Beyond Reason? Beyond Meat Soars 146%

|

| By Dawn Pennington |

In a move that seemed beyond reason, Beyond Meat (BYND) soared some 146% during Tuesday’s session.

That move may, in part, have been a response to the company’s new distribution deal with Walmart (WMT). Yet, the retailer’s stock fell three-quarters of a point during Tuesday’s session.

So what was the reason for Beyond performing far beyond its new retail partner?

That’s because BYND was just selected to add a protein-packed punch to an ETF that was recently resurrected from the dead.

BYND Isn’t Beyond Meme Stock Status

Beyond Meat was one of 2019’s most successful IPOs. And it became a pandemic-era darling in 2020.

Not just because it offered a plant-based alternative that proved popular when meat cases were otherwise empty.

But for newly stuck-at-home investors, BYND offered a way to play the new “meme stock” trend.

Five years later, Beyond Meat’s status as a meme stock became official with its inclusion in the Roundhill Meme Stock ETF (MEME, Not Yet Rated).

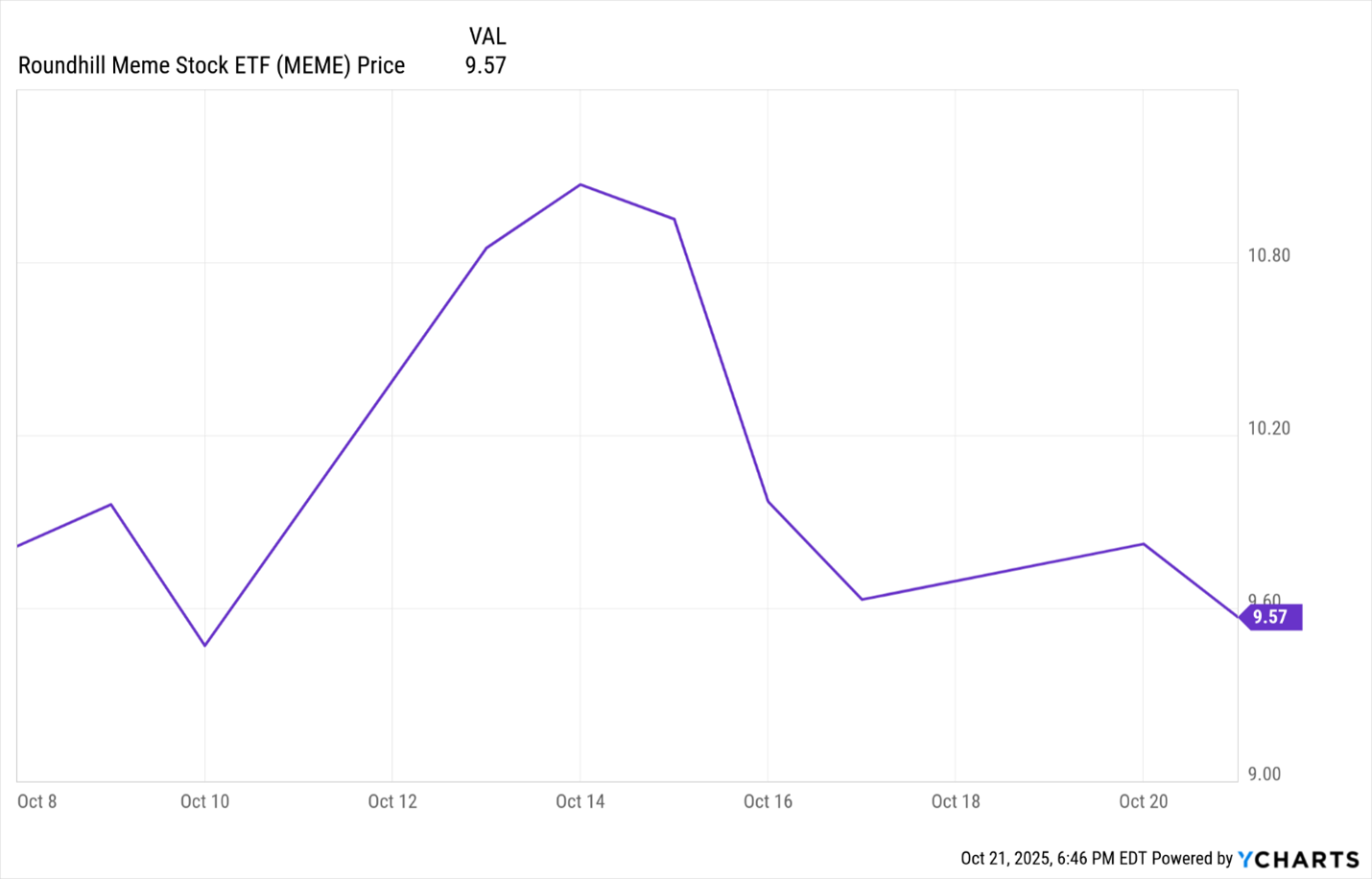

MEME launched in 2021, closed in 2023 because of waning investor interest and relaunched on Oct. 8.

