Are You Thinking About Retirement the Right Way?

|

| By Nilus Mattive |

I’ve been writing about income and retirement for about 25 years now, which is pretty wild … because it means I’m more than halfway there myself now!

Along the way, I’ve also helped my own parents through plenty of obstacles and watched as the landscape changed in a number of dramatic ways, too.

Indeed, the most difficult aspect of retirement planning is that the rules can change at any time, often because of politicians’ whims.

Just consider individual retirement accounts (IRAs).

I have always loved them and still do. But their value is premised on a lot of assumptions, including two big ones …

- Your own tax picture spanning several decades and …

- How Washington might alter your best-laid plans at any given time.

Here’s a personal example to show you what I mean …

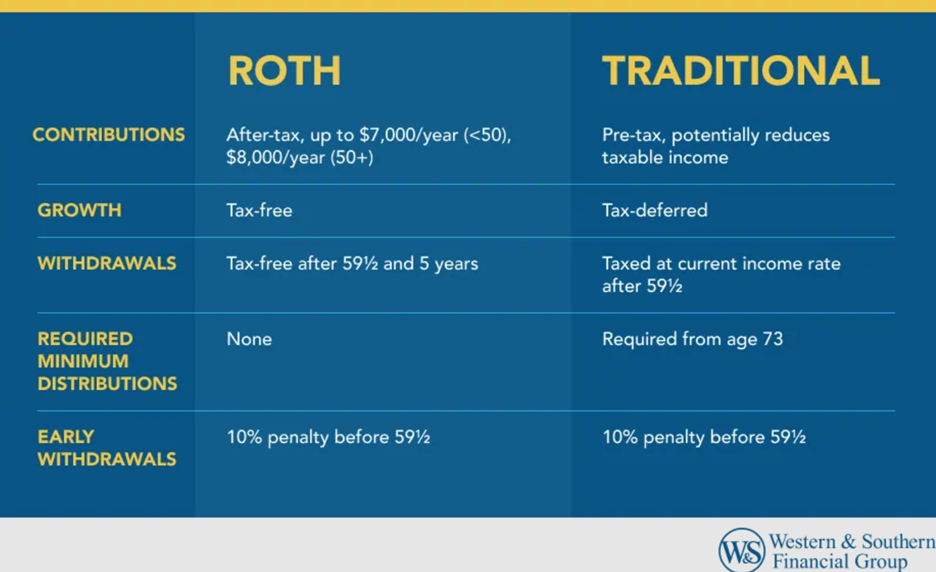

Twenty years ago, I started encouraging my father to aggressively fund a Roth IRA, largely because he wanted to pass along some of the money.

Using a Roth made a lot of sense because his investments could grow tax-free for the rest of his life, and he would never have to take required minimum distributions.

Better still, his non-spousal heir — i.e., me or even my daughter — would be able to keep the tax benefits going over the rest of our lives as well.

That’s because the law only required minimum annual distributions based on the heir’s own life expectancy. This strategy was commonly known as a “stretch” IRA.

For many years, this was a critical piece of my dad’s overall retirement plan. And he made other decisions somewhat because of it.

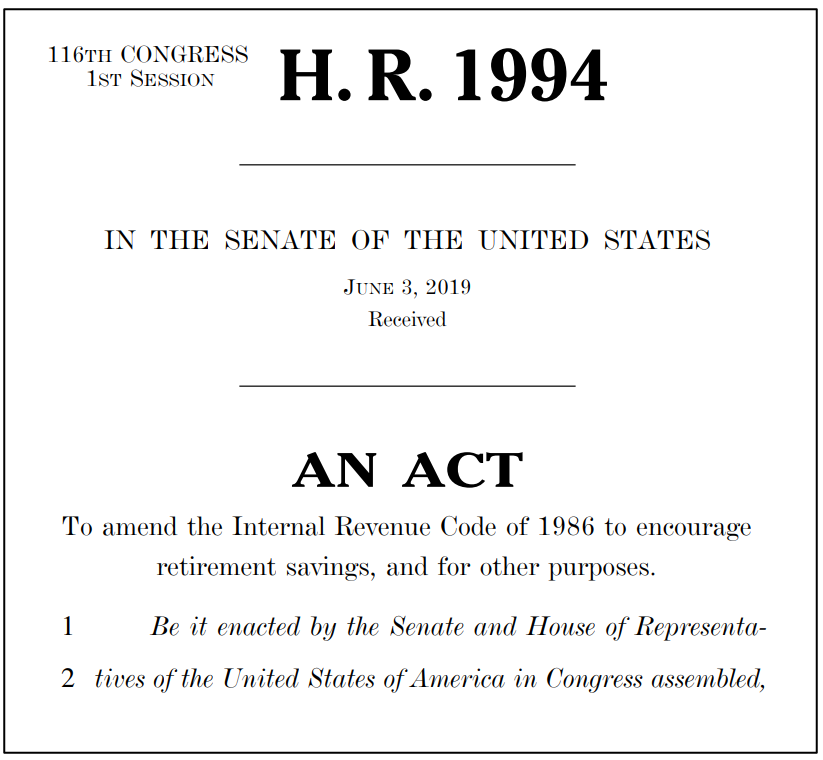

Then, the SECURE Act — which was ironically designed to enhance people’s retirement options — went into effect in 2020 and suddenly changed the rules regarding inherited Roth IRAs.

