Buy Reliable Florida Home Insurance with Weiss Ratings

|

| By Gavin Magor |

I’ve lived and breathed insurance ratings for 35 years, and I’m here to warn you: If you’re a homeowner in U.S. states prone to natural disasters, you could be in trouble.

It's difficult to secure affordable property and casualty insurance in places like hurricane-prone Florida, the Midwest states in Tornado Alley and earthquake-prone California.

The obvious reasons are catastrophic weather, the number of claims filed as a result and not enough cash in the coffers of insurance companies.

Florida has been impacted by all three. In fact, “impacted” is too weak a word — more like unraveled.

Get this: Floridians filed more than 535,000 claims since Hurricane Ian struck last September, creating an estimated $5.9 billion in insured losses.

Click here to see full-sized image.

The average cost of property insurance rose 39% higher than the national average after that catastrophe. And rates are headed even higher.

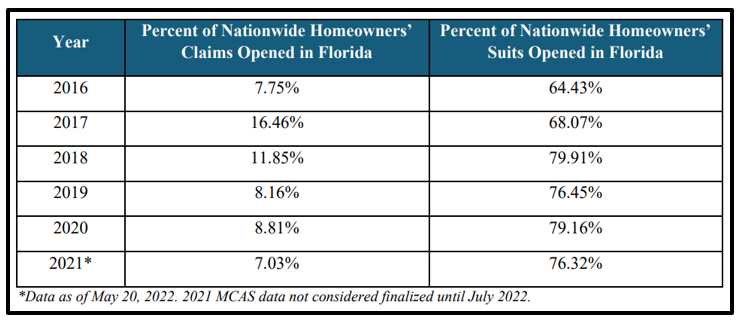

A rash of lawsuits is also chasing insurance companies away from Florida. The state accounted for 79% of lawsuits filed in the U.S. in the last two years.

Finally, the costs of reinsurance — policies that insurance companies buy to protect their balance sheets — are skyrocketing.

Small companies often cannot afford to insure themselves and are forced to go out of business or pass on premium hikes to policyholders. Larger companies simply don't want to take on that much risk and choose to not do business in Florida.

The result: a shrinking market, not just in Florida, but many other states where Mother Nature often wreaks havoc.

However, it did not shrink overnight.

Of the 29 insurers that set up shop in Florida between 2012–17, four failed or withdrew from the market. And since 2020, 15 insurance companies declared insolvency there, including FedNat Insurance, Southern Fidelity, Lighthouse, Avatar Property & Casualty, St. Johns and Weston Property & Casualty.

To put that in perspective, only 1.9% of property and casualty insurers in the U.S. fail each year.

All of this happened under the Florida Office of Insurance Regulation, which is ultimately responsible for making sure insurance companies operating in the state can afford to pay claims and not go out of business before doing so.

The Main Culprit

But that office isn’t entirely to blame. The ratings agency Florida substantially relies on — Demotech — has played the biggest role in the state’s insurance unraveling.

Anyone who takes out a federally funded mortgage by Freddie Mac or Fannie Mae is required to secure home insurance with a high rating. And if you can believe it, Demotech only offers “A” ratings and above, including “A++” and “A+’’ to insurers they believe suitable for a rating. It’s not only laughable, but it’s all smoke and mirrors.

These ratings, based on several variables that align with a company’s financial viability or liability, are supposed to be accurate and unbiased. I do not believe Demotech is as objective as it follows a pay-to-play business model, meaning insurance companies pay a fee to Demotech for providing their ratings.

Considering that Demotech reviews and rates 46 insurers that write approximately 66% of Florida’s homeowner’s insurance premiums, that should be concerning to any property owners. Demotech also rates companies in Louisiana, North Carolina, South Carolina and Texas.

I've always associated money with bias.

Demotech came under fire in 2022, just two months before the start of hurricane season, when it warned about an ensuing downgrade of 17 Florida property insurers, something that often results in a death sentence for companies.

