There are lots of seasons in a year.

Spring, summer, fall and winter, obviously. But also holiday season … pumpkin spice season.

And although those last two are two of my favorites, I will always get excited for every earnings season.

It’s probably because I love data.

Earnings season means more updated data about all the companies that I follow.

- It also means that we will see ratings changes as the model gets more data from our data suppliers.

Fourth-quarter earnings season is always my favorite. Why?

- First, I like to see what companies have done for the entire year. For companies that have cyclical businesses or that have been going through organizational changes, the year might be a better picture than looking at each quarter individually.

- Second, since I frequently follow many consumer staples and consumer discretionary companies, I want to see the results of holiday spending.

The full earnings season runs from Jan. 15–Feb. 29. The peak of that being Jan. 24–Feb. 21. Why? Because the middle of that peak is when the giants of Big Tech report.

Right now, we’re just kicking off the season. And it seems that banks have cast a gloomy shadow so far.

A recent article on Nasdaq.com proclaimed “Dow Closes Lower After Disappointing Bank Results.”

Now, I’ll admit that banks are not an industry I follow.

I bought some shares of Wells Fargo (NYSE: WFC) in a dividend reinvestment plan (DRIP) as a gift for my brother in 2012. He’s more than happy with them ... but that is the extent of my personal experience with investing in banks.

So today, I went over to the Weiss Ratings stock screener. I was looking in the banking industry for anything with a “Buy” rating that has seen a recent ratings change.

Let’s look at the top three:

1. Blue Ridge Bankshares (NYSE: BRBS) is the holding company for the Blue Ridge Bank. The company was originally chartered in 1893 as the Page Valley Bank of Virginia. To this day, it’s ranked the No. 3 community bank by market share in Virginia.

Although still headquartered in Virginia where it has 32 branches, the company also has one branch in North Carolina and 20 mortgage offices spread between North Carolina, Virginia, Maryland, South Carolina and Florida.

Blue Ridge Bankshares was stuck as a “Hold” from 2017 until earlier this year. But since May, it has stayed in the “Buy” range even though it tends to fluctuate between a “B” and a “B-.”

Most recently, it was upgraded to a “B” on Jan. 11.

And investors aren’t too disappointed by the run-up they’ve seen since the pandemic began.

Shares are up 1.6% over the past 90 days and 46% over the past year. Plus, it pays a 2.3% dividend.

2. Byline Bancorp (NYSE: BY) is the holding company for Byline Bank and operates 45 branches in the Chicago metropolitan area and one branch office in Brookfield, Wisconsin.

In the company’s third-quarter earnings, they noted that total deposits increased 5.2% year over year. And that average non-interest-bearing deposits increased 20.8%.

Maybe that was the result of people depositing their stimulus checks. So, I would be interested in seeing if that trend continued into the fourth quarter.

Byline Bancorp has the most interesting ratings history out of the three I looked at today. It was a “Sell” all the way until the beginning of 2019. And then a “Hold” up until August.

In that time, it saw a “Buy” rating for just 16 days in July. Just last week, it was upgraded from a “B-” to a “B.”

The earnings numbers, the ratings and the share prices all agree that the past year has been good for Byline.

Shares are up 21% over the past 90 days and 79% over the past year. Plus, it pays a 1.1% dividend.

3. City Holding Company (Nasdaq: CHCO) operates as the holding company for City National Bank of West Virginia.

This was one of the most interesting investor presentations that I’ve ever looked at. It had a — let’s call it unique — color scheme. And it gave some interesting facts.

Here’s a slide that jumped out at me:

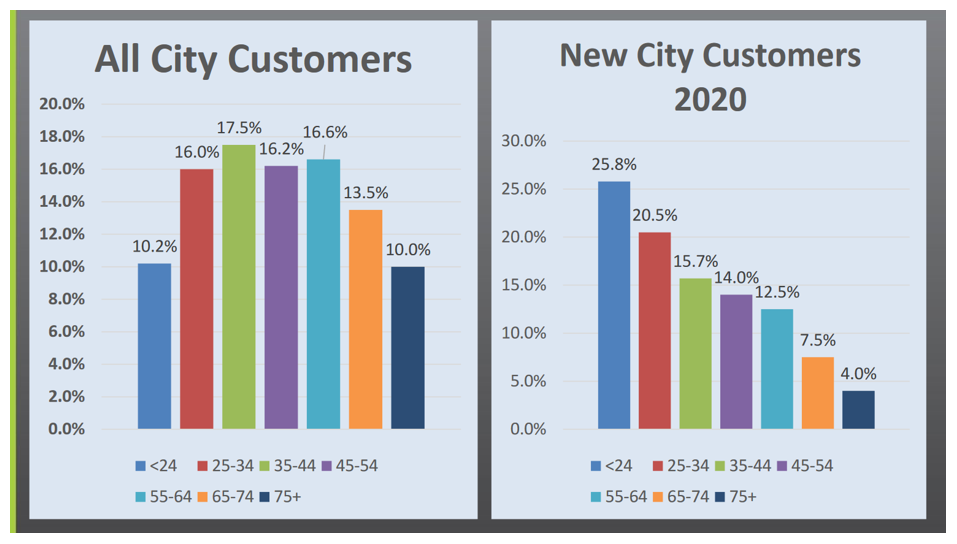

It shows the breakdown of all City customers and new City customers by age. The chart on the left shows a pretty even spread.

- It’s encouraging that the bank provides products and services that appeal to all age ranges.

Obviously, different banking products are needed at different life stages. And the ability to provide those means customers will stay for a longer period of time.

The chart on the right is interesting because you’ll see that, over the course of 2020, over 25% of new customers where under the age of 24. This includes teenagers with their first jobs, which is historically an unbanked sector.

- This is purely speculation on my part. But I could imagine this segment of the population being completely unprepared for the abrupt push into e-commerce.

When the pandemic picked up, we saw stores unwilling to take cash due to the exchange of germs and the coin shortage.

Now, these historically unbanked individuals had to change their habits.

City Holding Company has historically held a “Buy” rating. But during the pandemic, it fell briefly into the “Hold” range.

And since then, it’s toggled back and forth between “Buy” and “Hold.” The most recent upgrade was last week when the company was upgraded from a “B-” to a solid “B.”

Shares are up 12% over the past 90 days and 21% over the past year. Plus, it pays a dividend of 2.75%.

If you’re looking to add a bank to your portfolio, there were 24 of them that have been recently upgraded, and 269 of them are currently rated “Buy.”

And remember, the stock screener can easily help you quickly identify companies with recent earnings changes.

Best,

Kelly Green

P.S. If you’re interested in ways to diversify your portfolio and beat runaway inflation, I highly suggest you check out this video of the NFT Investor Summit.

You’ll learn all about non-fungible tokens (NFTs) and ways you can play the emerging trend. But this video is only available until 11:59 p.m. Eastern on Thursday, Jan. 20 … so act fast.

For more information, click here now.