|

| By Jon Markman |

There might be a way to get the performance of owning stocks without most of the risk.

This prospect, along with a solid stream of income, is the principal pitch of the Simplify Volatility Premium ETF (SVOL) from Simplify Asset Management, a New York City-registered investment advisor.

Investors seeking income should tread carefully, however.

The past 40 years have been extremely kind to most investors. Interest rates have been on a steady trek lower, and stock prices have trended mostly higher.

However, income investors have been left out of the windfalls. Global central bankers have shown a willingness to push interest rates to historic lows — and even zero — to combat the impact of macroeconomic events. These currency, housing and healthcare crises have all worked to the detriment of investors seeking income.

Analysts at Simplify Asset Management believe they have a solution.

SAM portfolio managers have been selling volatility, the premium that investors assign to risk of big changes in the value of securities. This may seem complicated. It’s not.

Think about insurance. Many insurance companies take in premiums in exchange for providing peace of mind against the impact of a disastrous event. You insure your car against accidents and your home against fires or break-ins.

The portfolio managers at SAM are going one step further. Selling volatility is the bet that a disastrous stock market event will not happen. It is a bet that investors will behave rationally.

Keep in mind, global central bankers have demonstrated repeatedly that they are willing to cut short-term interest rates to zero in the face of black swan, or extraordinary, events.

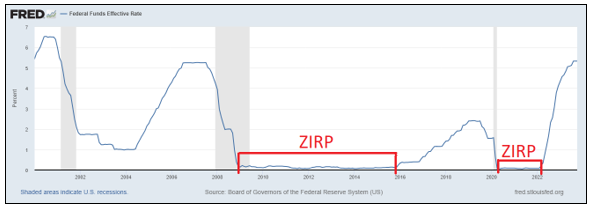

In this regard, zero interest rate policies, or ZIRP, have made the U.S. Federal Reserve the de facto insurer of last resort, a powerful backstop.

As you can see, ZIRP began in the United States in December 2008 following the financial crisis and remained in place until December 2015. Rates plunged to zero again in March 2020 through March 2022 in response to the COVID-19 pandemic.

This is the U.S. government’s way of managing risks in the market. Researchers at SAM are doing risk management, too.

What You Get with SVOL

The portfolio of SVOL consists mostly of U.S. Treasury Bills — high-quality, short-term notes and other extremely-liquid-income-oriented financial tools like money market funds.

Roughly one-fifth of SVOL assets are being used to hedge volatility through the selling of Volatility Index (VIX) futures, with a much smaller portion devoted to the purchase of VIX call options. A call option gives the buyer the right to buy an asset at a fixed price, for a fixed amount of time. In this case, that’s volatility.

This strategy should take in income, while simultaneously limiting the amount SVOL unit holders can lose if volatility unexpectedly rises.

That’s the strategy, and it seems to be working.

At a share price of $22.64, SVOL is up 3.1% year to date, and the dividend yield through Sept. 30 was 16.1% annualized. The latter is based on the strength of monthly distributions of about 30 cents per share.

It helps that volatility has been tanking all of 2023 as investors bet the Fed will soon abandon policies that promote higher interest rates.

Selling volatility is not all sunshine and unicorns, though.

Why a Volmageddon Event Can Wipe Away That 16.1% Dividend

The so-called Volmageddon event of Feb. 5, 2018, saw the VIX surge from 10 to 37.32 as traders worried that worsening macroeconomic events might topple the stock market rally.

Exchange traded funds devoted to selling volatility were caught in a short squeeze. The S&P 500 ultimately plummeted 10% during the next two weeks.

More importantly, another volatility-based instrument that bets against volatility going up — the VelocityShares Inverse VIX Short-Term Note — collapsed from a value of $1.9 billion in assets to only $63 million. The next day, Feb. 6, six short volatility funds did not open for trading.

The nature of the product was its undoing.

Short volatility funds bet against long shots. This seems like a solid concept. Unfortunately for investors, these products are extremely short-term oriented.

SVOL settles every day as managers attempt to mimic a fraction of the daily return of the VIX, a number that is designed to reflect market anxiety. Volmageddon blew up the entire sector in 2018 in a single session.

Investors need to understand what the current 16% yield implies. Sadly, it is not what most investors believe.

All the best,

Jon D. Markman

P.S. While it’s simply impossible to predict the next Volmageddon, there are ways to see what might instantly shake up individual stocks. In fact, my colleague Sean Brodrick just laid out exactly how a single tweet can do just that in a new presentation. Click here to check it out.