Like WMT, MEME ended Tuesday’s session slightly lower.

So why was BYND up 146%?

The Move Wasn’t Because of Fundamentals

The Weiss Ratings don’t have enough data on MEME at this time to assign it a grade.

But we do have plenty of data on Beyond Meat. And that data is unappetizing at this time.

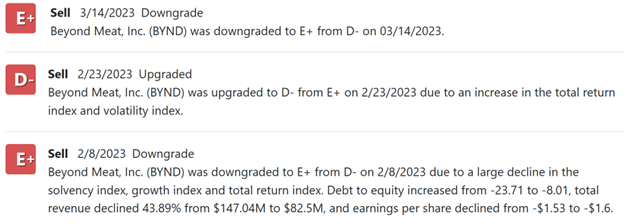

BYND earns a current grade of “E+,” which is about as low as you can get on our stock ratings scale. That’s considered a strong “Sell.”

However, as we’ve seen with classic meme stocks like GameStop (GME) and AMC Entertainment (AMC), declining revenues and outdated business models don’t bother some buyers.

In those kinds of cases, the lack of a good reason to buy them can be part of the appeal.

The Irony Writes Itself

On the very day Beyond Meat was added to the MEME ETF …

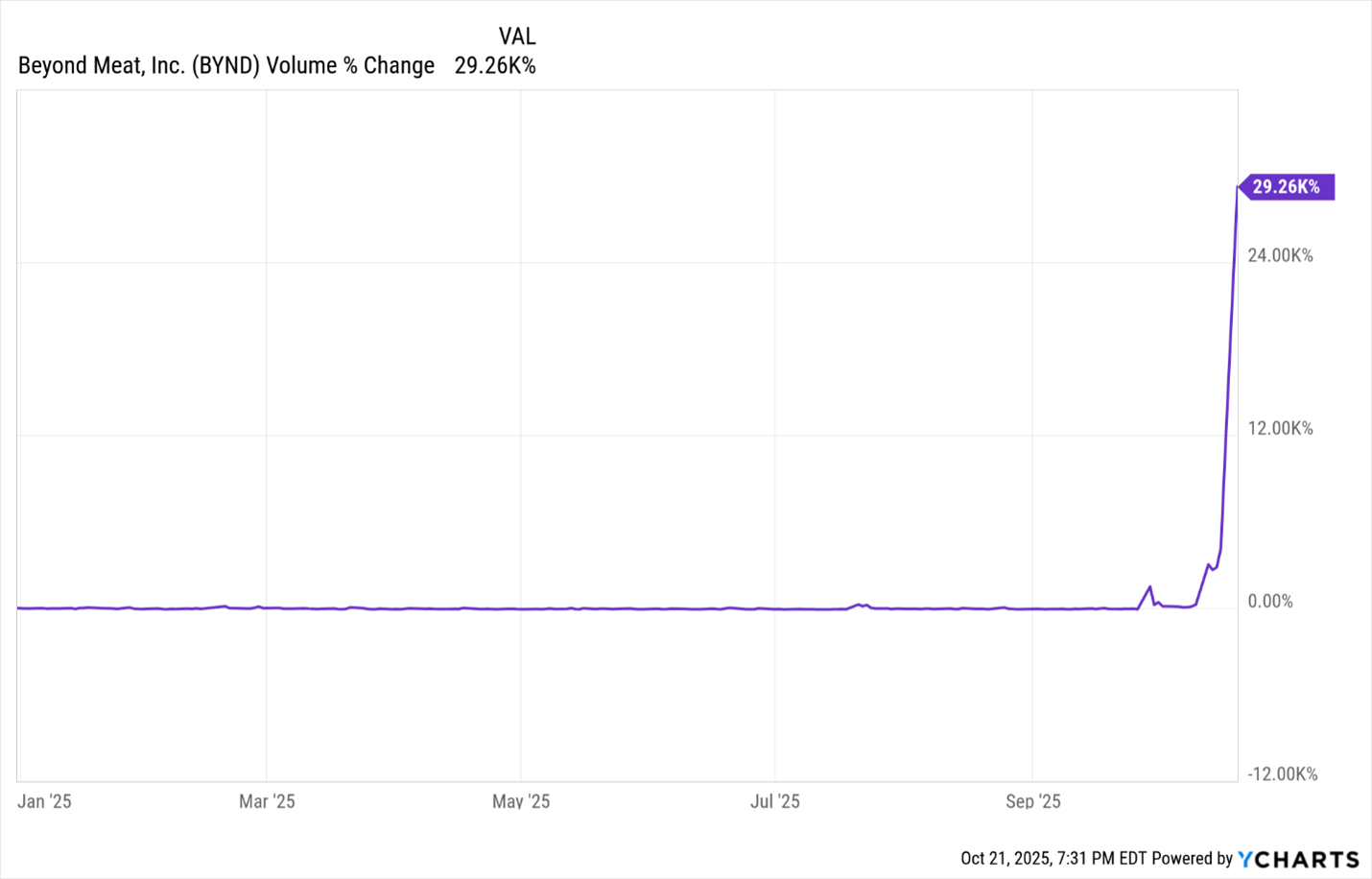

Buyers bid the stock higher to “squeeze out” institutions with short positions in the stock.

This is known as a short squeeze.

And just like we saw with GME, AMC and their meme-stock brethren, BYND’s surge forced shorts to buy it back quickly to cover their positions and try to limit their losses.

It’s Economics 101. When you have a limited supply of something (in this case, shares) and a massive demand (investors not wanting to get caught short) … the result is a “squeeze” higher.

How High (or Low) Can BYND Go?

Since its 2019 IPO, Beyond Meat’s shares are down 97%.

Its growth may have been organic at the time. But consumers tend to gravitate toward real meat vs. plant-based meat options. Especially when plant-based options are more costly.

Its new deal with Walmart could help on that front.

Best case scenario: If shares return to their all-time 2020 high just below $190, that would be a 5,077% gain from today’s price of $3.62.

