|

| By Nilus Mattive |

Nvidia (NVDA) posted very good results last week.

You will get no argument on that from me.

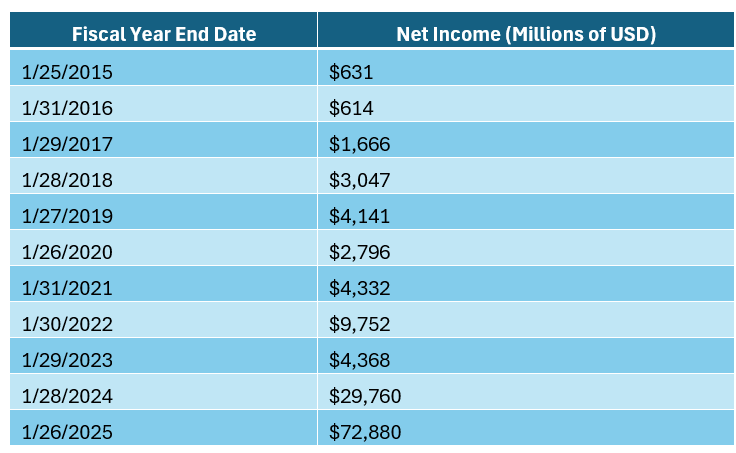

In fact, there is no disputing Nvidia’s stellar earnings growth going back a full decade.

The company’s annual net income went from just $631 million in 2015 … to $2.8 billion in 2020 …. and then completely exploded over the last several years all the way to $72 billion in 2025. (The company operates on a fiscal year that ends in January.)

That represents an earnings increase of 115x over 10 years.

So, yeah, there’s no denying that the company has been — and probably still is — a fantastic asset.

The problem today is the price.

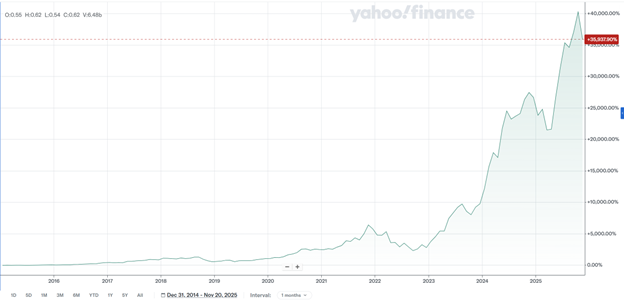

As you can see, Nvidia’s stock has climbed even more steeply than its earnings, rising more than 35,000% over the last decade with the lion’s share of the gains coming just in the last two years …

Today, the shares are trading at about 44 times the company’s trailing 12-month earnings.

Back in 2015, the shares were trading at less than half that multiple.

So, investors have become very comfortable paying a higher relative price for NVDA’s shares as the company continues to post massive growth.

If earnings keep growing, it’s reasonable to expect the gains to keep coming, too.

Newer investors — as well as many older investors with short memories — might even think this is an unprecedented story that can only have a happy ending with each new chapter.

They might think the idea of Nvidia ever really losing a lot of ground now is completely impossible.

It’s hard to blame them when I hear CEO Jensen Huang speak. As he said during last week’s earnings call …

“There's been a lot of talk about an AI bubble. From our vantage point, we see something very different. As a reminder, Nvidia is unlike any other accelerator. We excel at every phase of AI from pre-training to post-training to inference.”

Huang emphasized the rapid progress being made in AI, telling investors:

“AI is going everywhere, doing everything, all at once.”

And he explained that demand for the company’s products was absolutely massive — so much so that the company was looking at half a trillion dollars’ worth of near-term orders and an inability to even make enough semiconductors to keep up.

But is this really a new paradigm … without any historical precedent … and the first supposedly unstoppable train stock investors have ever hopped onto?

