|

| By Sean Brodrick |

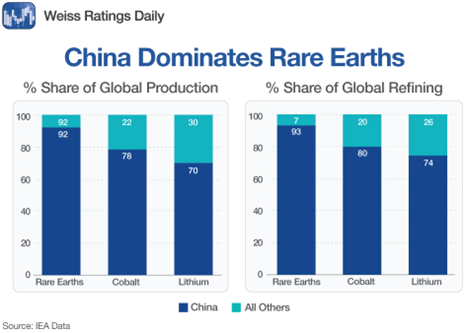

China controls more than 90% of rare-earth refining and holds a similar stranglehold on lithium, cobalt and other strategic metals.

But what’s new — and even more alarming — is how Beijing is now weaponizing that dominance in real time.

The good news is you can make a rather large fortune helping Uncle Sam fight back against China’s critical minerals oppression.

First, let me show you how much China dominates these markets.

China’s mastery of these markets was built through decades of centralized state strategy, mine consolidation, subsidized refining and woefully poisonous environmental standards that helped producers keep costs low.

This is by design.

Over the course of decades, China’s rock-bottom critical minerals prices drove Western producers and refiners out of business.

Then, when they had the market cornered, the Chinese swung the trap shut!

- In early 2025, China invoked new export-licensing controls over seven key rare earths and magnet materials used across defense, energy and automotive industries — dysprosium, terbium, samarium, yttrium, gadolinium, lutetium and scandium.

- Shipments of these materials plunged, with some magnet exports collapsing by nearly three-quarters year over year.

- Beijing also broadened its “dual-use export control” list to cover nearly a hundred products, from unrefined ores to advanced alloys, tightening the screws on foreign manufacturers.

The clampdown is backed by sweeping new regulations that give the Chinese state direct control over every stage of the rare-earth supply chain — from mining and refining to circulation and export.

The law includes stiff penalties for violations and codifies Beijing’s authority to suspend or revoke export permits at will.

On top of that, China has barred foreign companies from accessing its extraction and separation technologies.

That effectively traps decades of technical know-how inside its borders.

While a few export permits have trickled out this year, the process remains clearly designed to preserve China’s leverage.

Warfare by Other Means

This is not simple trade friction — it’s warfare by other means.

China is signaling that it can choke off the supply of materials essential to advanced manufacturing and national defense at any moment.

European auto plants have already faced disruptions, and U.S. defense contractors are beginning to model alternative supply scenarios in case shipments halt entirely.

China’s message is unmistakable: The rest of the world depends on it, and that dependence can be turned into a weapon.

Now, America is leading the rest of the world in scrambling to catch up, launching domestic mining projects, funding new refining plants and experimenting with rare-earth-free motor technologies and recycling.

That’s where the opportunity — and your potential profit — come in.

Here’s the scoop: The U.S. government is directly investing in critical mineral companies.

And when Washington puts taxpayer dollars and policy muscle behind a sector, the upside can be staggering.

The U.S. is rewriting the rules of resource capitalism because it must!

The U.S. currently imports 40 of 54 critical minerals it deems essential.

If we don’t have secure supplies of those minerals, our economy — and our national defense — will come to a halt.

I’ll give you two examples of Uncle Sam putting his money to work in this sector …

Example No. 1:

In July, the Pentagon backed MP Materials (MP) with a $400 million investment, taking a 15% stake and securing a price floor agreement on rare earth magnet inputs.

Example No. 2:

Then, in September, U.S. Antimony (UAMY) secured a $245 million, five-year sole-source contract from the U.S. Defense Logistics Agency to deliver antimony metal ingots into the National Defense Stockpile. This deal dwarfs UAMY’s 2024 revenues (about $14.9 million).

My Resource Trader subscribers owned both stocks before the big news.

Now, they’re sitting on triple-digit open gains, and I expect a lot more.

Interestingly, the White House appears to be looking for early-stage opportunities.

There’s a logic to this: Smaller players have the toughest time raising cash. Yet, they can sometimes sit on large, untapped deposits.

That means the potential return on investment for investors who buy these small stocks early can be staggeringly HUGE!

I've just sent my Resource Trader subscribers a new report featuring several new opportunities.

If you’re doing this on your own, be careful, because there are a lot of stinkers out there.

