|

| By Jim Nelson |

Do you hear that? It’s the sound of old, boring, dividend stocks coming back to life.

Sure, they’ve been unfashionable over the past several years with tech and AI leading a remarkable bull rally since 2022.

But savers and risk-averse investors will always return to income in times like these.

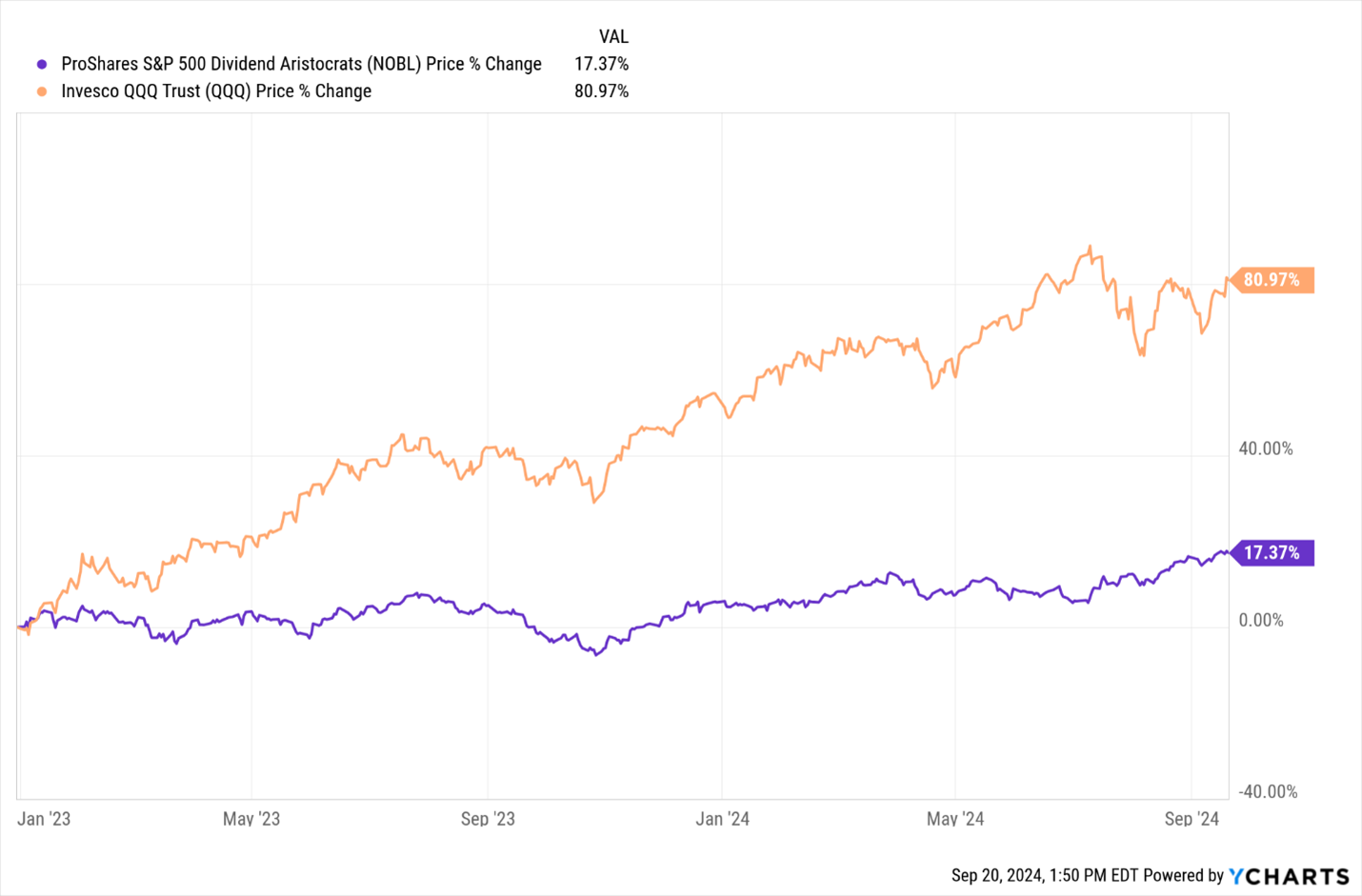

Take a look at two charts. The first is how dividend-paying companies fared against tech stocks since the beginning of 2023:

Tech — in orange, represented by the Invesco QQQ Trust (QQQ) — more than quadrupled the performance of dividend payers — in purple, represented by the ProShares S&P 500 Dividend Aristocrats ETF (NOBL).

Pretty bad, huh? No one wanted these safe income plays. And why would they?

By the start of 2023, the Fed had already hiked rates seven times. You could get investment income anywhere!

But only when that easy income disappears do we see how quickly investors start to move.