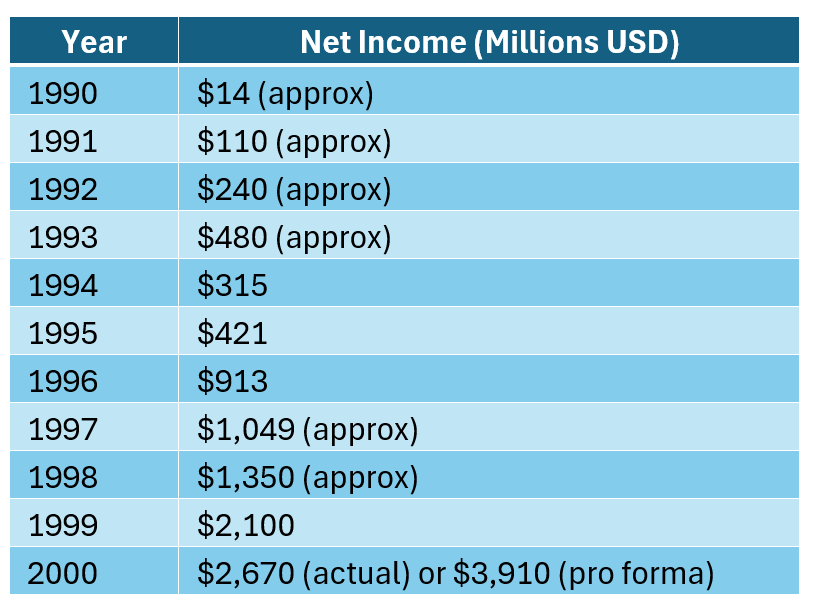

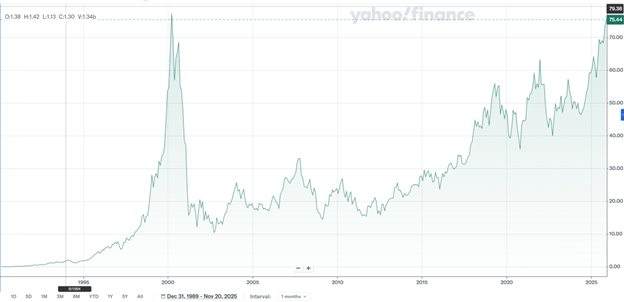

Let me take you back to the 1990s to study another golden boy from that decade — Cisco Systems (CSCO).

The company, which went public in 1990, saw its net income rise from just under $14 million that year to more than $2.67 billion by the year 2000.

That represents profit growth of 190x … far better than what Nvidia has posted in the last decade!

And how was the company talking about things at the top of that record run?

Here are a few excerpts from its 2000 annual shareholder letter …

“Over the next two decades, the Internet economy will bring about more dramatic changes in the way we work, live, play and learn than we witnessed during the last 200 years of the Industrial Revolution.”

“Today, Cisco holds a leadership position in 16 of our 17 key markets … For fiscal 2000, Cisco reported revenue of $18.93 billion, a 55-percent increase when compared with revenue of $12.17 billion in fiscal 1999 …

“Cisco has been one of the fastest-growing and most profitable companies in the history of the computer industry.”

“The Internet economy has grown more rapidly than even our most optimistic predictions and fuels the strongest period of economic prosperity in history.

“In the United States alone, this economy added 650,000 jobs and generated revenue in excess of half a trillion dollars in 1999.

“There is a direct correlation between the strength of this economy and the unprecedented productivity gains we are witnessing today.”

Basically, the internet was rapidly going everywhere and doing everything all at the same time.

It was single-handedly lifting the entire U.S. economy … and uniquely positioning a company like Cisco to keep posting massive profits going forward.

Demand for Cisco’s products looked just as insatiable and universal as it does for Nvidia’s semiconductors right now.

Which is precisely why investors had been sending shares higher the whole time with a growing willingness to pay bigger multiples in the process.

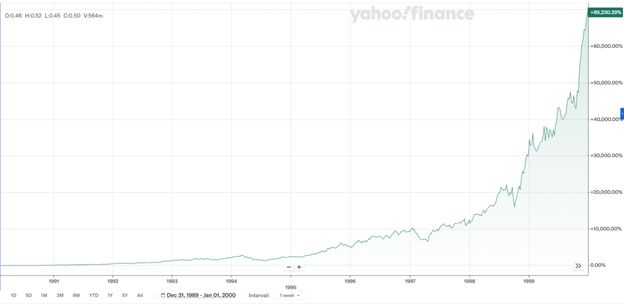

From 1990 through the beginning of 2000, the stock gained a staggering 69,230% … almost twice the gain that Nvidia has posted since 2015 …

Of course, you’ll also notice that the lion’s share of the gains came between 1998 and 2000.

So, the chart is eerily similar to the NVDA one I shared a moment ago.

What happened from this point on?

As demand from end users — i.e., the people building out all the internet businesses and infrastructure — starter to falter, so did Cisco’s growth.

After all, future orders are commitments, not certainties!

Cisco’s business never even really collapsed though.

Sales remained roughly flat in 2000, 2001 and 2002 even as the internet bubble burst.

And despite a modest loss for 2001, the company was back to turning a profit in 2002.

The bigger problem was that investors had become completely disenfranchised by the whole story and simply weren’t willing to pay big premiums for businesses like Cisco anymore.

So, within two years of topping out, Cisco’s shares had given back all the gains they made in the big run-up from the beginning of 1998 through 2000.

Again, the stock absolutely imploded — dropping roughly 85% from top to bottom — even though Cisco’s sales just flattened out over the same time period!

Then, the shares traded within that much lower range for roughly 20 years even as Cisco’s underlying results improved a bit more …

And the stock only clawed its way back to that former 2000 high LAST WEEK!

Today, Cisco’s stock is trading at about 29 times its trailing 12-month earnings, a fraction of the multiple it carried during its internet heyday.

So, could Nvidia go from its current price of $180 back to, say, $27 … which is where it was trading just two years ago?

Could it do that even if its sales merely flattened out and it continued to turn a profit?

And could it then stay stuck in that lower range for a decade or two even as AI itself continues to transform our lives in untold ways?

Cisco’s spectacular rise and fall suggests it could, whether anyone wants to remember that or not.

Best wishes,

Nilus Mattive

P.S. As you can see, even if a company does well, investors can crash its shares on a whim.

That’s why my colleague Chris Graebe only targets pre-IPO businesses.

These offer incredible upside without being held hostage by stock speculators.

And he just found his next candidate for those tremendous gains. He’ll unveil all the details tomorrow at 2 p.m. Eastern.

Grab your spot to find out more by clicking here.