|

| By Sean Brodrick |

Finally, FINALLY! Gold seems to be taking a breath after sprinting more than 10% higher since the start of the year.

That zoom-zoom is more than triple the performance of the S&P 500 over the same time.

I’m really hoping gold pulls back for a bit. After all, nothing travels in a straight line.

I want to use a pullback to add more leverage to gold’s big move, and I want to do it on the cheap!

But you know what? Something is leaving gold in the dust this year! I’m talking about gold miners.

While gold is up 10.65% so far this year, gold miners, as tracked by the VanEck Gold Miners ETF (GDX), are up a whopping 23.4% — DOUBLE the performance of the yellow metal.

That makes sense when you think about it. Gold miners are leveraged to the price of gold by the fact that they can mine gold for less than they can sell it in the market. When the gold price goes higher, the profit margins of miners — the good ones, anyway — can widen like the Grand Canyon.

And you know what? That’s just what’s happening.

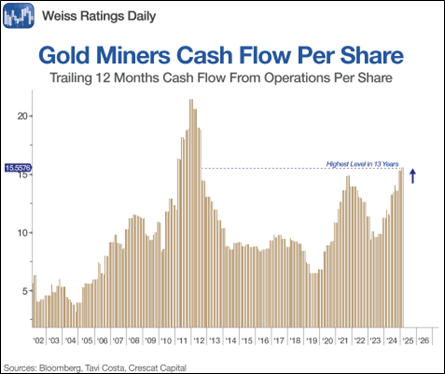

Over the course of the past year, thanks to the soaring price of gold, the average cash flow per share of miners has hit a 13-year high!

Each miner is different to be sure. This is the average cash flow from operations per share for miners in the Philadelphia Gold Bugs Index, which is similar to the GDX, but not tradeable.

My point is that select miners are seeing even bigger cash flows! Especially with gold hitting new all-time highs in the last week.

And that brings up an incredible, gold-plated opportunity. I’ll explain …

For years, gold miners were about as popular as a leper in a bikini contest. Even when gold started its big move in 2022, gold miners lagged.

Fast-forward — gold is up 59.3% in the past three years, while the S&P 500 is up 43.2% and gold miners bring up the rear with a 34.5% gain.

Look how much of that rally in gold and miners has come in 2025. Gold is sprinting ahead, and gold miners are playing catch-up.

Now, go back and look at the first chart. As cash flow per share for gold miners piles up, the share price of gold miners should hit the accelerator. And THAT’s your opportunity.

For quite some time, my price targets for gold were $3,000 by the middle of this year and more than $6,000 in the longer term.

I expect this big bull run to play out over the next couple of years, as cyclical, geopolitical and fiscal factors light a fire under metals.

Thanks to tariffs, trade wars and the threat of financial chaos, it sure seems like we’ll hit my first target early.

In big bull markets, gold miners usually outperform the metal thanks to that leverage I talked about. And I expect select gold miners to outperform gold and lead the way higher soon enough.

ETFs like the GDX should do fine. Select miners can do better than fine — a heck of a lot better.

I recently sent my Resource Trader Members a list of my top gold and silver picks. They’re ramping up already, and there is so much more to come. If you want to check those picks out, CLICK HERE.

If you’re doing this on your own, be very careful. There are a lot of gold miners I wouldn’t buy, even with metal prices going sky-high.

But don’t pass on this golden opportunity.

All the best,

Sean