The Florida Office of Insurance Regulation immediately took a public stance:

“This is an example of inconsistent, monopolistic power of a select rating agency that is trying to exert coercive influence over Floridians and policymakers in an effort to thwart public policy according to its own opinions.”

Bottom line: Policyholders suffer. You buy a home, secure insurance with a company you think is stable … only to be blindsided by its bankruptcy.

God forbid you cannot find a new insurer before Hurricane Arlene strikes or your loan is defaulted on by Fannie Mae, Freddie Mac or a private mortgage loan provider.

At Weiss, we believe that assigning an “A” rating to a company with below-average financial strength is tantamount to consumer deception.

Ratings You Can Trust

I urge you to take matters into your own hands and check out Weiss Ratings.

We have methodologies built into proprietary ratings algorithms. We believe that all insurers are not equal. There are some extremely well-funded ones and some that are vulnerable.

Our ratings are conservative, but they're unbiased and distinguish between the individual insurers. More important, they allow consumers to be better informed.

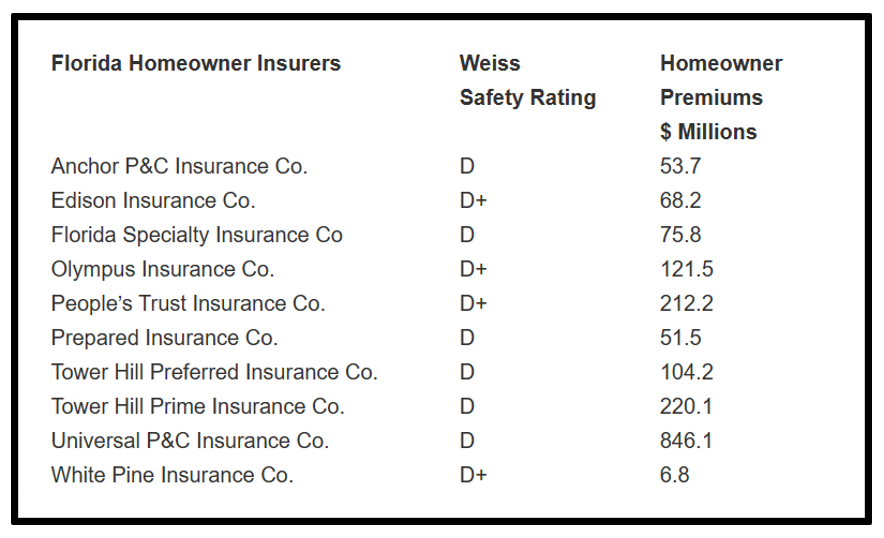

For example, from four months after Hurricane Irma struck, Weiss rated 10 insurance companies selling policies in Florida.

Click here to see full-sized image.

We assigned low ratings to each of the 10 companies, while Demotech gave all of them a Financial Stability Rating of “A” or better — with the exception of White Pine Insurance, rated “B+” by A.M. Best.

At that time, Weiss warned consumers to remain vigilant of these 10 insurers with weaker finances, which combined for more than $1.7 billion in homeowners’ premiums in Florida.

Today, a majority of those companies have gone out of business or continued earning low grades from us. Click here to find out how Weiss rates each of those insurers today.

Our track record is a testament to our success.

Weiss Ratings has been recognized by the U.S. Government Accountability Office for its accuracy in issuing warnings when companies failed, including Mutual Benefit Life of New Jersey, Executive Life of California, Fidelity Bankers Life, Executive Life of New York, First Capital Life and more.

So, while Demotech may not have your back, Weiss Ratings certainly does.

All the best,

Gavin Magor

P.S. America could default on its debt as soon as July, triggering the worst economic earthquake in history. What can investors do? The best option is a strategy is one that works regardless of volatility. Over the past five years, one little-known strategy produced 535 real winning trades, averaging 16% gains in just four days. Join Dr. Martin Weiss for an urgent video briefing where he reveals how to put this strategy to work starting immediately.