|

| By Karen Riccio |

Hello again, Karen here.

If you’re the kind of investor who skids through stop losses and other technical signals, I’d like to introduce you to bear market math.

It just might change your mind about how you do — or don’t — manage risk.

In fact, not being familiar with the math of investing is one of the biggest mistakes average investors can make.

They assume that a stock down by 10% merely needs 10% to recover. Unfortunately, that’s not even close to what happens in reality.

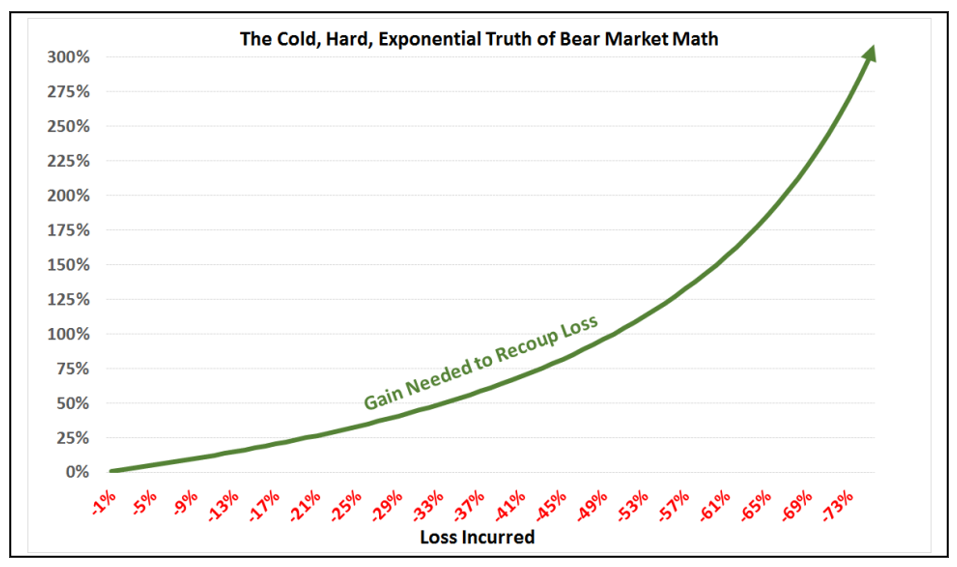

The cold, hard truth is that bear market math is exponential.

For example, if you lose 10% in a broad-based index fund, like the SPDR S&P 500 ETF Trust (SPY), you will need 11.1% to break even.

What’s the big deal, you ask? Allow me to continue.

Click here to see full-sized image.

Let’s say you lost 25% on an investment last year, then make 25% in the second year, your two-year return is not 0%. It is -6%.

Why? Because a 25% loss requires a 33% gain to get back to the starting gate. If you lose 50%, you need 100% to break even. And sadly, 50% losses requiring 100% gains take several years to recoup.

In essence, the more you lose, the more your gains need to be exponentially higher to recover lost principal and lost time. As you’ve hopefully figured out by now …

Discipline Is

Especially Important

Those without it face the potential loss of valuable time. And, as we all know, time is money.

Cliché notwithstanding, if you allow investments to languish or lose significant financial ground, there may not be enough time to make up that ground. This is particularly true for those with fixed income or who no longer earn income from traditional work.

Many of history’s bear markets have removed years — even decades — from investors’ financial, emotional even physical well-being.

If losing time and money is stressful, and if stress is a silent killer, can you really afford to cross your fingers through a severe downturn? Or would it better to take an approach that seeks to minimize titanic losses?

Considering that investment success hinges on risk management, you know the answer to that question. I find the simplest way to explain risk management is by comparing it to a relatable necessity: insurance.

Investment Insurance

Southern Californians, like yours truly, have grown accustomed to the tremors associated with living near active fault lines.

Should they buy earthquake insurance for the homes they own? Granted, only two major seismic events in Southern California happened over the past 40 years: the Whittier Narrows in October 1987 and the Northridge Quake in January 1994. Both were memorable. And yet, neither caused much damage or rattled Orange County residents’ nerves.

As a result, Southern California homeowners who pay earthquake premiums year in and year out feel like they are throwing away hard-earned money. The deductibles are extremely high. And the “big one” never seems to hit (knock on wood).

In other words, four decades have passed with little more distress than a smattering of phone conversations about whether anyone actually felt it.

Insurance is one of those things that we can only appreciate with grave misfortunes.

Ironically, though, we purchase insurance with the hope that we will never actually need it! So why waste hundreds of dollars to renew an earthquake policy? Some insurances are necessary evils. Others can be viewed as overkill or unnecessary.

Yet a residence typically represents a family’s largest asset. It is better to pay premiums year after year after year, even with the possibility that there will be no “benefit,” than to experience a total loss of equity because you didn’t protect the value from catastrophe.

An earthquake insurance premium represents a small loss that provides a California homeowner with the peace of mind that there will never be a massive, life-altering loss. Avoiding the possibility of a cataclysmic loss brought on by an earthquake is worthwhile, even if nothing happens in the state for another 40 years.

Just as your home needs protection from the risks that could severely damage or destroy it, so too does your investment portfolio. And yet, very few investors have an actual risk management plan in place to protect their financial future.

If that describes you, it’s time to develop a lifelong plan that minimizes losses first and maximizes gains second. After all, as Alabama legendary football coach Bear Bryant used to say, “Offense wins games; defenses win championships!”

Until next time,

Karen

P.S. Another approach you can take to ensure safety is joining my colleague and Income Analyst Nilus Mattive’s service, Safe Money Report. Like having insurance for your wealth, Nilus gives members numerous strategies to both protect and grow their money even in this ongoing, range-bound market. Click here to learn more.