|

| By Gavin Magor |

Here’s a topic that’s probably long gone from your memory: banks.

Whilst the failure of four regional banks dominated headlines and people’s attention early last year, they managed to stay under the radar in the second half of 2023. But now that some of the biggest banks kicked off earnings season last Friday, they’re back in the spotlight.

As Weiss’s Director of Research and Ratings, though, I never stop thinking about them. And as we start a new year, I can’t help but question if there will be more bank failures in 2024, what challenges they will be facing and, most importantly, how Weiss can continue to keep you informed so you can make sound decisions about where you keep your money.

Just like last year, the health of the banking industry remains hinged on inflation, interest rates and how they impact hold-to-maturity assets like Treasury Bonds and loans.

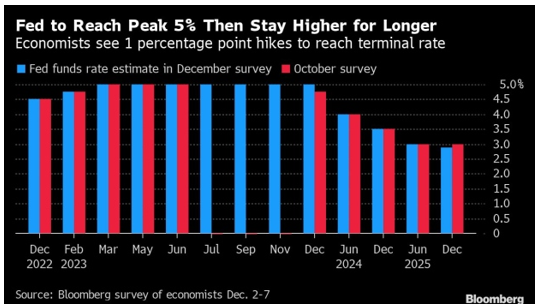

Unfortunately, the Fed still has not provided a timeline for when it might begin to lower rates. In fact, the reigning motto is, “higher for longer.” The fact that inflation actually rose in December just adds more uncertainty.

There’s a big difference between the Fed cutting rates in March — a belief that’s waning — and rates possibly staying higher for the balance of the year.

So, let’s take a look at …

Possibility No. 1: Lowering Rates Sooner

If the Fed lowers interest rates sooner than later, it will increase the value of Treasurys and mortgage securities, improving firms’ liquidity positions and lowering the threat of additional bank runs.

The reasons are twofold: One, the big paper (unrealized) losses banks racked up on fixed-rate bonds would continue shrinking after a Q4 2023 boost in bond prices. But given that bonds are intended to be held until they mature, unless a bank is in liquidity trouble, these potential losses will not become relevant.

And two, the draining of excess amounts by customers from checking or savings accounts — in favor of more lucrative alternatives like CDs offering a higher rate of return — would stop. Customers wouldn’t gain from moving their money if rates were equal everywhere.

The Treasury yield curve probably remains inverted — with long-term rates below short-term rates — through much of 2024 … but shifts to an upward curve again by 2025. This would help to stabilize bank balance sheets and earnings. In the meantime, credit loosens, spurring economic recovery led by home sales and new construction.

That’s a breath of fresh air, right? Well, it’s not the only possible outcome.

Possibility No. 2: Higher for Longer, in Truth

It would really stink if rates indeed stayed higher for longer. The current headwinds for banks would strengthen, and we could see a string of small to medium banks become insolvent and fail under the weight of their portfolio losses.

The timing of a pivot by the Fed is of utmost importance. Even in the best-case scenario the banking industry is going to face headwinds, many similar to those of 2023, until lower rates begin to impact the economy and consumer.

It took some time to feel the negative effects of a tightening monetary policy, and the positive effects of loosening won’t happen any faster.

Overall, I’m optimistic about banks in 2024. However, they still face enough challenges to warrant caution, such as …

Bank Headwinds to Watch for

New rules and regulations will pressure banks. In particular, higher capital and liquidity requirements, as well as a closer scrutiny of risk modeling will be priorities for regulators.

Some banks may not want to remain below certain asset thresholds or struggle with higher deposit requirements. As a result, I think we could see a mergers and acquisitions wave within the banking industry.

Banks with strong deposits but weak lending practices may be attractive targets.

Some midsize and regional banks could also seek mergers that will bring in enough outside capital to offset the sale of low-yielding assets.

Big banks would thrive, while smaller banks are gobbled up. That could signal the demise of community banks.

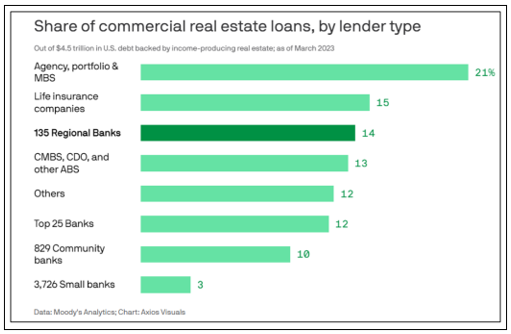

Defaults for consumer and commercial loans are rising. That’s to be expected in an economy facing headwinds. But a few commercial real estate sectors are facing more fundamental changes.

Malls and other retail shopping outlets, for example, have long been under pressure as consumers increasingly shop online, and remote work during the pandemic accelerated that trend. Even more worrisome for banks are Commercial Real Estate (CRE) loans.

With office occupancy rates unusually low in a post-Covid-19 world, it is difficult to see how property developers will manage to roll over at higher interest rates the $500 billion in property loans coming due this year.

This could be particularly problematic for the regional banks, which account for two-thirds of all CRE lending and with as much as 18% of their balance sheets exposed to commercial real estate lending.

Mortgage defaults are also creeping into the equation. Some banks have already started to reduce their exposure to home lending, as mortgage originations fell to their lowest point in 20 years — dropping 56% between the first quarters of 2022 and 2023.

Many property owners are unable to refinance their mortgages, triggering a wave of defaults, and price declines further erode the value of banks’ loan portfolios.

The multifamily market holds up somewhat better as government-backed Fannie Mae and Freddie Mac continue to provide financing to property owners.

Additionally, large lenders could soon face stricter capital requirements under a proposed overhaul to bank capital rules by U.S. banking regulators. These changes may impact banks’ ability to lend to first-time homebuyers.

One of the biggest signs of weakness is how much a bank keeps in reserves — above and beyond Federal requirements — for “just in case” scenarios. Higher reserves are a bank’s way of protecting themselves against defaults, lower deposits and bank runs, among other challenges.

That’s just one of the many financial issues Weiss Bank Ratings monitors on a regular basis to warn consumers of a bank’s potential decline in health.

If you want to know the state of your bank, be sure to use our ratings to see if we’ve issued a yellow or red flag on it.

Only then will you be armed with the knowledge needed to decide if you want to continue to do business with your bank or look elsewhere.

Cheers!

Gavin Magor