Editor’s note: Today is a very important one for our startup expert, Chris Graebe. You see, in just a few hours — at precisely 2 p.m. Eastern — he will be unveiling his latest pre-IPO find.

He calls it “The Greatest Energy Breakthrough in a Decade.” And Weiss Members can claim early shares in it BEFORE it ever goes public.

First, follow this link to secure your spot for the event right now. Then, discover Chris’ system for spotting sizzling startup deals below …

|

| By Chris Graebe |

Since “the earlier, the better,” is one of my mantras in startup investing, knowing what to look for in the greenest of companies is key to picking the best ones at the best time.

If you invest in stocks, you probably have a methodology for weeding out the thousands you don’t want to invest in … and narrowing that list down to those that appeal to you.

I have my own methodology for doing the very same thing in the private-equity markets. It all comes down to the four main factors that I consider when evaluating a deal.

I call it the “FIVE” strategy. So, F-I-V-E.

Four factors, but I picked the acronym FIVE? Yes! That’s because I aim to see at least a 5x return on any investment that I make.

As I look at these different startups and deals, I ask myself, “Can this company do what I think it can, based on what I’ve seen and heard?” My methodology will help answer that question.

‘F’ for Founder

The founder is a huge part of the equation. I’ve seen founders with ideas, technologies and direction for where they were going, and it just didn’t work.

I’ve also seen when a market wasn’t cooperating and the founder was smart enough, talented enough and experienced enough that they were able to pivot and find a way to make their world work.

One of the best examples of a type of founder you should be looking for is Angela Hood, CEO and founder of ThisWay Global.

I’ve written about her before. You can go back and reread that here.

The short version is that Angela had deep personal experience and knowledge of a problem. She then created a solution.

But most importantly, she remained vigilant in everything from forming partnerships with the likes of IBM (IBM) to adapting to ever-changing technologies.

I like the boots-on-the-ground approach. That’s how I met Angela … in person.

In fact, you can do the same. She plans to join me at the 2025 Weiss Investment Summit at the Boca Raton resort May 4-6. We will be joined by others with plenty of real experience in startup success.

If you want a crash course on what to look for in a founder, this is the place to meet a successful one with a private company that continues to grow. Spots are going fast. Save yours here.

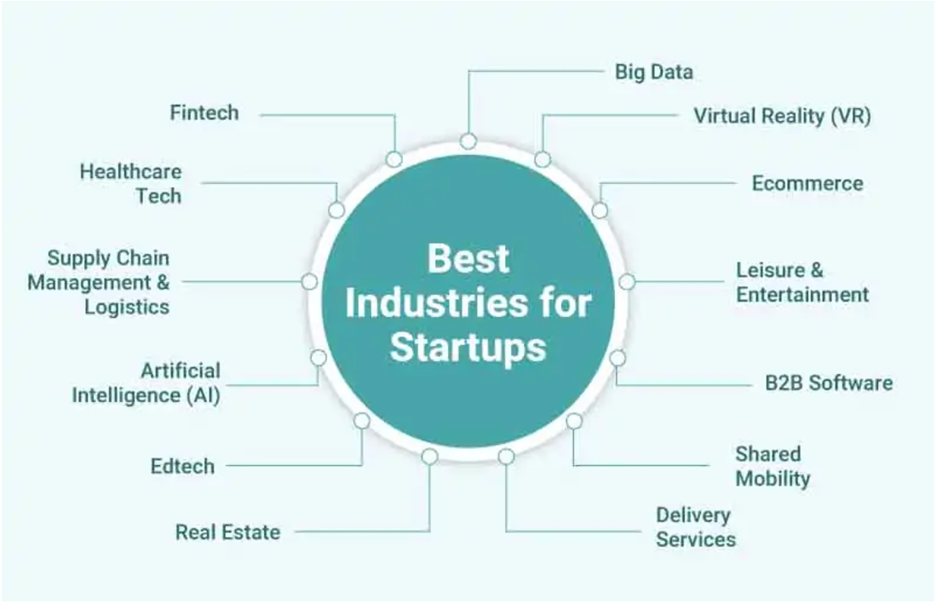

‘I’ for Industry

In what industry do these startups belong? Is it one that’s growing and delivering good multiples, or is it one that’s kind of lost momentum and steam with slowing investments?

It’s also important to know and understand the relevance of an industry today.

If it’s too hard for me to understand, then more than likely I’m probably just going to walk away because that industry is not the industry for me.

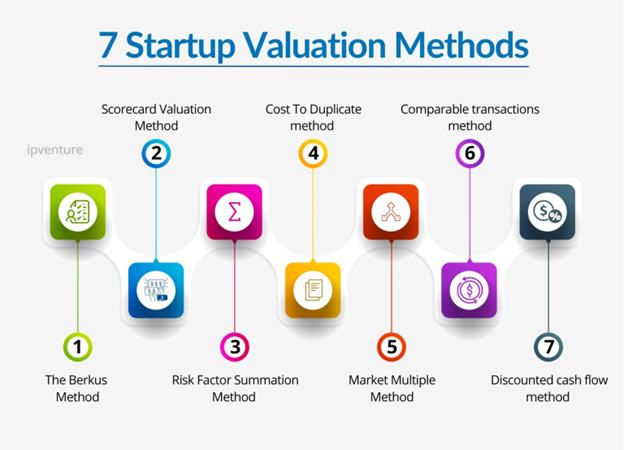

‘V’ for Valuation

You make your money on a company just like you do in real estate — on the front end.

If you buy the company at the right valuation, that is how you can see a solid potential return on the backside.

Sometimes it turns into a verbal wrestling match. So, when a founder comes to equity crowdfunding, more times than not, there’s a couple portals and platforms out there that will push back on valuation.

But I will say this — typically, the founders pretty much get to decide whatever they want when it comes to their valuation in the crowdfunding world.

And shocker, they all think their company’s worth more than it really is. So, valuation is important.

There are different models and ways you can look at valuation. At the end of the day, though, you want to know how a company calculated its valuation.

Today at 2 p.m. Eastern, I’ll share details about a startup that’s positioned to become a dominant supplier in a rapidly growing part of the energy sector.

One of its execs previously grew a tiny, $3 million company in this sector to a valuation of $3 BILLION. That’s 1,000x growth!

You can be among those who gain “first access” to his upcoming deal. Click here now to see how.

‘E’ for Exit Potential

Anytime you’re investing in a company, anytime you want to know what the potential exit looks like, a founder will tell you, “Well, we’re just building now, and we’re not really thinking about an exit.” But as an investor, you should definitely be thinking about it.

When can I get my money back? When can I see a return on my capital?

And what does that exit look like?

You have to determine if this is a pre-revenue company that might fail down the line.

Is this a company that’s going to be focused on gaining millions of users before they ever make one dime?

So, exit potential is very important. It’s something I want to look at, especially when I’m talking about seeing a 5x return.

Bonus X Factor

There’s one other thing I like to consider as my bonus to this strategy: the X factor.

Your gut’s saying, “I see it. It makes sense to me. I want to do it,” or vice versa. You always should listen. Remember, red flags never get smaller. They only get bigger.

It’s okay to pass on a deal, especially if the company doesn’t have an X factor.

Just keep looking for ones that do. I found one with this X factor. It also passed my “FIVE” test with ease.

It holds the key to the biggest energy revolution in over a decade. And in just a few hours, I’ll be sharing the whole story. Click here to make sure you join me.

Happy hunting,

Chris Graebe