinking about it — whether it’s Nike (NKE), whether it’s Walt Disney (DIS), even PLBY Group (PLBY), the old Playboy Group.

So, there are a ton of companies doing stuff in that space.

There’s been a lot of talk about music rights going through NFTs and it’s all tied to the metaverse in a way.

There are some really interesting projects out there. I think the metaverse has a ton of room to grow.

I think it’s still the early days for crypto in general and certainly for things like NFTs and the metaverse, but it’s moving at a pretty rapid rate, as well.

JB (narration): He says there is a variety of asset classes that have been around for decades, offering high returns with low volatility.

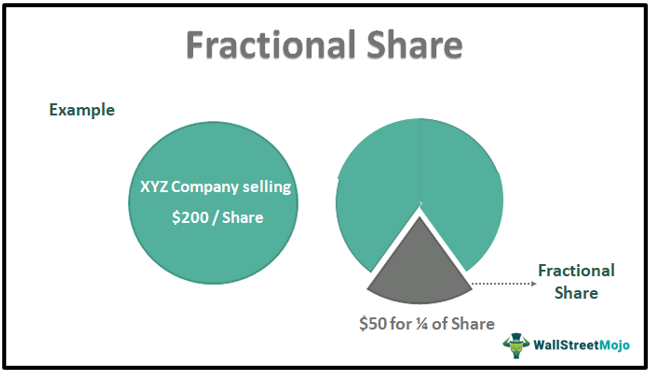

GW: The fractional investing component allows the everyday investor — not just the ultra-high net worth investors or accredited investors — to get into those asset classes that fit into the alternative bucket … where you can invest in private companies, where you can invest in private real estate, where you can invest in fine art, where you can invest in fine wine, where you can invest in collectibles, where you can invest in farmland.

JB (narration): Farmland, for example, in this index, shows an average annual return of 11%.

GW: I think if you study a lot of those alternative asset classes that are now offering a fractional investing component, you’ll see that some of them have generated monstrous return like cryptocurrencies and other ones have generated more conservative returns, but they don’t have the big downturns that the stock market will have, and they’ve performed very well over the long term.

So, I think that just pitches toward that safety angle. They can actually reduce your risk in your portfolio and increase your return, which is magic in the world of investing.

JB (narration): And you’ll learn more about them in upcoming issues.

JB: Investment Analyst Grant Wasylik, it was so great to speak with you. Thank you so much for making time today.

GW: Thank you for having me.

Best wishes,

Jessica Borg

Financial News Anchor

Weiss Ratings