Editor’s note: Now that we’re in Q4, this is the perfect time to reshare this list of Wall Street rip-offs.

Soon, we’ll be in the season to begin reallocating our portfolios, deciding whether to take gains or harvest losses before the fiscal year ends and looking ahead to 2026.

So, with all of that coming up faster than we’d like, here’s safe-money expert Nilus Mattive with the red flags you need to look out for with your investments …

|

| By Nilus Mattive |

Early in my career, I interviewed at all kinds of places on Wall Street — including lots of the big names like Jefferies, Bernstein and Morgan Stanley.

But my most memorable experience was at a place that ended up resembling Jordan Belfort’s place in “The Wolf of Wall Street.”

I’ll never forget the guy I met. He was exactly what you imagine — right down to the tanned face, pinstripe suit and flashy jewelry.

He wasted no time explaining what the job entailed.

Here’s a really brief version of how I remember it:

“Okay. You get in early and read The Wall Street Journal to get up to speed on what’s happening in the markets.

“Then you start making phone calls. We mostly target the U.K. first since they speak English and it’s later in the day there.

“You pitch the ideas we give you. And you keep doing that all day.”

Would my own security analysis factor into this?

Would we base our recommendations on fundamental developments?

I started asking some of these questions and sharing my own thoughts on investing.

Rather than address any of that, my interviewer started talking about a current employee’s rise to fame …

“Two years ago, he was hopping the subway turnstiles to get on the train. Dropped out of high school. Didn’t know a thing about investing.

“Today, he’s one of our best producers. Just bought a condo on the Upper East Side, has money coming out of his ears and is engaged to a very attractive girl now.

“All you have to do is follow the approach I just told you about and you can be there, too.”

I said no thanks.

The Wall Street “boiler rooms” of the 1990s and early 2000s have now been replaced by Reddit and Instagram posts.

Today, the irony is that the bigger-name firms continue to take money out of Main Street investors’ pockets on a daily basis.

Sure, their methods are more subtle than pitching you shady investments. But that doesn’t mean the financial outcome is any better.

We don’t even need to talk about Bernie Madoff-type Ponzi schemes or AI-driven trading bots.

Instead, just consider the following four ways Wall Street “steals” from regular investors day in and day out …

No. 1: Investment Fees

The average financial adviser charges 1% a year to manage your money.

That means the typical investor who uses a professional adviser could be handing over $1,000 a year on a $100,000 portfolio before one single penny is earned from the lump sum.

Put another way, it means that same investor has to beat a benchmark’s return by one percentage point a year just to break even.

Do some advisers provide great information for their fees?

Absolutely. Some are worth far MORE than 1% a year, in fact!

But a lot of others aren’t.

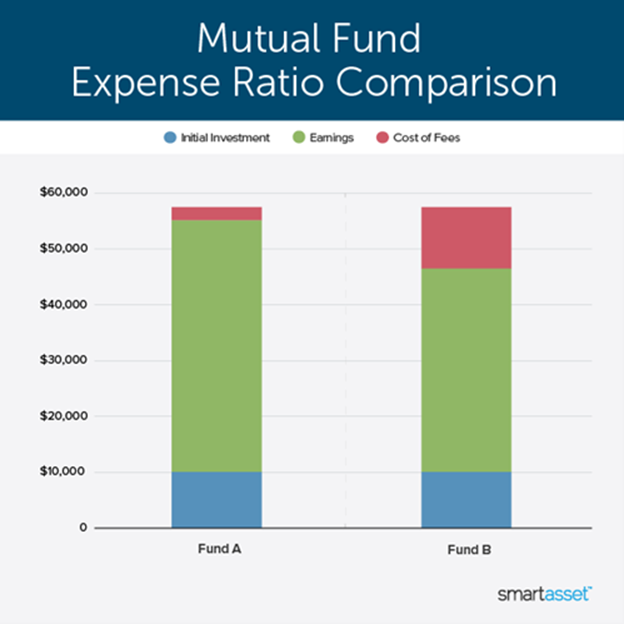

No. 2: Out-of-Whack Expense Ratios

The typical actively managed mutual fund carries an annual expense ratio of 1.1%.

So, whether or not you use an adviser, you could be losing more of your money just to pay for a mutual fund’s marketing materials, managers and other operating costs.

On top of an annual expense ratio, many mutual funds also slap on plenty of other fees — for getting in or out.

They may even charge additional fees for every year you stay in.

Obviously, a lot of investors are getting wise and switching to low-cost index funds and ETFs.

However, there are still billions in unnecessary, unjustified fund management fees going into Wall Street’s coffers every single year.

And in many cases, the advisers earning 1% a year are steering their clients into “house” funds … compounding the problems on top of each other.

