|

| By Karen Riccio |

Have you used Google or Bing in the last couple of months? Then you’re a user of generative AI.

It’s all happened in the blink of an eye. And that doesn’t include the more obvious AI apps — like ChatGPT and text-to-image system Dall-E — destined to change the way we work and live coming down the pipeline in due time.

It’s clear that AI is not only here to stay, but its potential uses are only just now starting to be explored.

That makes now the right time to address the AI-generated elephant in the room …

How do we power all these energy-hogging AI models?

A single Google search can power a 100-watt light bulb for about 11 seconds.

GPT-like instances can be anywhere from 600x to 800x more powerful than one Google search.

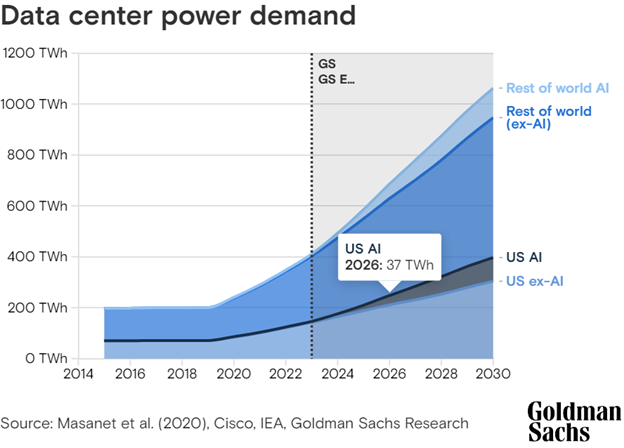

As data centers globally face a surge in energy consumption, projected to increase by 160% by 2030, the shift toward alternative power sources is becoming increasingly urgent.

As we grapple with how quickly AI has grown in popularity and how we can ensure continued development, new conversations are popping up around some good, old-fashioned power sources.

And Microsoft (MSFT) is doing much more than talking.

A Nuclear Reaction

The tech giant recently signed a deal with Constellation Energy (CEG), the owner of Pennsylvania’s Three Mile Island nuclear power plant.

Microsoft wants to purchase 100% of the plant’s electric-generating capacity over the next 20 years. If approved, this energy center is expected to begin producing electricity in 2028.

To be clear, we’re talking about enough energy to power some 800,000 homes for almost two years.

But all those megawatts (837 when the site closed in 2019) would serve Microsoft exclusively.

Specifically, its AI data centers.

The deal leaves the tech giant in good shape to power up its hyperscale data centers.

Those data centers run complex AI models and require a massive amount of energy.

Also, this move — to restart a plant that’s home to the worst nuclear accident in U.S. history — takes a lot of chutzpah.

However, along with raised eyebrows, the move also raised hopes for a solution.

Microsoft is also pursuing power from nuclear fusion.

This potentially abundant, cheap and clean form of electricity has been under development for decades.

Microsoft has signed a contract to purchase fusion energy from a startup that claims it can deliver it by 2028.

A Nuclear Chain Reaction

The pressure to generate the type of power needed to run AI models is hardly just a Microsoft problem.

That’s why this history-making event could trigger a chain reaction from tech companies, data center providers and utilities all over the country.

Even Nvidia (NVDA), which is practically synonymous with AI, has added the building of high-powered AI factories to its repertoire.

So, it’s not surprising that CEO Jensen Huang recently advocated nuclear energy as a critical component of the energy mix.

If approved by regulators, there are two firsts set to happen:

- Three Mile Island would become the first U.S. nuclear plant to come back into service after being decommissioned.

- Plus, never before has a single commercial nuclear power plant’s entire output been allocated to a single customer.

These new developments aside, the U.S. nuclear sector hasn’t changed much since the early 2000s.

All but a handful of our roughly 90 nuclear reactors were built during the second half of the 20th century. Their average age is about 40 years.

Renewed Interest

As of 2023, the U.S. derived almost one-fifth of its electricity from nuclear power. That’s nearly as much generated by renewable resources.

And, importantly, nuclear plants provide a dependable source of electricity for utilities to use in conjunction with wind and solar power.

As you probably already know, nuclear power is considered “clean.” That’s because, unlike burning natural gas or coal to produce electricity, it does not create greenhouse gas emissions.

And so, to shed a cleaner light on the nuclear plant, Constellation plans to rename Three Mile Island as the Crane Clean Energy Center.

The rebrand may or may not stick. But the reopening of closed nuclear power plants, or facelifts of aging ones, likely will.

3 More Projects to Watch

The owners of a shuttered plant in Western Michigan called Palisades are also working to bring that facility back to life.

It’s the hope of privately owned Holtec that the $1.5 billion federally funded project will feed nuclear energy from Palisades into the region’s power grid by late next year.

The Duane Arnold nuclear plant in Iowa is another potential candidate.

It closed in 2020 after 45 years, and owner NextEra Energy (NEE) has recently made comments about the plant possibly reopening.

And earlier this year, Amazon (AMZN) purchased a data center site right next to the Susquehanna nuclear power plant, also in Pennsylvania.

Regulatory approval for restarting any or all of these sites could be the latest sign of an approaching nuclear resurgence.

Clean Ways to Invest in This Trend

Big tech companies need lots of energy.

And bringing old nuclear plants onto the grid — or keeping aging ones open — seems like a no-brainer to chip away at burgeoning energy demand.

There are currently 413 nuclear reactors in operation worldwide, with an average age of around 32 years, according to the International Atomic Energy Agency.

Winners from the nuclear revival include utilities and energy companies like NextEra and Constellation, the largest owners of nuclear plants in the U.S. that are not rate-regulated.

Constellation accounts for about 5% of Utilities SPDR (XLU) and other utilities index funds. The company also represents about 10% of the Range Nuclear Renaissance ETF (NUKZ).

You might not have had nuclear power on your investment bingo card for 2025. But it’s no longer a relic left to the past. Rather, if the big techs are right, it could lead the way to the AI-powered future they are promising right now.

Best,

Karen Riccio

P.S. Our Tech & Biotech Strategist Michael A. Robinson is hot on the trail of a drug company that’s ahead of the game when it comes to artificial intelligence. Not only does AI help identify and map DNA strands much quicker … but AI is creating brand-new molecules on its own. Click here for Michael’s full investigative report about how he finds big biotech winners … and big potential winners like this one.