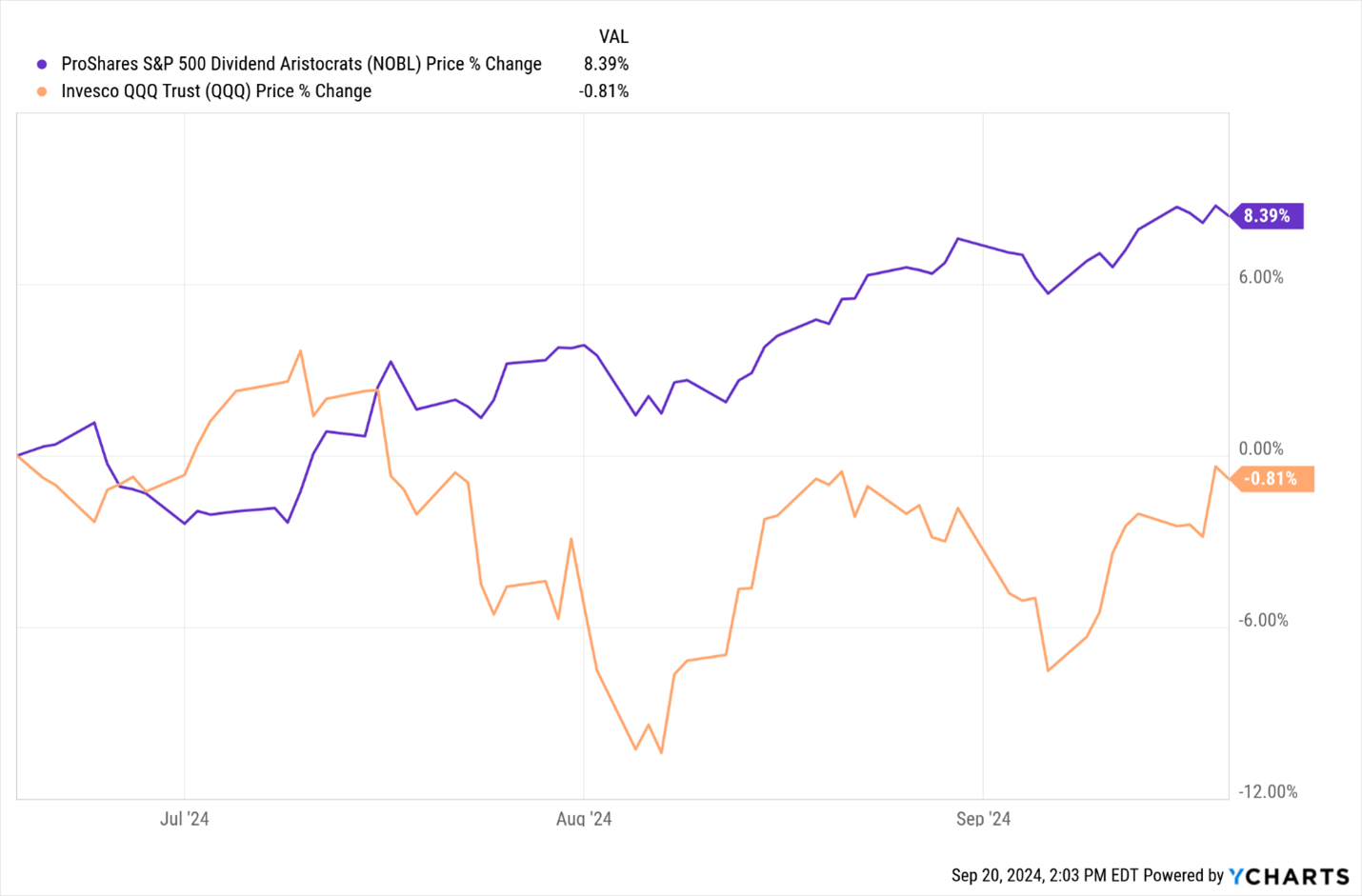

This shows how the two groups have switched places over the past three months … right around the time the market started expecting interest rate cuts.

And we just got the first one this week. What do you think will happen next?

Dividends may not be as fun as tech. But they are waking up. Meanwhile, tech stocks are still reeling from their midsummer highs.

Of course, if you know where to find the right tech stocks, you are still doing better right now. A few of your editors have been hunting for those … and have been successful.

Gavin Magor — our Director of Research & Ratings — even shows you how to find them for yourself in his article: “2 Ways to Aim for Titanic Tech Gains.”

Tech expert Michael Robinson shares how to invest in AI and software tech by avoiding popular dud ETFs. He has one that is booming in “Wall Street’s Dirty AI Secret.”

Nilus Mattive — our chief Safe Money expert — takes a different approach. When doesn’t he?

He insists that he’s seen this rally in tech stocks before. And that this time is worse.

Yet, he also notes that there are still tech opportunities out there worth owning today.

But his take on Nvidia (NVDA) is worth reading “Hotter than the Sun” on its own.

Sean Brodrick changes gears and highlights something that’s been dead longer than dividends. And why it is going to jump out of its grave in a hurry. He calls it “The Biggest Bargain on Wall Street.”

Of course, knowing how to navigate this market and these changes is only part of the story. You also need to know the specific hurdles in your way.

Dawn Pennington says the first step is to open up your calendar and circle these dates … including THE date. Read about that in “The Time Has Come … Now What?”

That’s all for this week. Have a great weekend!

Jim Nelson

Managing Editor, Weiss Ratings Daily