|

| By Nilus Mattive |

Over the last several years, I’ve gotten a reputation for being a bit of a bear.

A negative Nancy.

A “glass half empty” sort of guy.

It wasn’t always this way.

Indeed, when I first joined forces with Dr. Martin Weiss almost 20 years ago, a lot of people probably considered me the bull — maybe even the Pollyanna — of the firm because I was always talking about dollar cost averaging and dividends.

Well, here’s the truth: Nothing has changed at all … only people’s perceptions.

Back then, I agreed with Martin that we were in a massive real estate bubble.

And right now, I agree with Martin that we have entered a new “Age of Chaos.”

Here’s the reality …

I am always looking out for the risks AND coming up with solutions that work despite — or in some cases BECAUSE OF — the current dangers.

That doesn’t make me a bull or a bear.

It makes me a rational, data-driven, safety-minded investor.

One who happens to have access to one of the largest financial datasets in the world — a whopping seven terabytes of it — with proprietary, state-of-the-art technology analyzing this data 24/7.

I’m talking about the Weiss Ratings, of course. This massive data source gives us unique insights into where stocks are headed based on where they’ve been.

Also, we’re not keeping that data to ourselves.

We’ve just released the ultimate data-powered investing tool, Weiss Ratings Plus, that gives you access to the same stock-picking technology as your favorite editors. Check it out here.

As for what I personally see? I’ll tell you very plainly …

The risks appear far greater in number or size than the markets seem to believe.

And I’m not alone in that belief …

Buffett & Burry Are Both Bearish

Warren Buffett and Michael Burry exist on two completely different ends of the spectrum.

Buffett has been a prominent and generally bullish investor since the 1960s.

Burry only rose to fame when he famously bet against the collateralized debt obligations (CDOs) that underpinned the aforementioned housing bubble.

Besides thinking for themselves, what do these two investors have in common?

Both have become far more cautious on U.S. stocks.

Here’s the proof …

In Buffett’s case, Berkshire Hathaway has been trimming its equity positions. It’s currently sitting on a record level of cash.

Indeed, during Berkshire’s annual shareholder meeting last month, someone asked Buffett about that cash pile — which currently sits at roughly $300 billion, or 27% of Berkshire’s assets … about twice the normal amount.

Here’s what Buffett said in response:

“The amount of cash we have — we would spend $100 billion if something is offered that makes sense to us, that we understand, offers good value and where we don’t worry about losing money.

“The problem with the investment business is that things don’t come along in an orderly fashion, and they never will …

“Every now and then, you find something. Occasionally, very occasionally — but it’ll happen again, I don’t know when — it could be next week, it could be 5 years off, but it won’t be 50 years off — we will be bombarded with offerings that we’ll be glad we have the cash for.

“It would be a lot more fun if it would happen tomorrow, but it’s very unlikely to happen tomorrow.

“It’s not unlikely to happen in five years, and the probabilities get higher as you go along.”

In a nutshell, Buffett isn’t seeing good deals right now.

He suspects they’ll be coming. And probably sooner than later, based on history and statistics.

What about Burry?

He has largely flown under the radar ever since his story was made famous by Michael Lewis’ book “The Big Short,” which was later turned into a movie.

But we just got the latest quarterly 13F filing on his investment fund, which continues to hold a sizeable portion of his net worth.

In it, we learned that the fund liquidated eight out of its nine stock positions and now contains only a single stock — Estee Lauder (EL) — along with put options on Nvidia (NVDA) and several other Chinese technology stocks. (Put options are time-sensitive bets that the underlying investments will drop in value.)

Because these filings become public on a delayed basis, we only know that’s what Burry was holding at the end of 2024. We don’t know what Burry is holding today.

It’s entirely possible that Burry already cashed in his bearish bets during the last big market downdraft.

That’s what I did with my personal put positions on the Invesco QQQ Trust (QQQ) as well.

However, I just recently took all my remaining profits from that previous trade and loaded back up on new rounds of the same puts.

And I have a feeling Burry is still betting on more market downside, too.

To understand why, let’s turn back to Warren Buffett for a minute.

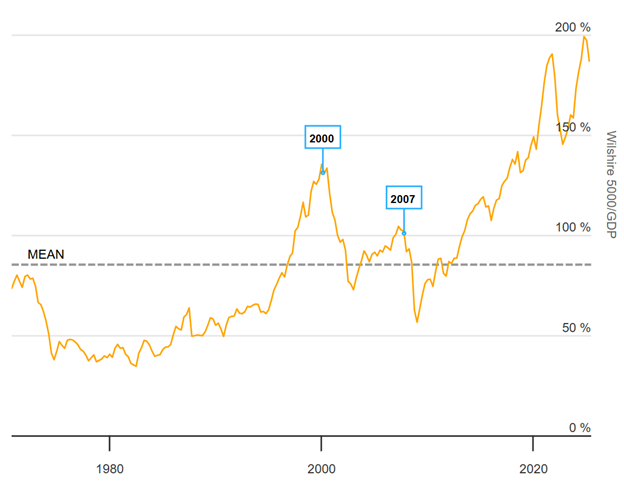

For a very long time, his favored valuation gauge has been taking the value of the U.S. stock market and dividing it by U.S. gross domestic product (GDP).

The result tells you how much of a premium that investors are collectively paying for the total U.S. economy as measured by the U.S. stock market.

Normally, this so-called Buffett Indicator hovers around the 80% to 100% range.

Today, it’s near an all-time high of 200%.

Note that even during the top of the Dot-Com Bubble, it only hit the 130% level.

Also note that it only really surpassed that previous all-time high once governments kicked their money-printing efforts into high gear as the Covid crisis unfolded.

In my opinion, everything since then has been a blow-off top driven by massive amounts of easy money coupled with a “YOLO” mindset.

At the very least, it has created valuations that have moved far ahead of the fundamentals.

Perhaps AI-fueled innovations will quickly narrow that gap.

Perhaps the economy will suddenly take off like a rocket.

Perhaps some other unforeseen catalyst will justify the price action.

Or maybe not.

As Buffett points out, it’s reasonable to expect corrections — even very severe ones — fairly regularly.

Given ongoing tensions all over the world … the latent effects of the trade war just starting to kick in … and several other major risks boiling under the surface, I don’t recommend taking a wildly bullish stance right now.

Instead, I continue to suggest the same approach I’ve been advocating for decades now.

That is, to always stay mindful of the dangers, zig when the market zags, and use a whole array of investments and strategies to minimize losses and keep your portfolio growing no matter what happens next.

Best wishes,

Nilus Mattive

P.S. If you haven’t seen Martin’s new “Age of Chaos” presentation yet, please do it now.

In it, he clearly outlines the six specific steps to take next … including several that I personally helped him put together. Just click here and it will start playing automatically.