|

| By Gavin Magor |

The auto industry is one of, if not the, most economically sensitive industries. That’s a historical truth, but probably never truer than it is today.

High interest rates make it more expensive to finance autos. Consumers face crippling costs for food, gas and housing, so they’re not exactly clamoring to buy big-ticket items.

Inventories rise and fall due to kinks in supply chains (i.e., computer chips from China). Empty lots push up prices, and higher prices discourage buyers.

Click here to see full-sized image.

It's a pretty vicious cycle caused by issues out of the control of manufacturers, dealers and parts’ suppliers. None are immune from the disruptions in business caused by all of the above.

Add a strike by the United Auto Workers into the equation, and you’ve got a recipe for disaster. Employees from the big three — Ford (F), General Motors (GM) and Stellantis (STLA) — are walking the picket line with the hopes of a 40% raise over four years, better retirement benefits, a new health insurance deal and four-day workweeks.

I don’t have an opinion one way or another about what autoworkers should or shouldn’t get … but I have a strong opinion on investing in auto manufacturers: Stocks in this sector are too risky to own right now, and returns are often underwhelming, anyway.

Economically sensitive sales cycles make it one of the most difficult businesses to manage, and investors are better off avoiding the industry altogether.

That’s despite the fact that it’s hard to imagine an industry that has had more of a profound impact on the day-to-day lives of billions of people over the past 100 years. The automobile changed the way people lived, worked and played.

However, investors have not really benefited that much from all that impact. In fact, there are a lot of reasons why automobile companies have not historically provided good returns — and why they probably won't in the future, either.

Why You Should “Steer” Clear of Automakers

Here are just a few reasons why ...

Manufacturing automobiles is extremely capital-intensive. It requires massive assembly plants, large capital outlays for the heavy machinery needed to assemble vehicles, large stockpiles of parts inventory and big maintenance expenses to keep it all up and running. Before even $1 is made on a new car model, millions have to be spent just to produce that first one off the assembly line.

Naturally, this kind of business model requires a pretty healthy amount of cash up front, usually raised in the form of debt. Running a debt-free (or even low-debt) automobile business is almost impossible.

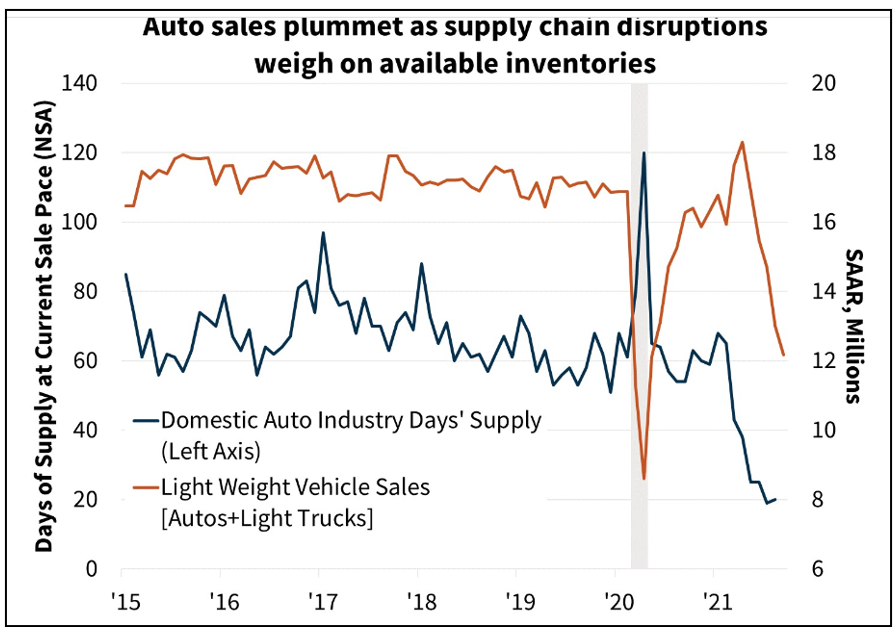

Capital-heavy business models are already unattractive for that reason alone. Just as importantly, it limits the potential for return on investment. High capital requirements are particularly risky when you consider that for the past 20 years, U.S. vehicle sales have been about 16-18 million per year.

In addition to that, sales are vulnerable to sudden, dramatic downturns.

During the 2008-2010 recession, auto sales plummeted to just 10 million and remained under 13 million up until 2012 for a 40% reduction. Then along came the pandemic in 2020, and new car sales hit a three-decade low as lockdowns crushed demand, despite interest rates near 0%.

Similar declines occurred regularly throughout the past 40 years, especially in economic downturns. It is one of the hardest-hit industries in a recession, as autos are extremely expensive consumer discretionary purchases. Consumers can easily delay new car purchases or decide to drop a new transmission into Old Betsy.

