|

| By Nilus Mattive |

My dad helped me get my first credit card at age 16.

It wasn’t because I really needed one. It was to start building my credit score.

Even then, I knew it was the financial equivalent of a razor-sharp chef’s knife — a useful tool that could do a lot of damage without the proper training and caution.

More than 30 years later, I’m proud to say I have never carried an unpaid balance. I’ve never paid any interest or late fees, either.

That doesn’t mean I don’t use my cards.

In fact, I use a credit card to pay for just about everything my family buys. And I get massive benefits for doing so!

But before I go any further, let me say this …

The very best investment anyone can make is paying off an existing credit card balance as quickly as possible.

The average interest rate on credit card debt is about 24% right now.

In other words, paying off that balance is like getting a risk-free return of 24%.

And considering the effects of compounding, letting unpaid balances sit for long periods of time is financial suicide.

What if you or someone you know has a current balance that can’t be paid off immediately?

I suggest calling the credit card issuer and trying to negotiate a better rate. Or move the balance to a friendlier lender with a better interest rate.

There are usually 0% intro APR offers floating out there at any given time. Just watch out for balance transfer fees, teaser rates and the like.

I only recommend using credit cards as a more convenient form of cash.

That means borrowing what I can afford to pay back immediately and paying off my balances in full and on time every single month.

As long as you do this, it doesn’t even matter what your interest rate is. Nor does it matter if the company charges ridiculous fees for late payments.

These days, I even have all my credit cards scheduled for automatic “full amount due” payments just to make sure I don’t forget to meet a deadline.

What About Annual Fees?

There are plenty of great credit cards that don’t charge them, which is obviously preferable in most situations.

However, I’m willing to pay an annual fee on certain cards as long as they provide benefits that are worth the yearly cost.

For example, I have a Marriott rewards card with a $650 annual fee. But every year, I get back $300 in credits for using my card at restaurants … a free night certificate worth roughly $731 … automatic platinum elite status with Marriot’s loyalty program …. plus several additional benefits.

So, my $650 annual fee “investment” easily returns double back to me.

As the resident “Safe Money” expert here at Weiss, that’s a risk-vs.-reward setup that’s hard to say no to!

Indeed, as a responsible borrower, I love making credit card reward programs work for me.

Annual benefits associated with different cards are just the beginning.

Earning points or cash back for every dollar I spend makes using my cards far better than paying cash, too.

The Biggest Bonus?

And what many people fail to realize is that the biggest windfalls come from signing up for different credit cards — and those offers change all the time.

For example, I used the sign-up bonus for my Marriott card to book a five-day President’s Day weekend trip at a slopeside Ritz-Carlton in Lake Tahoe. Because it was an insanely busy holiday period, the value of our stay was a staggering $7,500.

Another time, I used an American Airlines sign-up bonus to get my mom, my daughter and myself back home from a trip to Venice, Italy. The tickets would have cost us $9,000, but I got them for just 30,000 miles.

My best score?

I once signed up for two Southwest Rapid Rewards Visa cards in the same year and got 100,000 Rapid Reward miles in the process.

That was good enough for four or five free roundtrip domestic flights.

Even better was that I only needed to earn a modest number of additional miles to get a coveted Companion Pass … which allowed me to take a companion on every flight for the rest of that calendar year PLUS the next onefor free (other than mandatory taxes). And yes, the companion pass even applies to free travel you book with miles!

Only you can decide which particular programs and strategies make the most sense for your goals.

Just pay attention to all the different bonuses out there … how they interact with individual reward program rules … and then use that information to your advantage.

Do a quick search and you’ll find plenty of websites that provide in-depth profiles on various card offers and rewards programs. Some popular ones include www.nerdwallet.com, www.millionmilesecrets.com and www.thepointsguy.com.

Okay, but what about the OTHER financial impacts of doing this?

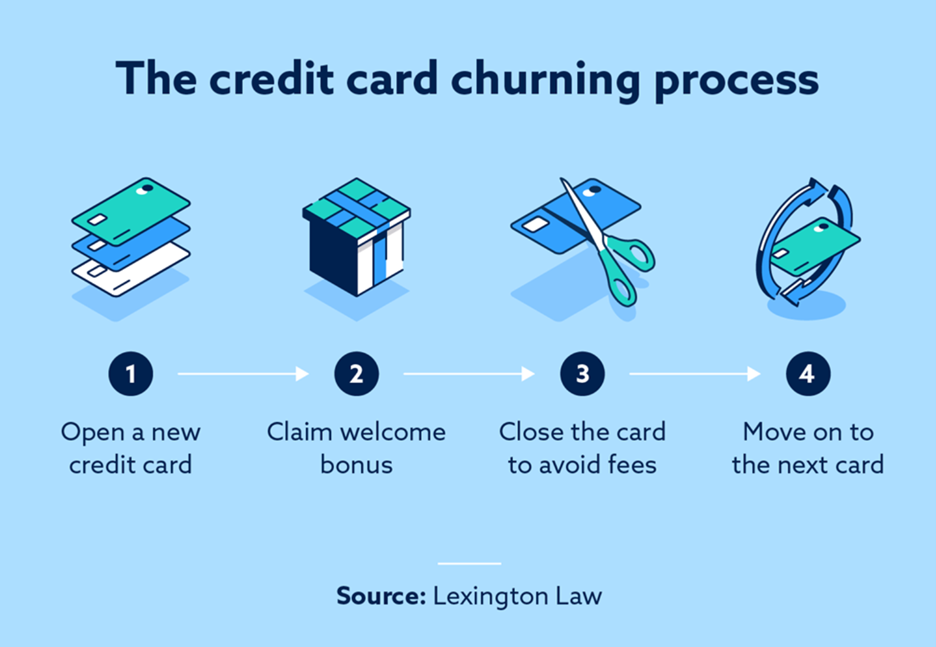

The process of signing up for multiple credit cards just to get bonus rewards is commonly known as “churning” … and most financially conservative people avoid doing this for a number of reasons.

Many don’t want to take on new debt.

But again, I am NOT advocating piling up bigger credit card balances or making unnecessary expenditures.

Instead, I’m saying you should take advantage of the most generous sign-up offers, put all your regular expenses on the new card and pay the card in full to avoid any interest charges or other fees.

Meanwhile, I used to avoid credit card churning because I believed it would negatively impact my credit score. But I’ve changed my tune on that.

In fact, I’ve seen credit scores go UP after opening a new card!

Reason: Debt-to-available-credit is a primary factor in how your score is determined and taking on a new line of credit boosts this number.

So, unless you’re planning on getting a major new loan, or your credit score is already lower than average, I wouldn’t worry about the effects of opening new cards to get big sign-up bonuses.

Bottom line: If you use credit cards the right way you can end up with a top-tier credit score and some top-tier freebies to boot.

Best wishes,

Nilus Mattive

P.S. And if you do have miles saved up, I have the ticket for you. Literally.

Our exclusive Weiss Investment Summit is a unique opportunity to meet with our experts — including myself, Dr. Martin Weiss and the rest of the Weiss Ratings Daily team — in person.

We will share actionable ideas you won’t get anywhere outside of the Summit.

It will take place May 4-6, 2025, at the luxurious Boca Raton resort.

If you’re interested, I suggest saving your seat sooner rather than later. Just click here to register.

Seats are filling up. Once those are reserved, the doors are closed until 2026.

I hope to see you there!