|

| By Jon Markman |

Most of the Magnificent Seven companies are in the process of building out exceptional digital assistants powered by artificial intelligence.

This is a big investment opportunity.

Next-generation AI digital assistants are headed to Meta Platforms (META), according to CEO Mark Zuckerberg. Facebook’s parent company is now buying 350,000 AI processors from Nvidia (NVDA) to ensure success.

While great news for both companies, there are others set to do even better from this trend.

Let’s back up, though.

Next generation digital assistants will not be Siri, the slow-witted DA from Apple (AAPL).

In addition to knowing most of the personal details of our lives, these DAs will be context aware. They will also be multimodal — able to make sense of the physical world through sound, sight, video and the written word.

These truly smart DAs will be a game changer for most of us, a trusted personal valet. And only a handful of companies are capable of investing in the software and hardware required to make it happen. This process will necessitate deep pockets and a lot of engineering talent.

Meta, Apple, Alphabet (GOOGL), Amazon.com (AMZN), Microsoft (MSFT), Tesla (TSLA) and Nvidia are the so-called Magnificent Seven … the biggest tech companies in the world. These companies have the money and the human resources to build next-generation DAs. These companies are sitting on gold mines.

It's popular among bears to scoff at the valuations afforded to the Magnificent Seven. Bears love to take the other side of success. They misunderstand the size of the opportunity.

Next-generation DAs will become integral to our lives, even more so than ubiquitous smartphones.

These uniquely personal assistants will be capable of independently setting our calendars, booking appointments, writing emails and sending messages on our behalf. They will even be able to spend our money via machine-to-machine transactions. Magnificent Seven platforms that control these DAs will scrape fees. Some will even charge monthly subscriptions. And if history is any indication, we will gladly pay for the convenience and peace of mind.

This is the bet being made by Zuckerberg. He wants to bring personalized DAs to Facebook and Instagram. He also seeks to dramatically enhance Meta’s augmented reality headset business with AI.

Meta’s Big Bet on the AI Goldrush

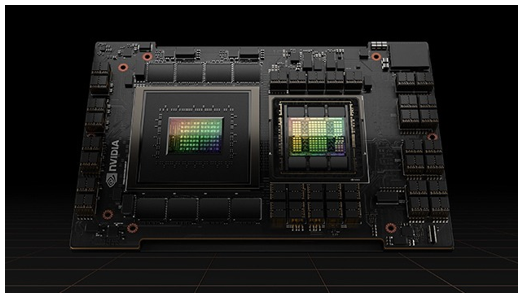

PC Magazine reported on Thursday that Meta is buying 350,000 H100 AI processors from Nvidia. The size of this order is shocking, perhaps four times the size of the investment made at Microsoft to get ChatGPT off of the ground.

As an aside, as I wrote last week, Microsoft will spend even more money to bring ChatGPT-like capabilities to CoPilot, a branded AI digital assistant.

Indeed, the current AI goldrush is running full steam ahead …

Alphabet is building out digital assistants under its Google DeepMind division.

Amazon is using AI to make its Alexa assistant smarter.

Apple is finally getting Siri up to speed.

And Tesla, in China, replaced in-car voice commands with a fully functioning AI digital assistant, according to several Chinese customers.

All of these DA processes run on Nvidia AI processors and software infrastructure.

AI Goldrush Pick & Shovel Plays

The opportunity for investors, apart from Nvidia shares, are the companies working closely with the Santa Clara, California-based chipmaker to bring new AI hardware to the world’s data centers.

If the DAs are the goldrush, these firms are providing the pickaxes and shovels for excavation. It is a tremendously lucrative opportunity because most of the world’s data centers will need to be outfitted with next generation servers, switches and smarter silicon.

Nvidia CEO Jensen Huang put the size of that opportunity at $1 trillion. Here are four companies set to grab a big slice of that pie …

- Super Micro Computer (SMCI) makes the actual server racks and computers that house and cool the powerful Nvidia chipsets.

- Arista Networks (ANET) builds the super-fast switches needed to transfer AI data.

- Arm Holdings (ARM) designs and licenses the circuitry for ultra-low powered central processor units. Although Nvidia’s GPUs are the star of AI chipset, CPUs are a critical component.

- And Broadcom (AVGO) controls most of the intellectual property required for connectivity.

The services of these companies are essential to build out next generation DAs.

While the Magnificent Seven might be sitting on a gold mine, you want to own the companies selling them the picks and shovels.

All the best,

Jon D. Markman

P.S. This news from Meta — buying 350,000 AI processors from Nvidia — is huge. In fact, it only increases the potential for what my colleague is calling a possible “Nvidia Crash” on Feb. 28. Click here to find out more.