|

| By Nilus Mattive |

As I told you the other day, a great rotation is clearly underway.

While it’s exactly what I expected — and what history itself suggested would happen — it seemingly caught most everyone else off guard.

Unfortunately, many of them are about to get surprised ... and potentially burned ... again. And I don’t want you to be one of them.

Indeed, I’ve seen a lot of people trying to make sense of the recent moves in all the major asset classes. So, I wanted to give you my own thoughts on where things stand right now.

We’ll start with stocks …

Despite a pullback, equities are nowhere near fairly valued — let alone UNDERVALUED — given all the possible risks in the world today.

It’s actually quite laughable to see headlines about “buying the dip” already hitting the wires.

Now, is it possible we see a period of relative calm or maybe even relief rally?

Absolutely.

But I’m not a short-term trader, and I don’t recommend you try to time those types of moves, either.

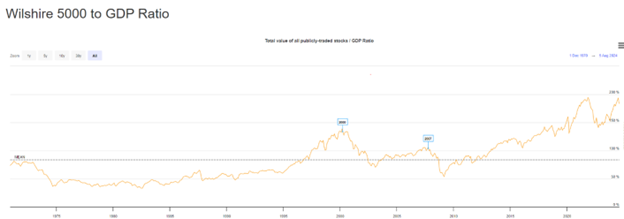

Instead, focus on the bigger picture … like this “Buffett Indicator” chart I keep showing over and over.

This is simply the total value of U.S. stocks — represented by the Wilshire 5000 Index — divided by the U.S. GDP.

As you can see, Monday’s quick drop in the stock market is barely a blip. The Buffett Indicator is still near 200%.

That’s ridiculously high by historical standards … far above the TOPS we saw leading up to the tech wreck or the last financial crisis.

Now, a new working thesis I have is that valuations can remain a bit more extended than they have in the past because of the possibility of future inflation and dollar devaluation.

Yet even if that ends up being correct, it doesn’t imply today’s levels are sustainable.

Bottom line: I think the broad stock market — particularly high-flying tech companies — has a far greater likelihood of dropping further over the next few months.

Meanwhile, other asset classes offer far more upside. Here are four you should have in your portfolio.

4 Non-stock Assets You Need Now

For starters, I believe high-quality, fixed-income investments like U.S. Treasury bonds remain attractive.

It is absolutely true that our federal debt is outrageously high, and the long-term picture is grim.

However, that won’t matter much in the near term.

Investors almost always take refuge in this part of the markets when the going gets tough elsewhere, as they temporarily did on Monday. Treasuries across the board had a great day.

And given the major slump leading up to the present day, as well as the possibility for Fed rate cuts, I think there is still outsized profit potential in longer-dated Treasuries.

In the December 2023 issue of Safe Money Report, I explained this to readers and told them it was time to load up.

More than that, I gave them three different profit target scenarios.

The first of the three is already getting closer by the day.

But if my “blue sky” scenario plays out they could make as much as 85% from some of the safest investments on the planet.

And just so you know, I personally have more than $300,000 of my own retirement money invested in various Treasury bond funds across the entire duration spectrum … so I’m walking the talk.

Now what about the two major “alternative” asset classes you hear about on days when markets slump — precious metals and crypto?

Many people — even very seasoned investors — have been surprised to see these two categories dropping in value along with the major stock indexes.

They shouldn’t be.

Gold has typically dropped during days of extreme market panic as traders sell almost everything, often times because of forced margin calls. That too temporarily happened on Monday.

However, it then levels off or rises as things settle and longer-term fundamental forces prevail.

I expect gold to do well this time around, too … especially given the fact that inflation still hasn’t even dropped to the Fed’s own stated target of 2% as well as the clearly unsustainable long-term government debts mentioned a moment ago.

This is why, ultimately, the yellow metal still remains within striking distance of all-time highs.

This long-term chart of the SPDR Gold Shares ETF (GLD) demonstrates everything I just said …

And what about crypto, a new asset class that didn’t even exist during many past sell-offs, panics and crises?

Here’s my take, which is a bit more nuanced than the standard talk you’ll hear from crypto evangelists …

Over shorter time horizons, I believe crypto is very much a “risk on” asset class.

In other words, it is highly correlated to movements in things like tech stocks because hot money chases investments that can make the biggest outsized moves. We saw this on Monday as well when Bitcoin dropped as much as $9,000 at one point.

At the same time, the diversification value in blue-chip cryptos — particularly Bitcoin and Ethereum — remains valid … particularly their ability to provide yet another layer of diversification away from paper money and the traditional centralized financial system.

They may not act like short-term hedges in the traditional sense. But their longer-term protective power may very well be revealed over time.

One final non-stock asset class full of potential in a volatile market is private equity.

As my good friend, Chris Graebe, points out all the time, these aren’t tied to the markets.

These are opportunities in individual companies that aren’t beholden to the whims of day traders.

If they have the capital and backers, they keep plugging away no matter what the market does.

In fact, some of the biggest startup success stories grew out of terrible economic times. Uber and Airbnb both came out of the Great Recession in 2008-’09.

That’s why this is the fourth — and least discussed — asset class you need to be in while stocks remain so overpriced.

Fortunately, now is the perfect time. Chris just finished his due diligence on one of the most exciting private equity opportunities I’ve heard about.

It has a secret technology that could destroy Elon Musk’s empire and spark an $1.8 trillion tech disruption.

Again, this isn’t like the rest of the tech stocks that I believe are still overbought. Its shares aren’t traded alongside Nvidia and Microsoft.

But on Tuesday, Aug. 13, Chris can give you a sneak peek of how to get in, nonetheless. All you have to do is grab your free ticket here.

In summary: Most stocks still look dangerous …

High-quality bonds are still attractive …

Gold should be held …

Crypto will continue dancing to its own unique drumbeat …

And the right private equity deals can grow even in the worst of times.

I recommend investing accordingly.

Best wishes,

Nilus Mattive