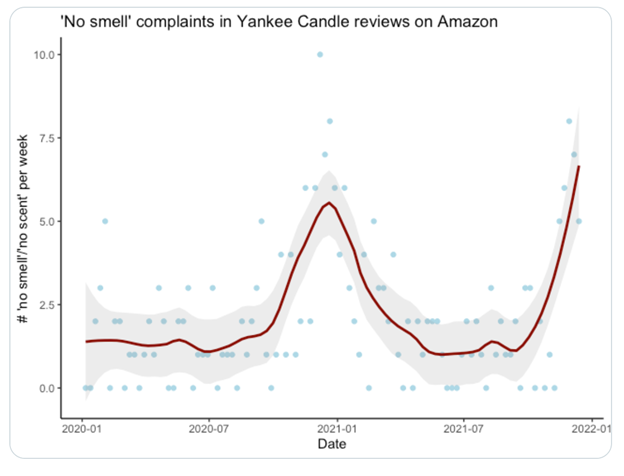

Last week, a friend of mine shared this chart on social media.

The snippet was taken from @nick_beauchamp’s Twitter response to @drewtoothpaste about a surge in negative reviews for Yankee Candles.

Nick Beauchamp is a Northern University professor who specializes in natural-language processing and machine learning.

He used a scraping tool to pull reviews from the top three Yankee Candles that included the words “no smell” or “no scent.”

And the pattern that he found resembled the current COVID-19 surge.

I caught up with the whole story in a Protocol article titled “Amazon Yankee Candle Reviews are Mirroring the COVID-19 Surge — Again.”

Apparently last year, Bryn Mawr College researcher Kate Petrova conducted a similar experiment tracking Yankee Candle reviews before and during the pandemic.

- She found that reviews of scented candles lost one full star while unscented candles maintained their rating.

As impressed as I was by the Yankee Candle indicator, my brain started into a whole other line of questioning.

I wonder if sales of candles are down? Why buy candles if you can’t smell them?

Is Yankee Candle even publicly traded?

Do you think fewer people are buying other scented products such as Febreze?

- I turned to the internet for answers … and to WeissRatings.com for what to do with them.

Yankee Candle has been around since 1969.

Headquartered in Massachusetts, the company sells scented candles, candleholders, accessories and dinnerware in 50 countries worldwide. It is the largest candle manufacturer in the United States.

The company went public in 1999 and, soon after, the line was picked up by mass retailers. This pushed the company’s sales to its highest levels so far.

In 2007, the company was acquired by private equity group Madison Dearborn for $1.6 billion, which made a decent profit in 2013 when the company was acquired by Jarden Corp. for $1.75 billion.

Just two years later, Newell Rubbermaid acquired Jarden for over $15 billion. And the result was Newell Brands (Nasdaq: NWL).

Newell has a powerhouse portfolio of brand names in addition to Yankee Candle ...

Rubbermaid, Ball, Crockpot, Mr. Coffee, Oster, Sunbeam, Elmer’s, Expo, Paper Mate, Sharpie, Graco, NUK, Coleman, Contigo, Chesapeake Bay Candle, WoodWick and First Alert, just to name a few.

- You’ve probably got products from about half of those in your house right now.

I know I do. Anyone who knows me will tell you that I’m a sucker for Ball brand Mason jars. My house is full of them for all sizes. I use them for storage and for drinking glasses.

I would love to add these brands to my investment portfolio. Plus, the company pays a 4.2% dividend and didn’t decrease or suspend its payment over the past 18 tumultuous months.

Newell shares are down 9% over the past 90 days, but still up 3.5% so far this year.

Pullbacks aren't necessarily a bad thing. It can be a great buying opportunity if the company is solid.

- How do you know if a company is solid? Here’s my “tell” ...

I look at the company’s rating … and, maybe even more important, the company’s historical ratings.

The company hasn’t seen a Weiss “Buy” rating (an “A” or “B” grade) since October 2017.

Although it would occasionally dip to a “Hold,” or “C” grade, the company spent most of its time between 2014 and then with a “Buy” rating.

By the end of 2018, the company was in the “Sell” range, with a “D” grade.

It stayed there all the way until the end of 2020 when it was upgraded to a “Hold.” But by February of this year, it was back to a “Sell.”

- But now might be the turning point of that story.

Newell Brands has now climbed back up to a “C+.” It’s seen an increase in operating cash flow of 504% and net income of 121%. Earnings per share doubled.

The Weiss Ratings is signaling that your money may be a little safer here, although Newell is still not quite a “Buy” yet.

So, I’m not going to put my money in Newell Brands anytime soon. But I will keep it on my watchlist.

Maybe this will be the chance for the company to finally break out of that rut and see the “Buy” range again. And I sure wouldn’t mind having that 4% yield in the income portion of my portfolio.

Best,

Kelly