Unfortunately for carmakers, recessions are also the most difficult times to refinance or secure new debt financing. The combination of high capital requirements, heavy debt burdens and volatile sales cycles makes investment in auto manufacturers a more risky proposition than your average industry.

Those aren’t the only reasons to stay away from auto stocks ...

The most attractive revenue models are those that recur, with customers paying month after month or year after year, often without even thinking about doing so. Successful models also steadily grow with new services added to cross-sell existing customers and add new ones.

This is the best of all worlds because the recurring component ensures that the company will rarely face dramatic 30%-40% revenue drops in a single year, and the growth opportunities allow the company to expand and its investors to profit.

As you probably guessed, the automotive industry has neither of these.

Revenue is certainly not recurring. Even the most frequent car buyer goes two to three years between purchases. Most wait between six to eight years.

It isn't really a growth industry, either. The average inflation-adjusted cost in the U.S. of a new vehicle in 1977 was $22,748, while in 2016 it was $25,449 ... a compound annual increase of just 0.28%. Inflation has pushed prices higher and more quickly today, with new vehicles averaging around $46,000.

However, with the cost of manufacturing cars rising just as fast, companies are hardly rolling in the dough because of higher sticker prices.

See for Yourself with Weiss Ratings

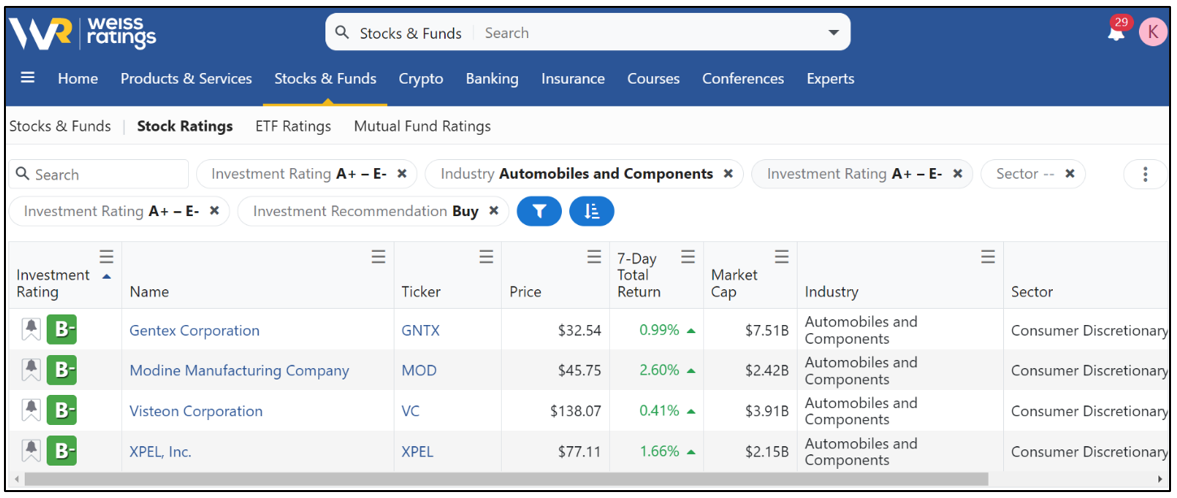

If you visit the Weiss Ratings stock screener and take a closer look at the fundamentals and performance of auto companies — past and present — you’ll find even more reasons to keep them out of your portfolio.

There, you can filter companies according to ROI, debt, revenues, profits, etc. and equally important, see how Weiss rates them after taking a plethora of financial data into consideration. We also provide “Buy,” “Sell,” or “Hold” recommendations for each.

In this section of the website, you can filter stocks to find what you’re looking for.

You’ll find that of the 85 companies in our database in the Automobile and Components industry, only four are currently rated above a C+ with a “Buy” recommendation. All of those are players in niche component markets.

Currently, Weiss doesn’t rate any of the big manufacturers as a “buy.”

Weiss Ratings is always here to help with your investment decisions, and if you’d like to explore more deeply, you’ll find the good, bad, and ugly about all 85 companies in the Automobile and Components sector conveniently located on our site.

And if you like what you see at Weiss Ratings, our stock recommendations are about to get a whole lot better.

On Tuesday, Oct. 10, at 2 p.m. Eastern, I will be having an urgent sit-down with Weiss Ratings founder, Dr. Martin Weiss. We have created a stellar stock portfolio that uses our proprietary Weiss stock ratings, our proprietary market timing models and our new tech upgrade, which I am going to reveal for the first time.

Spots will be highly limited. I am aiming to give you a behind-the-scenes look at our newest technology and a portfolio that could have returned more than 2,900% over two decades — even before the upgrade.

Be sure to reserve your spot now by clicking here. I expect those to fill up fast.

Cheers,

Gavin