Which brings me to …

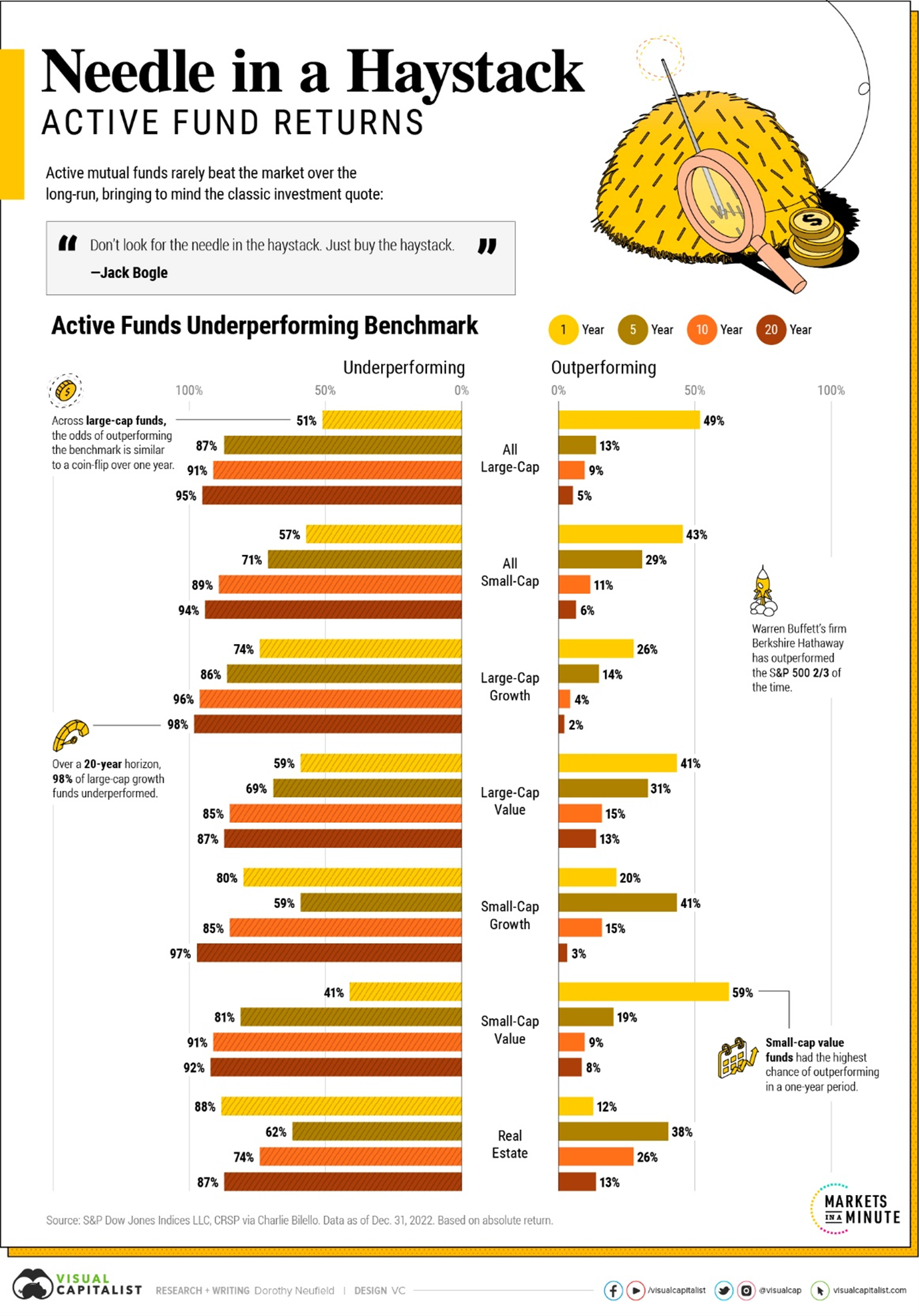

No. 3: Paying for Underperformance

Most actively managed funds are consistent underperformers.

It would be one thing to pay for performance.

In fact, you will often hear Wall Street describe its compensation structure this way …

But the reality is that the majority of actively managed mutual funds (and ETFs) fail to beat their benchmarks.

The number varies year to year, but it usually sits right around 80%.

It’s the same thing with hedge funds, too.

And with hedge funds, you still have to factor in their typical management fees — 2% of assets and 20% of any profits earned!

Of course, there’s one absolutely huge way that Wall Street is sticking it to regular investors … and given what’s happening right now, it’s a critical thing to understand …

No. 4: Wall Street Keeps the Best Strategies for Itself!

Lately, a lot of people have made a lot of money by simply picking momentum stocks and watching them go up.

But we’ve already seen some of the cracks start to show in this endless money loop.

April showed us how quickly everything can turn on its head with just a few headlines about tariffs.

Speaking of headlines, you have surely seen plenty in and even outside of the financial press now discussing the possibility of an AI bubble.

Here’s the thing. Even if tech stocks continue to climb in 2026, these cracks will begin to turn into volatility.

And there’s a strategy that can take market volatility and turn it into cold, hard cash just about any time you want.

Better yet, it works GREAT in choppy markets like we’re seeing right now.

Of course, a financial adviser will almost certainly not tell his clients about this approach.

That’s because Wall Street firms typically use this strategy for their own trading desks … collecting billions in the process.

But since 2022, my research team and I have taken this same technique the big firms use and customized it specifically to help individual investors bring in consistent cash payments no matter what the market is doing.

I even shared this technique with my fellow analysts here at Weiss Ratings this week.

And they were unanimously “all-in” the minute they saw it in action.

You can see their reactions here … and learn about how it works yourself.

Best wishes,

Nilus Mattive