China’s Recent Ban Sends These Tiny Miners Skyrocketing

|

| By Sean Brodrick |

I have a new idea for you, one that’s much more speculative than gold.

It’s a play on a mineral that our government wants as much of as it can possibly get. And yet, it’s in desperately short supply.

I’m talking about antimony.

Antimony is a shiny gray metalloid. It’s used as a fire retardant, as well as in things like photovoltaic glass and lead-acid batteries. It’s essential as a hardener in weapons of all sorts.

The U.S. Interior Department has listed antimony as a mineral critical to our economic and national security. Fun fact: Cobalt and uranium have the same distinction.

Antimony is used as a hardening agent for bullets and tanks … and much more. Other armored vehicles, artillery shells, cruise missiles and javelin missiles all contain antimony.

Plenty of those are getting used up in Ukraine and other world hotspots.

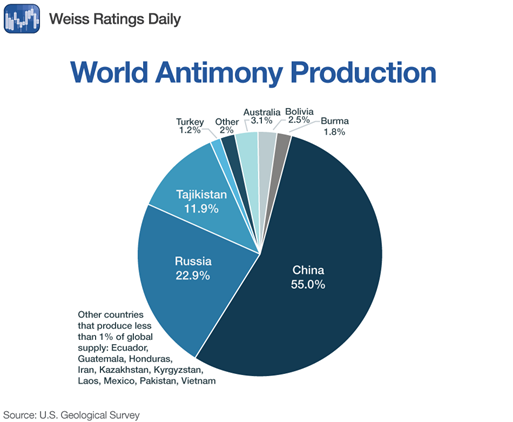

It’s especially critical because we’ve been relying on China and other countries for it.

China produces about half of the world’s antimony. Global supply was already tightening when China, the world’s biggest exporter, imposed export controls starting on Sept. 15.

Then, last week, China tightened the screws:

China outright banned exports to the U.S. of gallium, germanium, antimony and other key high-tech materials with potential military applications.

Oddly, this is not about the military (at least for now). Beijing is mad that the U.S. is tightening restrictions on semiconductor exports to China.

The price of the metal has already TRIPLED since May. No wonder, then, that Western governments are fast-tracking antimony mine developments and have been backing billion-dollar loans for similar mining projects.

The Federal government invested $75 million into an Idaho gold mine owned by Perpetua Resources (PPTA). The gold mine will produce antimony as a byproduct. It will start commercial production in 2028.

Another American company, United States Antimony (UAMY) operates the country’s only antimony mill in Montana, which runs at about 50% capacity.

Interestingly, UAMY inked a deal this week to test PPTA’s antimony ore, with the idea of processing that in Montana.

What’s more, United States Antimony recently staked 4,000 acres of claims in Alaska’s interior around an antimony mine that last produced ore in World War I.

Why Alaska? Only four U.S. states have known antimony deposits — Alaska, Idaho, Montana and Nevada. Alaska holds deposits of nearly all the 50 minerals that the U.S. Geological Survey considers “critical” to the American economy and national security.

There are two Australian companies prospecting near Fairbanks and Anchorage for potential antimony projects. Those companies are Felix Gold and Nova Minerals (NVA).

All these projects are far from being completed. However, that doesn’t mean they’re not investable. In fact, I recommended United States Antimony to my Resource Trader Members in late September.

That position was recently up more than 90% from our entry point. It has been a wild ride. But I firmly believe this stock is going much higher as the hunger for antimony increases.

China has caught America on the back foot at a time when we need to increase weapons production as hostilities increase all around the globe.

It could take us years to catch up. If you think the price of weapons-grade antimony is increasing now, just you wait. It could go ballistic.

It’s likely that the U.S. and other Western governments will continue to pour money into the problem. Savvy investors will grab a bucket to catch some of that cash.

All the best,

Sean

P.S. While antimony is crucial to munitions, the real power play in the defense industry is AI. I urge you to check out this new presentation on the last thing holding AI back … and how to play it.