|

| By Jon Markman |

The seeds of the next big tech rally are being planted, fertilized and watered by glowing assessments about the potential of artificial intelligence.

A bloom of stock offerings is inevitable.

Google DeepMind CEO Demis Hassabis said last week that he’s concerned the flood of money pouring into AI startups is clouding research efforts.

Welcome to the real world, Mr. Hassabis.

And in a moment, I’ll show you the perfect way to play it …

While bears grouse that the current environment looks like 1999, the period immediate ahead of the internet bubble bursting private investment — and the behavior of technology stocks — suggests a more bullish analogy is appropriate.

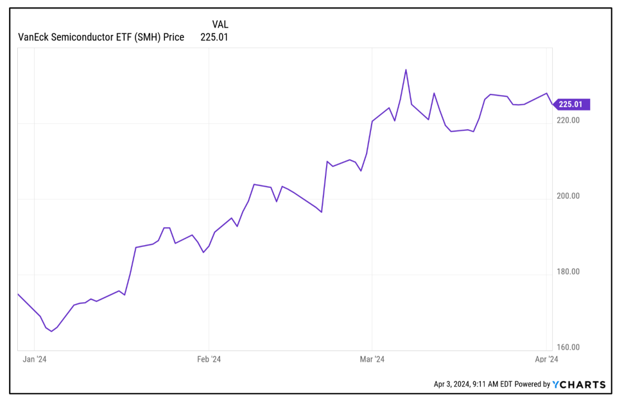

Semiconductor stocks, as measured by the VanEck Semiconductors ETF (SMH), recorded its best performance during a quarter since 2002 … the beginning of the great recovery from the tech bubble.

Like now, the early 2000s featured dovish policies from the Federal Reserve. It also saw coordinated public investment in the infrastructure that digitized the commerce and telecommunications sectors.

Governments are scrambling to move processor production out of southeast Asia. There is growing fear China holds too much influence over the world’s production of chips … especially in Taiwan, where 92% of the most advanced chips are made.

Japan, Europe and the United States have announced programs of $67 billion, $51.7 billion and $52.7 billion, respectively, to help domestic companies build new silicon processor factories in the homeland.

The scale of this investment is NOT being lost on the monied class.

Venture capitalists invested a record $42.5 billion during 2023 into 2,500 startups, according to CB Insights, a private analytics platform.

Investors see fertile fields of opportunity as AI moves from the infrastructure phase to deployment. The hype certainly helps. Optimists say AI is bigger than the internet, and they are clearly investing for that future.

To find out, let's rewind to the late 1990s.

The Backdoor to Tomorrow’s AI Boom

Historically, investment banks have played a key role in fueling tech bubbles. They act as intermediaries — connecting VC firms with potential investors.

In a hot market, investment banks are incentivized to push the narrative, potentially overlooking risk factors to get deals done and generate fees. This dynamic can exacerbate the bubble's formation.

The 2002-2008 bull market post-Dot-Com Bubble should serve as a valuable lesson … for pessimists.

Investment cycles follow predictable phases.

The first phase is investment … followed by hype … then initial public offerings … more hype … and finally disillusion.

Bears ignore the dynamism of the first four phases at their peril. The investment bankers have not started to arrange stock offerings.

Demis Hassabis is a serious person. He led a team at DeepMind, who used AI to solve protein folding — a biology problem that befuddled scientists for more than 50 years. Determining why proteins behave as they do will speed drug discovery and breakthroughs in materials science.

Hassabis received a knighthood in his native United Kingdom in March for his contribution to science.

He told the Financial Times last week that he is concerned that the flood of VC investment into AI will cause a hacker approach to AI research … a development he says could be dangerous.

However, the bankers are not worried about reckless Silicon Valley AI firms. The bankers see only dollar signs.

JPMorgan Chase (JPM) is the largest investment banker in the world by assets, a distinction that has been mostly true since the 1800’s … when J. Pierpont Morgan was the financier to U.S. Steel (X), the world’s first billion corporation.

Since that time, executives at JPMorgan have had their fingers on the pulse of the capital markets, with extensive experience in global finance.

These investment bankers are capable of creating hype and ultimately selling stock to the public.

During the period from January 2002 through December 2008, JPMorgan shares advanced from $19.35 to $206.30 — when accounting for dividends and stock splits, a gain of 966.2%.

Historical performance is no guarantee of future results. However, JPMorgan is in great financial health. And a strong harvest of AI companies should soon flower.

If you are looking to add a backdoor way into the coming boom in AI companies, shares of JPM are a great way to do that.

All the best,

Jon D. Markman

P.S. There’s another, even more immediate way to play the boom in AI. New crypto wonders — especially those involved in AI development — are already making waves.

Our crypto experts, Juan Villaverde and Dr. Bruce Ng, have already tracked gains of 7x in a year and 200% in just 12 days on this trend. Click here to see their latest presentation before they reveal their next one tomorrow.