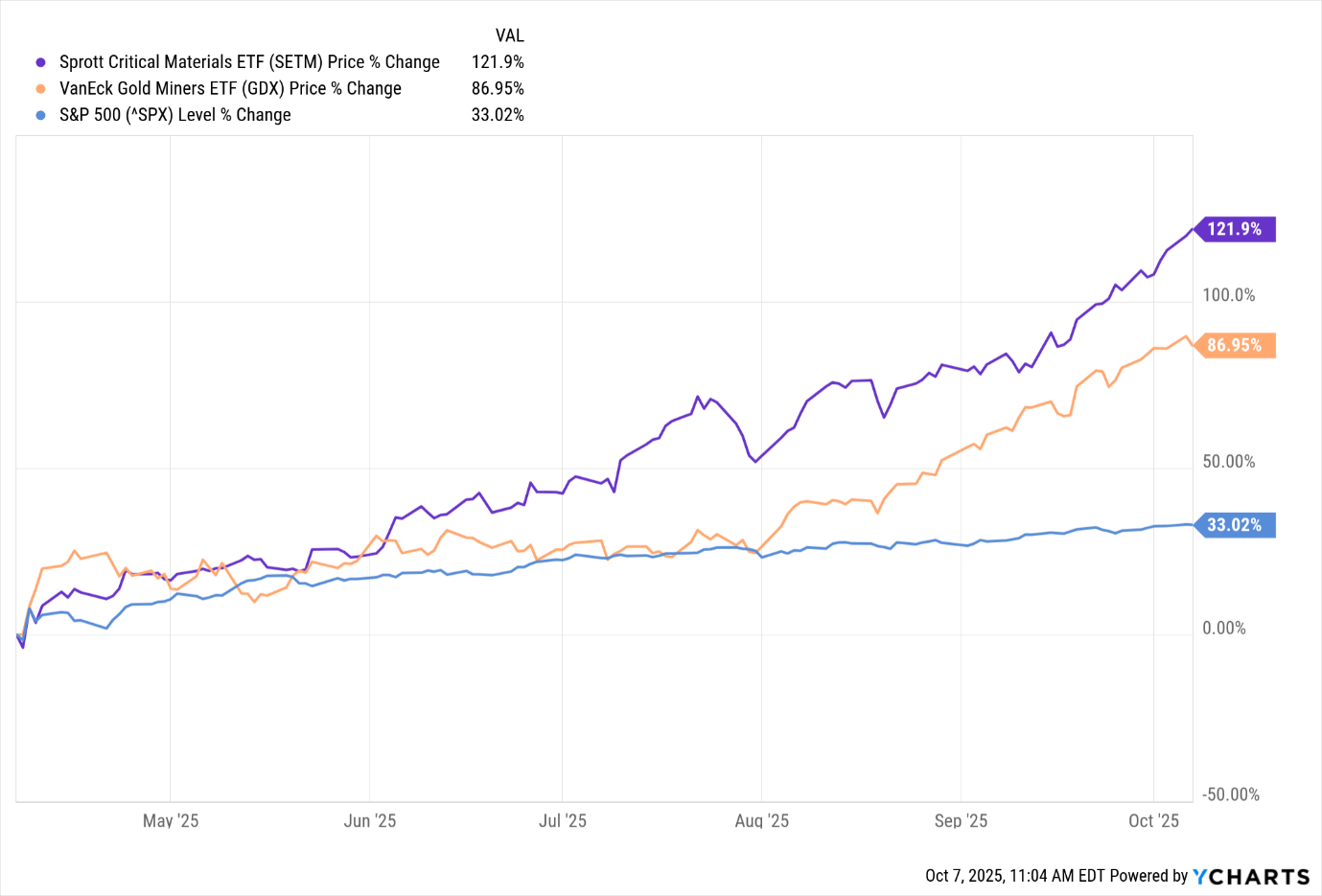

An easier way to play it is to buy the Sprott Critical Materials ETF (SETM).

It is one of the largest and most liquid ETF focused specifically on rare earths and strategic metals.

MP Materials, which I mentioned earlier, is among SETM’s top holdings.

Let’s look at the chart …

Look at that thing blast off.

I’ll tell you something else …

Recently, SETM hasn’t just outperformed the S&P 500. It’s outperforming gold miners, too!

The S&P 500 has risen 33% since its April low. Not bad.

Gold miners, as tracked by the Van Eck Gold Miners ETF (GDX), are up 87% at the same time — nearly tripling the S&P 500’s performance. Pretty good!

But for real outperformance, look at SETM — up 122% over the same time frame.

Wow!

I believe there’s a lot more to come.

Uncle Sam is rolling up his sleeves and throwing bags of money at small companies, trying to jump-start U.S. critical minerals production and get us out from under China’s thumb.

It’s a race we have to win. But winning it won’t be cheap.

Put your money to work now, and your rewards could be truly epic!

All the best,

Sean

P.S. While SETM is outperforming major gold miners, like those held by the GDX, it isn’t topping select smaller ones.

I recently put together a series of reports to highlight which smaller gold and silver miners you want to own to make this historic rally even more profitable.

If you watch this to the end, you can find out how to grab these reports.