Could This Make Buffett Change His Mind About Bitcoin?

|

| By Nilus Mattive |

I got an Apple (AAPL) iPod in 2001, which was the first time I considered any product from the company since my childhood Apple IIc computer.

Two years later, when Apple released its 17-inch Powerbook, I bought one of those, too, largely because I loved my iPod so much.

Yet as a Wall Street analyst, I did not believe Apple’s stock was a good investment.

Sure, the company was having modest success, but its quarterly results were swinging between losses and profits.

So, it was just too risky to consider … Even though on a split-adjusted basis, the stock bottomed out at just 20 cents in April 2003.

Based on the all-time high it reached last January, shares have since risen as much as 76,601%.

That means a $1,500 investment back then could have been worth more than $1 million two decades later.

In retrospect, I feel pretty dumb for not seeing what was happening.

But I was blinded by the notion that all tech stocks were risky garbage with fairly short business runways.

And I am not alone …

Warren Buffett’s Big Technology Blunder

Warren Buffett is one of the most successful investors of all time. He has been a vocal critic of technology companies from the late ‘90s all the way through the first decade of the millennium.

He said he did not understand tech …

Did not understand tech businesses …

And could not see if they would have much value in the future.

Buffett stuck to that viewpoint all the way up until 2011, when he ended up buying into International Business Machines (IBM).

Then, in 2016, he bought his first stake in Apple for roughly $1 billion.

Today, after follow-on purchases and a whole lot of price appreciation, Apple is Buffett’s single biggest stock position, representing roughly 37% of Berkshire Hathaway’s (BRKA) entire equity portfolio.

Take a step back and think about how incredible that is!

Now, think about how much money Buffett missed out on …

Had he bought at its bottom in April 2003, just his first $1 billion invested in the company could have produced $765 billion in profits at the stock’s high point last year.

Instead, his actual entry point “only” handed him a paper gain of roughly $6.3 billion.

OK, fine.

But how could anyone really have known that Apple was a solid business worth investing in all the way back then?

Well, the Weiss ratings system first identified Apple as a “Buy” in September 2004, and it has never dropped the stock below a “C-” (or “Hold”) since!

Simply buying on the system’s signal and holding through last week would have resulted in a 23,156% open gain.

Naturally, we cannot go back in time and act on that signal now.

But we can learn from the history I just shared.

Why Today’s Crypto Market Looks Like the Tech Wreck 20 Years Ago

Like technology stocks two decades ago, we’ve seen cryptocurrencies come out of nowhere …

Garner insane amounts of money and investor attention …

Blossom into a market of more than 20,000 different investments …

And then subsequently collapse as much as 80% from highs made less than a year ago, evaporating trillions of dollars along the way.

In both cases, we’ve watched know-it-all personalities end up eating humble pie and lose their shirts …

In both cases, we’ve seen splashy, celebrity-driven Super Bowl ads that looked outrageously stupid just months later.

Heck, in both cases, we have even seen football stadiums themselves bearing the names of companies that ended up imploding!

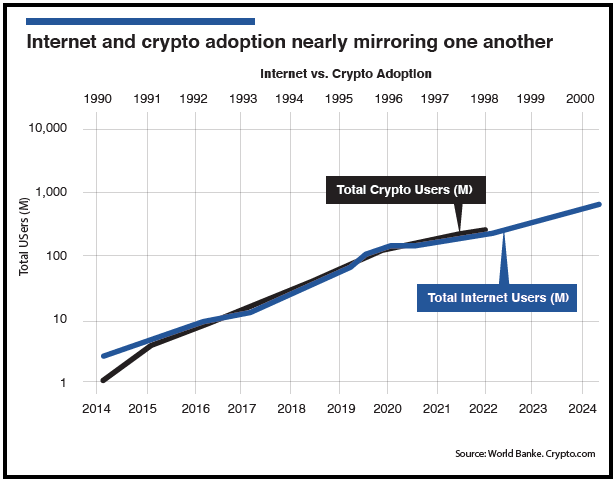

But there are other similarities to consider as well. For example, crypto adoption is trending in perfect lockstep with internet adoption 20 years ago:

Click here to see full-sized image.

The Weiss ratings system is also signaling a bottom in the crypto markets and giving some individual cryptos “Buy” ratings as well.

So, what does Warren Buffett think?

Today, he is saying many of the same things about Bitcoin (BTC) and other cryptos that he said about tech stocks 20 years ago!

The whole pattern seems to be repeating itself, which is why I have changed my opinion on the crypto markets …

Why I have already invested some of my own money in the space …

And why I just put together this urgent new video presentation that tells investors what steps I recommend they take right away.

Because now we now know that not all internet stocks were garbage 20 years ago, and there are many strong reasons to believe not all cryptocurrencies are trash today.

In fact, some are just new technology projects that may radically alter our lives in the future the same way iPods and iPhones have over the last two decades.

All that makes me wonder if Berkshire Hathaway will end up buying Bitcoin or some other crypto 10 years from now, too.

Best wishes,

Nilus Mattive