Still, BYND’s fundamentals remain weak, and competition remains very strong in an industry that really has yet to take off.

What the Weiss Ratings Say about Beyond Meat

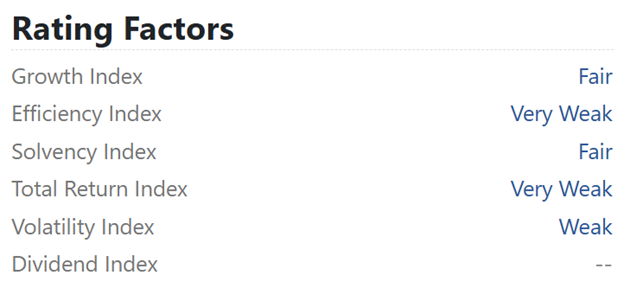

Several ratings factors go into its “E+,” or “Sell,” grade:

BYND scores “Weak” or “Very Weak” when it comes to Total Return, Growth, Efficiency and Volatility.

Beyond that, it doesn’t pay a dividend.

Plus, looking at BYND’s ratings history, it was rated a “Hold” for two months in 2019. It’s been a “Sell” for the rest of its six-year history.

During its time as a public company, it’s never achieved positive net income. In addition to that, its growth has been slowing.

So, it’s not surprising that the stock started this week with some 60% of its shares outstanding held short.

Beyond Earnings

The Weiss stock ratings can change daily, as more data becomes available.

Beyond Meat is scheduled to report its Q3 earnings on Wednesday, Nov. 5.

Expectations are low. Analysts expect EPS to come in at a negative 40 cents this quarter.

Last quarter, revenue fell 19% year-over-year, and earnings-per-share came in at a negative 43 cents.

Our stock ratings tend to reward consistency, profitability and stability. So it’s not likely we’ll see the stock rise beyond its “Sell” rating anytime soon.

Check the Weiss Ratings site anytime, day or night, to keep tabs on this or any stock’s grades.

Weiss Ratings Plus members can set an alert to be notified any time a stock’s grade or even its price changes.

They can even use our proprietary Stock Analyst Tool to find stocks to buy, short or simply run far away from.

Click this link here to see how Weiss Ratings Plus can put the power of our proprietary financial database to work for you today.

To your health and wealth,

Dawn Pennington & PJ Amirata