|

| By Tony Sagami |

As a child, Labor Day was one of my favorite holidays out of the whole year.

I was raised on a small vegetable farm near Tacoma, Washington, and Labor Day was a big holiday for my family. Not because of barbecued hot dogs, swimming at a lake, baseball games or family vacation … but because it meant school was about to start.

You see, when you're raised on a farm, summertime means getting up early and working until the sun sets. School, however, was a welcome change from three months of hard, physical work on the family farm.

Sitting in class and hanging out with my friends was infinitely more fun than breaking my back in the fields under the hot sun.

We still had to work on Labor Day, though. There was always lots of work to be done. Heck, I think my father worked us extra hard because he knew that his quasi-free labor was about to vanish.

President Grover Cleveland made Labor Day a federal holiday in 1894 as a tribute to American workers who routinely worked 12-hour days and seven-day weeks.

My father never got that memo. He worked those grueling 12-hour days and seven-day weeks until his health failed him in his late 80s. You see, my father truly considered hard work and long hours to be a godly virtue, and he thought his sons should do the same, which is why my brother and I cheered the start of every new school year.

Another reason my father worked until his late 80s was that he never made much money. He didn't have a choice. He had to work long, hard hours because he didn't have any retirement savings.

What about you? How much money have you saved? How much do you think you need to save to fund a comfortable retirement?

According to a survey from Charles Schwab, Americans between 25 and 70 years old feel they'll need $1.9 million to comfortably retire.

The dollar amount changes by generation. Millennial and Gen Xers believe they need to save $2 million while older Baby Boomers think they can get by with $1.6 million.

Here's the problem … only 37% of those surveyed think it's likely that they'll be able to save that much money.

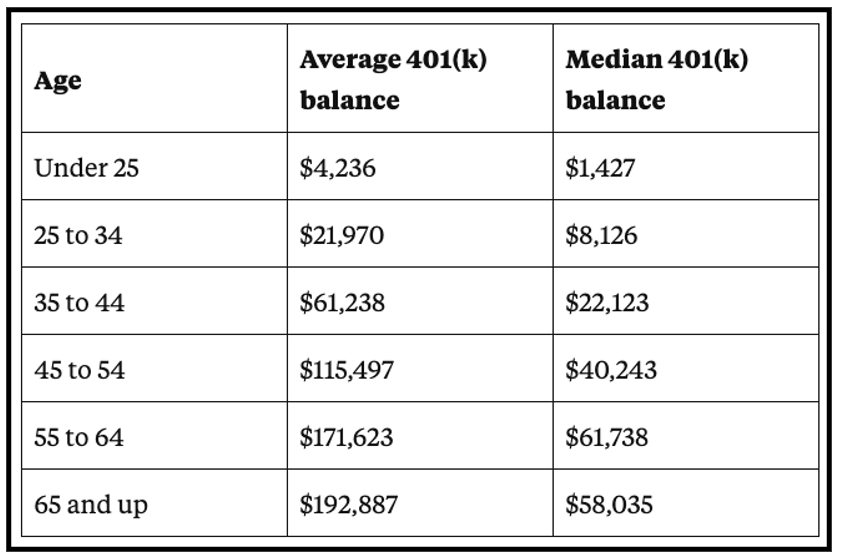

According to Vanguard, the average 401k balance today is $92,148, a far cry from the $1.9 million savings goal. The median account balance is far lower, a paltry $22,217.

Start Saving Now

I found it difficult to save money when I was raising my four children. Kids cost a lot of money!

But I started saving like a madman in my personal pension plan after I put my kids through college.

You can, too. And if you find yourself making excuses, you should cut them just like you should cut your expenses in order to free up capital to invest.

In 2022, the maximum contribution limit for a 401(k) plan is $20,500 and if you're age 50 or older, you can add another $6,500 to your account using the catch-up provision contribution. That's $27,000 a year in total.

There are also other ways to save money for retirement, such as income investing. This investment strategy helps you to create a portfolio that's specifically focused on generating a constant stream of income.

Your income portfolio will mainly consist of dividend stocks, bond yields and interest payments. You'll have solid, consistent income coming your way in the form of dividends from stocks that pay you to own them.

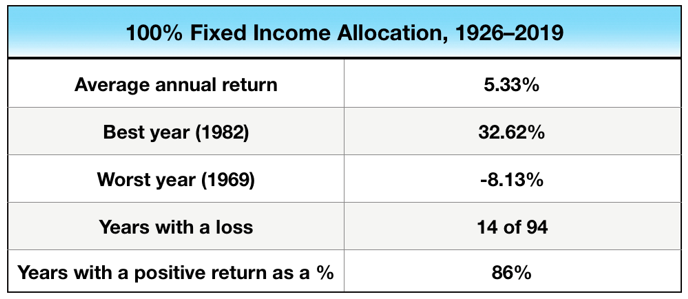

You can also own government or corporate bonds that provide bond yields. And currently, the yields on Treasury notes are beating the average yield of Dividend Aristocrats. Fixed-income funds — or bond funds — are also some of the safest asset allocations an investor can make.

Additionally, mutual funds and various interest-bearing accounts will generate a periodic flow of income in the form of dividends, interest payments, etc.

Bottom line: It's important to not only get serious about saving money, but to also come up with a plan that works for you. That way, you'll be able to save consistently from now until the time you retire. And the sooner you do it, the better.

If you'd like my tailored picks to help you prepare for retirement, join my service, Disruptors & Dominators. Members are currently sitting on gains of over 58%, 44% and 32%. Click here to learn more.

Best wishes,

Tony