Buy the Biggest Bargain on Wall Street Right Now!

|

| By Sean Brodrick |

Oil bears are wrong.

It’s going to get very expensive for them.

And it could turn into a fortune for you.

The Bear case: The International Energy Agency forecast for global oil oversupply this year has ballooned from 1 million barrels a day to nearly 4 million bpd in its latest update.

The IEA and other bears believe more oil is coming from both OPEC and the Americas.

Set aside the fact that the IEA has a lousy track record forecasting prices.

What they aren’t factoring in is that oil prices have been in a slump since 2023. And years of lower prices are starting to impact production.

We know that because U.S. oil production peaked in July.

In fact, the Energy Information Administration forecasts U.S. oil production will average 13.5 million bpd in 2026 — about 100,000 bpd below last year's level.

And the U.S. is one of the sources the IEA is counting on to raise production!

Sure, if prices go higher, production will eventually follow.

But it takes time.

And that opens the door to higher prices that could be very profitable.

Here’s the best part …

Energy stocks are dirt-cheap. And the better ones pay you to own them.

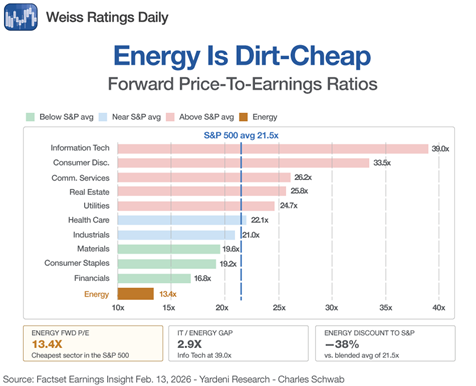

Energy is one of the cheapest sectors in the S&P 500.

The divergence is stark: IT and Consumer Discretionary trade at nosebleed valuations of 39x and 33.5x forward earnings, while Energy companies trade at 13.4x forward earnings due to an oil price slump.

I’ll get to that.

Some will say that tech always has sky-high valuations.

I’ll give you more context: The S&P 500's forward 12-month P/E ratio is currently 21.5.

And energy is MUCH cheaper than that.

Now, for the payday …

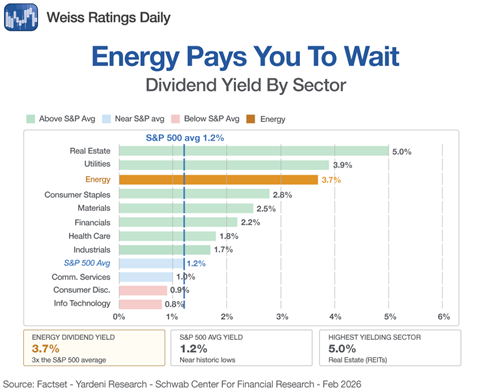

The average dividend yield in the energy sector is 3.7%.

You can find individual stocks that pay more.

Compare that to 1.2% for the S&P 500 … or 0.8% for information technology.

So, you’re paid to wait even if energy prices go nowhere.

Now, I’ll give you three reasons energy prices are poised to pump higher …

Reason #1: The Global Economy Is Growing

The International Monetary Fund recently raised its global growth forecast to 3.3% in 2026.

China could grow at 4.8%, and India could grow at 6.2%.

Both of those countries are energy hungry.

And most of the rest of the world is growing, too.

Reason #2: There Are ALWAYS Supply Shocks

I’ve been in these markets long enough to know that something always goes wrong.

Whether it’s Ukraine blowing up more of Russia’s oil infrastructure or a blockage of the Straits of Hormuz, it’s always something.

Reason #3: Producers Are Cutting Back on Spending

Since late 2022, the industry has deliberately shifted away from growth-at-all-costs toward capital discipline and maximizing free cash flow.

In 2025, 38 exploration and production companies tracked by RBN Energy lowered their collective capital expenditures to $60.4 billion, about 3% below the 2024 level.

Oil-weighted producers cut spending by 2% year over year.

That is great for company profits. Because as they spend less, their profit margins widen.

But it’s lousy for future oil and gas production.

What You Can Do

To me, this looks like a no-brainer.

The smart thing to do is buy energy stocks that are leveraged to oil prices and pay you handsomely to own them.

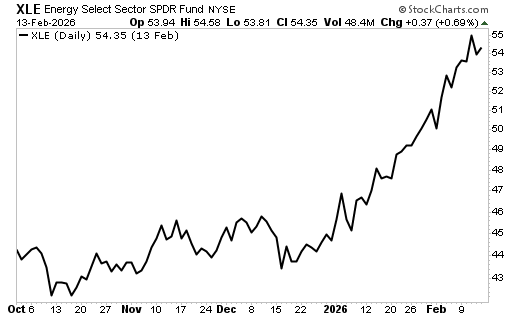

And even if you don’t want to do the hard work, you can buy the State Street Energy Select Sector SPDR (XLE), which holds a basket of leading oil and gas companies.

It has an expense ratio of just 0.08%, a dividend yield of 2.87% and a Weiss Rating of “B.”

Yeah, you missed the XLE’s breakout in January.

Don’t worry, there’s still plenty of gas in the tank.

This ETF should run to at least 65.

And if energy prices go higher, it could blast off.

It’s the biggest bargain on Wall Street. Are you buying?

All the best,

Sean

P.S. Do you like investment ideas like this one?

Please join us for the upcoming 2026 Weiss Investment Summit at the historic Boca Raton resort in Boca Raton, Florida, on May 3-5.

It’s the only time of year when we’ll have all our experts — including Dr. Martin Weiss — gathered to share their insights across industries, from natural resources and crypto to startups and more.

Attendees from last year’s Summit had the opportunity to see gains of 447%, 225%, 208% and 175%.

We will also have a featured speaker, NFL Hall-of-Fame Dan Marino, joining us to talk about his business and entrepreneurial journey post-football career.

What’s more, you’ll get special, Summit-only exclusive picks from some of the smartest traders in the business.

Trust me, you won’t want to miss it. For a limited time, when you purchase two (or more) General Admission tickets, we’ll automatically take $300 off your total price! No code needed.

Click here to secure your tickets now, then reserve your stay at the recently crowned Forbes quadruple 5-star property.

This is the only property in the Americas to receive this honor.

You don’t want to miss out on staying at this luxurious resort and taking advantage of our exclusive discount on your stay.