|

| By Jon Markman |

Warren Buffett has made some brilliant moves over the years — from buying Coca-Cola (KO) in 1988 to investing $31 billion in Apple (AAPL) for just $34.26 per share.

But the single greatest move of his career was way back in the 1960s and ‘70s. He became the face of the insurance industry.

Not long after Buffett acquired Berkshire Hathaway (BRKA) in 1964, he turned the fledgling textile company into a holding company by purchasing National Indemnity Company, a small regional insurance company.

A decade later, Buffett’s infamous gamble on GEICO made his career. There would be no Oracle of Omaha without GEICO.

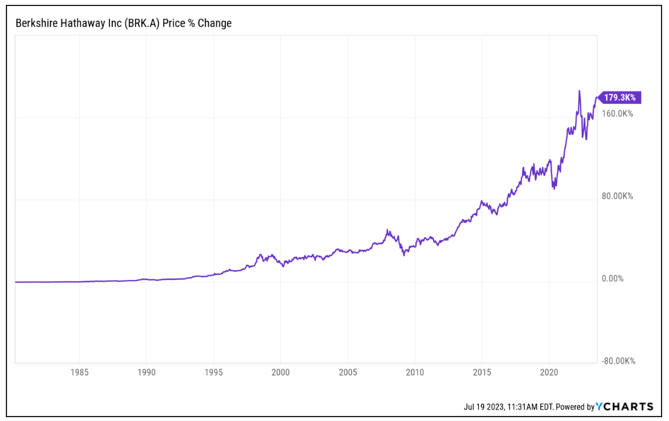

And we all know what he did in the time since buying GEICO …

Click here to see full-sized image.

So, why did Buffett love insurance investments so much? That’s a story that goes back even further in history.

The Most Important Industry

in the History of Money

Insurance could be considered the most important industry in the history of money.

You could even say that without insurance, you probably don’t get the trade and travel of the Renaissance. And you likely don’t get capitalism as we know it today.

For thousands of years, insurance has helped individuals and businesses protect themselves from unexpected financial losses.

Insurance-like practices can be traced back to ancient civilizations such as Babylonia and China. In those early societies, merchants would pool their goods and divide the risks of maritime trade.

If a merchant's goods were lost at sea, the loss would be shared by all contributors, lessening the impact on any single individual.

During the medieval period, trade expanded across Europe, and the need for insurance grew.

Marine insurance, specifically, became increasingly prevalent as the risks associated with long-distance trade became apparent. Merchants and ship owners started forming informal agreements to share risks, paving the way for the development of more structured insurance practices.

In the late Middle Ages, insurance guilds began to emerge. These guilds were formed by individuals who pooled their resources and provided financial assistance to members who suffered losses.

The first underwriters — individuals who assessed risks and set insurance premiums — also appeared during this time.

The late 17th and early 18th centuries saw the birth of modern insurance as we know it today.

Lloyd's of London, established in 1688, became a renowned hub for insurance and shipping. Lloyd's Coffee House served as a meeting place for ship owners, underwriters and merchants, where they could negotiate insurance contracts.

In the 18th century, the concept of life insurance began to take shape. Early life insurance policies were based on the idea of pooling premiums from policyholders to provide financial support to the families of deceased members.

Life insurance gained popularity as societies recognized the need for protection against loss of income due to premature death.

The Industrial Revolution, which began in the 18th century, brought about new risks associated with the rapid expansion of factories and urbanization.

Fire insurance emerged as a response to the growing threat of devastating fires in cities. Insurance companies started offering policies to protect against fire-related losses, further expanding the scope of insurance.

As insurance practices became more widespread, the need for standardization and regulation became apparent. Insurance companies and associations began formulating rules and guidelines to ensure fair practices and financial stability within the industry.

Governments also started enacting regulations to protect policyholders and prevent fraudulent activities.

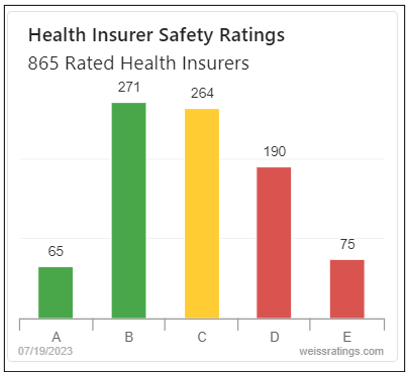

In the 20th century, the insurance industry experienced significant growth and diversification. New types of insurance emerged, including health, automobile and liability.

Click here to see full-sized image.

Technological advancements, such as computers and the internet, revolutionized insurance operations, making processes more efficient and accessible.

Today, the insurance industry continues to evolve. It faces new challenges, such as cybersecurity risks, climate change and emerging technologies like autonomous vehicles.

“Insurtech,” a term referring to the use of technology to enhance insurance services, is driving innovation within the industry.

Artificial intelligence, big data analytics and blockchain are being leveraged to improve underwriting, claims processing and customer experiences.

In sum, the history of insurance is a testament to humanity's efforts to mitigate risks and protect against unforeseen circumstances.

From its ancient origins to the present day, insurance has played a crucial role in promoting economic stability and safeguarding individuals and businesses.

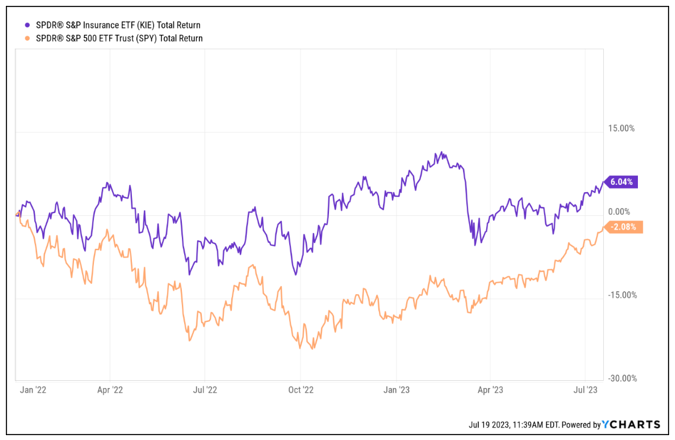

From this history, we now have an absolutely booming insurance market. Take the SPDR S&P Insurance ETF (KIE) for example ...

Since the start of last year, it has outperformed the S&P 500.

Click here to see full-sized image.

Despite a harsher drop with the bank failures earlier this year, it still has a positive return since January 2022 compared to negative numbers for the S&P 500 represented here by the SPDR S&P 500 ETF (SPY).

That drop, incidentally, has made certain insurance-related stocks even cheaper. That’s creating unique buying opportunities right now. I recently revealed my No. 1 AI Stock for 2023. To discover how you can get the name of that stock … plus three more that are “buys” right now … click this link here.

You should consider getting in while you can.

All the best,

Jon D. Markman