|

| By Sean Brodrick |

Europe is rearming at breakneck speed. And opportunities are booming for investors.

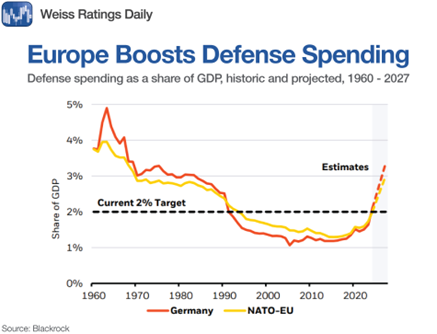

The European Union spent $354 billion on defense in 2024, representing a more than 30% increase from just three years earlier.

And that’s only the beginning.

At the recent NATO summit, alliance members pledged to significantly raise their defense spending targets, from 2% to 5% of GDP by 2035, signaling increased public borrowing over the coming decade.

By 2030, European nations are expected to pour up to $1.2 trillion into tanks, missiles, drones, submarines and cyberwarfare.

This rearmament wave is creating major opportunities on both sides of the Atlantic.

But let’s start with Europe, which is beefing up its own military-industrial complex while still relying heavily on U.S. technology and systems.

A Trillion-Euro Arms Race

The numbers are staggering.

- Germany passed a €100 billion “Sondervermögen” fund to buy F-35s, Arrow-3 missiles and CH-53K helicopters.

- Poland is spending nearly 4% of gross domestic product (GDP) — more than any other NATO nation — snapping up tanks, HIMARS launchers and 96 Apache helicopters, while building a 300,000-person army.

- France’s new €413 billion defense budget includes next-gen submarines and a hypersonic strike vehicle.

Even smaller states are in on the action.

Sweden just boosted its defense budget by 65%, while the Netherlands fast-tracked 10 more F-35s and is funding NATO’s next-gen early warning fleet.

The UK will boost spending to 2.5% of GDP by 2028 and is pouring billions into submarines, drones and munitions stockpiles.

The EU’s “ReArm Europe” initiative adds more fuel to the fire, unlocking €650 billion in additional fiscal space for defense spending.

Made in America, Deployed in Europe

While Europe is scaling up local production — Rheinmetall, BAE, Saab and Dassault are all running three-shift schedules — it’s still reliant on American gear.

Between mid-2022 and mid-2023, 63% of EU defense orders went to U.S. companies. That includes major orders for fighter jets, helicopters, missile defense systems and battlefield networking gear.

This creates a two-pronged opportunity for investors: Direct exposure to European firms getting fat government contracts … and indirect exposure through U.S. firms exporting high-end systems across the Atlantic.

Two ETFs That Get You Paid

1. Select STOXX Europe Aerospace & Defense ETF (EUAD)

EUAD is the only U.S.-listed ETF focused solely on European defense stocks. It has an expense ratio of 0.5%.

EUAD holds 13 major players — like Rheinmetall, BAE and Dassault — all of which are benefiting from the defense gold rush.

These companies are on the receiving end of national procurement programs, EU subsidies and a surge in joint weapons development.

This is a pure play on Europe’s military-industrial comeback — and it is still the early innings.

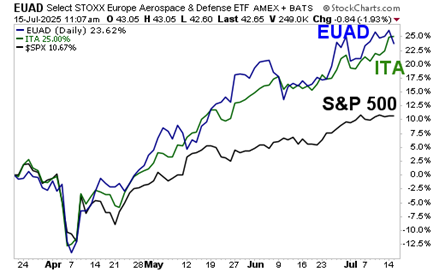

I recommended Wealth Megatrend subscribers buy EUAD in late March.

That position is already up more than 24% — leaving the S&P 500 in the dust.

2. iShares U.S. Aerospace & Defense ETF (ITA)

ITA offers the other half of the trade.

It has an expense ratio of 0.4% and a Weiss Rating of “C.”

With $6.3 billion in assets, it’s loaded with U.S. defense giants like Lockheed Martin (LMT), RTX (RTX) and Northrop Grumman (NOC).

These companies directly profit from Europe’s reliance on American arms.

The ITA also benefits from rising U.S. defense budgets and increasing geopolitical tensions globally.

Let’s examine the performance of both funds against the S&P 500 since I recommended EUAD to my Wealth Megatrend subscribers.

There is nothing wrong with the S&P 500’s 10.67% gain over this time frame — but that’s less than half of the performance of EUAD and ITA, which are closely tracking each other.

It seems clear that defense is one of the biggest bulls in this bull market.

Why This Megatrend Will Last

This isn’t a short-term trade triggered by a single conflict.

It represents a significant shift in European policy, financing and public opinion.

The EU is breaking decades-old norms around defense spending, with new fiscal tools, expanded borrowing and political cover from rising threats.

Europe is in the early stages of a once-in-a-generation rearmament cycle.

That means long-term spending, rising industrial capacity and steady order flows.

Meanwhile, the U.S. defense industry continues to dominate globally, with the manufacturing scale, export pipelines and tech leadership to remain indispensable.

With up to $1.2 trillion in defense spending coming over the next five years, the best time to invest is now — before the next wave of contracts go KA-BOOM!

All the best,

Sean

P.S. While these ETFs will give you a good allocation to this unstoppable boom, when it comes to defense companies, the smaller ones can offer even larger returns.

And startups can do best of all!

That’s why I want to offer you a free spot at my colleague’s upcoming Private Investment Summit.

It kicks off at 2 p.m. Eastern on July 22. Grab your seat.