|

| By Sean Brodrick |

China has a stranglehold on the world’s supply of rare earths.

Now, there is an American company that is on a mission to break China’s iron grip — and potentially become the “Apple of Rare Earths” in the process.

Do you wish you’d bought Apple (APPL) when it was still in its early stages?

In that case, read on …

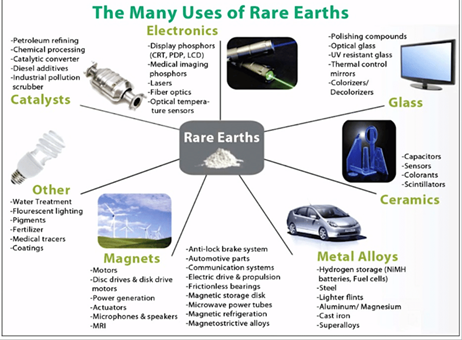

Rare earth elements (REEs) are a group of 17 elements on the periodic table that are lightweight, super strong and resistant to heat.

This makes them useful in magnets, small electric motors, missile guidance and much, much more.

China accounts for more than half of global rare earth mining and almost 90% of processing.

For years, China purposely sold rare earths so cheaply that Western suppliers could not compete.

Result: The U.S. now sources 80% of its rare earth imports from China. The European Union relies on China for 98% of its supply.

China flexes its muscles in the rare earths market from time to time — restricting exports because it is displeased with its Western customers.

The most recent flex came in April of this year, when China imposed export restrictions on seven heavy REEs and related magnets.

These are crucial for defense, energy and automotive sectors.

This devastated global supply chains. And it added some heat to a Western company that was already starting to ramp up production.

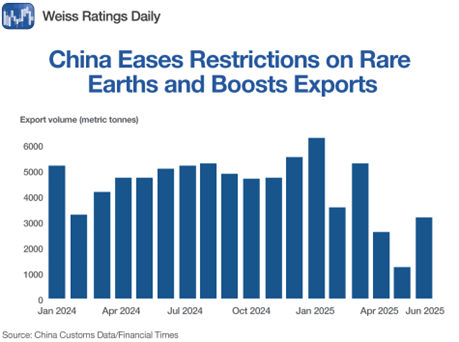

Now, China is getting scared and ramping up exports again.

In June, China's rare earth exports surged by 32% compared to May, reaching 7,742.2 metric tons.

This also represents a 60% increase compared to June of the previous year. Exports continued to rise in July, though at a slower pace.

This rise in Chinese exports of rare earths is strategic.

By easing up just as new Western projects come online, it’s attempting to undercut non-Chinese supply just enough to make marginal Western production uneconomic.

Think of it as a well-timed head fake.

I’m thinking Western governments will quote the Who in saying, “Won’t Get Fooled Again.”

They’re pouring money into potential western suppliers — and Uncle Sam is showering cash on a company called MP Materials (MP).

MP Materials has the only active rare earths mine in the U.S. — Mountain Pass, in California.

The mine has an integrated processing plant where REEs are refined into high-purity oxides, such as neodymium and praseodymium (NdPr).

This sets MP Materials apart from other Western companies that must send their rare earths to China for processing.

Then, MP Materials manufactures neodymium-iron-boron (NdFeB) magnets at its Fort Worth, Texas, facility.

This plant produces finished magnets for the automotive and defense industries.

So, here’s the only U.S. company with top-to-bottom integration of the rare earths pipeline.

That grabbed some eyeballs in Washington, D.C.

In July, MP Materials signed a significant partnership deal with the U.S. Department of Defense (DoD) aimed at accelerating American independence in rare earth magnet production.

The DoD became MP Materials’ largest shareholder through a $400 million stock purchase. This gives the government a 15% stake in the company.

The DoD guarantees a 10-year price floor for NdPr oxide at $110 per kilogram, nearly double current Chinese market prices.

This deal ensures financial stability for MP Materials even if global prices drop.

Simultaneously, the DoD signed a 10-year offtake agreement for 100% of output from a major new magnet manufacturing facility that MP Materials is building.

That new factory should begin operations in 2028 and add 10,000 metric tons of NdFeB magnet-making capacity, which is vital for defense and advanced technologies.

This makes the U.S. government a major financial backer and customer of MP Materials.

It also establishes a durable domestic supply for rare earth magnets crucial to national security and industry.

Unlike most “aspirational producers” still stuck in permitting, MP Materials is already the largest producer of rare earths in the United States — and it is unique in its scale and integration in the Western Hemisphere.

MP Materials’ production capacity should reach 40,000 metric tons of REE oxides annually by 2026.

Even better, MP Materials also has:

-

A long-term offtake agreement with Apple, supplying rare earth magnets for the iPhone and Mac supply chain.

Apple will prepay $200 million as part of this $500 million commitment to guarantee a supply of U.S.-made, recycled rare earth magnets for future iPhones and other devices.

-

A strategic partnership with Saudi Arabia aimed at expanding magnet production in the Middle East and securing additional non-Chinese feedstock in the future.,

The deal will establish a strategic partnership focused on building a fully integrated rare earth supply chain in Saudi Arabia.

In short, MP sits at the center of three powerful forces:

- U.S. defense reshoring.

- Tech sector supply chain diversification.

- Geopolitical competition over critical minerals.

I believe this could make MP Materials “The Apple of Rare Earths.”

Remember, Apple didn’t rise to the top on the strength of one product or one big break.

It was the convergence of three powerful forces:

- Vertical integration. Apple fused hardware and software in a way no one had done before. Apple tightly controlled the entire stack (chips, OS, handset), which produced a seamless user experience and instantly set it apart from other handset makers.

- Its platform ecosystem. The launch of the App Store turned the iPhone into a platform. Suddenly, developers were building products on top of Apple’s device, which created network effects.

- Shifts in global market dynamics. Consumers wanted innovative, multifunctional tools, causing massive new demand for Apple devices.

Now let’s look at MP Materials …

- Vertical integration. MP Materials has end-to-end control of the rare earth supply chain. It mines raw ore, processes high-purity REEs and manufactures NdFeB magnets.

- Structural shift in global supply chains. Western governments are moving aggressively to secure critical minerals, even if it means paying more. That secular shift in policy and strategy puts MP Materials in the catbird seat for years to come.

- Uncle Sam helps build out the platform. U.S. and allied governments are actively building a demand ecosystem around MP Materials by pushing defense contractors, EV makers and tech manufacturers to source domestically.

Getting Apple as a customer was a big win for MP Materials.

It won’t be the last.

As MP Materials proves to be indispensable in the Western rare earths supply chain, expect more customers to line up.

And expect more support from Washington to secure the domestic supply.

Do You Own MP Materials?

If you’re a subscriber to my Resource Trader, you do. And you’re up about 150%.

It’s pulling back now — a normal and necessary part of any bull market. But man, it could go a lot, LOT higher.

If this stock gets below $60 a share, that’s a gift.

You’d be wise to buy “The Apple of Rare Earths” on a pullback opportunity.

MP isn’t the only “critical material” producer I’ve shown my Resource Trader readers …

I have another that’s only up 42%, with just as long of runway as MP.

Heck, we have a whole portfolio of resource stocks that are headed higher.

If you'd like to get in before those stocks jump like MP, you can join my readers here.

All the best,

Sean