Most non-spousal beneficiaries must now deplete their inherited Roth IRAs within 10 years.

So, lawmakers rarely give new options without taking something else away, and the rules can change regardless of how long you’ve operated under some other promised outcome.

I have seen the same thing when it comes to Social Security strategies, too.

Indeed, some of the strategies I recommended to my own parents and my readers a decade ago have since been outlawed!

For this reason, I recommend anyone planning for retirement hedges their bets — creating a mix of different account types and using a range of assumptions about what might happen in the future regarding legislation, as well as their own personal situations.

What about more universal guidelines, like how to get the best combination of income, growth and safety from your nest egg?

Well, here’s another thing I’ve observed over more than 25 years now — you can’t expect traditional “safe” income investments to do the trick.

Indeed, interest rates have been artificially low for the most of that time.

And now, after just a little while of finally seeing reasonable numbers from CDs and other fixed-income investments, here comes the Fed starting what looks to be a whole new rate-cutting cycle once again!

So, for money that you want to keep growing ... stocks with long histories of dividend payments — especially INCREASING dividend payments — are a great starting point.

I also think REAL diversification is key.

This will sound controversial, but I have also been telling readers to allocate very small amounts of money to “riskier” assets.

That’s because despite their high volatility, they can also offer outsized returns that juice a bigger portfolio’s performance.

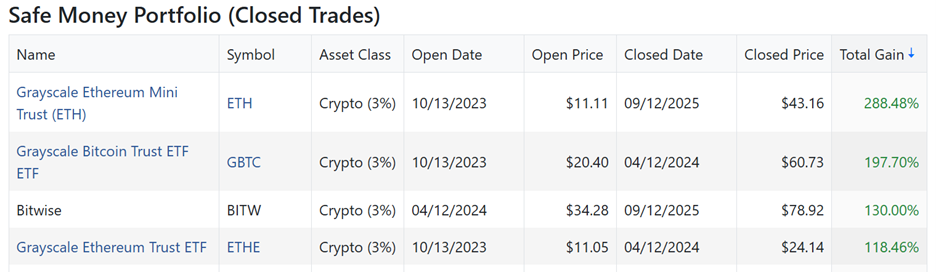

Prime examples were my Safe Money Report recommendations back in October 2023 to allocate small amounts to the Grayscale Bitcoin Trust (GBTC) and the Grayscale Ethereum Trust (ETHE) — cryptocurrency investments that could be held in retirement accounts like IRAs.

We have since booked gains from those investments and other related ideas of 118%, 130%, 197.7% and even 288.48% … plus, we still have another open gain of 370% on a remaining position!

What about gold, silver and other precious metals investments?

Yes, I think they belong in a retirement portfolio as well … especially as a way to hedge against major downdrafts and ongoing inflation.

Plus, I want you to know that there are other ways to squeeze extra income out of an existing portfolio …

Whether it’s invested in dividend stocks, gold and silver investments or even some crypto funds like the ones I just mentioned.

I plan on telling you more about that VERY soon!

I will also say that where and how you choose to live can have a massive impact on your retirement — not just the city, state and country you live in, but also the size and type of property you occupy.

As someone who currently lives in California and has also lived in many other parts of the country, it’s obvious that different places offer wildly different tax structures … costs of living … social opportunities … and recreational possibilities.

Also note that what’s ideal during your working years might be different during your retirement years for all those same reasons.

For example, income taxes during your working years might greatly affect how much you actually take home and save, while a state’s treatment of retirement income might greatly affect how much you receive in your golden years.

If you keep a flexible outlook, you can often find the best combinations for each phase of your life.

Bottom line: Retirement planning is a complex topic.

So, you need to stay flexible …

With a solid, well-diversified portfolio kicking off ongoing income to support the lifestyle you want …

Preferably in a place that offers you the best mix of financial and personal benefits.

Best wishes,

Nilus Mattive

P.S. My fellow Weiss Ratings analysts and I have been working on a special event on this very subject.

Whether you are looking to boost your income in retirement or would just like some regular payments to help you enjoy your life right now, you’ll want to attend.

I can’t share everything just yet. But keep an eye out for tomorrow’s announcement.