|

| By Nilus Mattive |

Social Security.

It’s the third rail of politics …

One of the largest fiscal problems in the U.S. today …

And a topic I have researched and written about for more than two decades.

So, now that Elon Musk and DOGE are starting to dig into the program — and regardless of our individual opinions about that investigation — I’d like to highlight three aspects of the program that seem ripe for change.

It’s quite possible you won’t like everything I’m about to say.

That’s OK. I’m just as interested to hear your take on things.

If anything, Social Security is always the elephant in the room. We need to start talking about it again one way or the other.

Because the reality is that that program’s math ain’t mathing, and it hasn’t been for a very long time.

My suggestions today are not really about how to solve the major financial shortfalls the program faces. We can save those for another time.

Today, I just want to propose three relatively easy changes that can get things started in a direction that makes more sense financially and philosophically.

The first was proposed by President Trump himself …

Change No. 1: Stop taxing Social Security benefits.

Under current law, Social Security benefits are subject to income taxes.

As the IRS explains it …

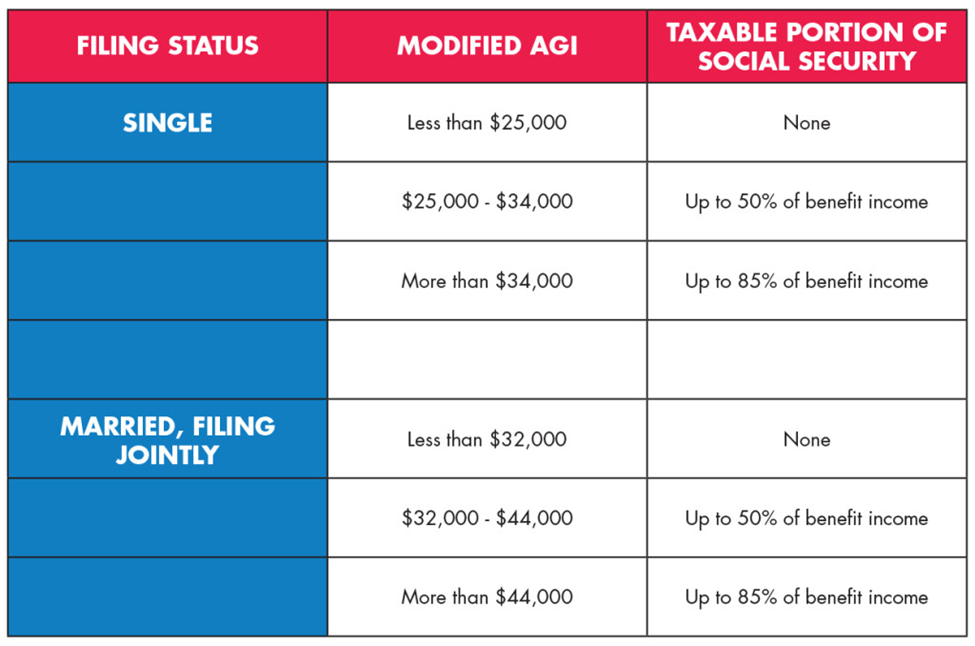

“The portion of benefits that are taxable depends on the taxpayer’s income and filing status.

“To determine if their benefits are taxable, taxpayers should take half of the Social Security money they collected during the year and add it to their other income. Other income includes pensions, wages, interest, dividends and capital gains.”

There are several different thresholds that come into play.

But a single person who earns just $25,000 can see part of their benefits subject to taxation. Married couples start getting taxed at just $32,000.

And by the time those numbers reach $34,000 and $44,000 respectively, as much as 85% of their benefits will be reduced by income taxes.

This makes absolutely no sense, and I have railed against it for almost as long as I’ve been writing about Social Security.

The program’s basic construction is relatively straightforward.

People pay into the system and are promised certain retirement benefits in return.

The idea that those benefits — which were collected through taxation — are then potentially taxed upon receipt makes absolutely no sense at all.

This amounts to the most egregious example of double taxation in the U.S. IRS code today.

At the very least, we must immediately adjust the thresholds for all the inflation that has taken place between the passage of this law back in 1983 and today.

After all, the ranges right now impact almost anyone who has other sources of retirement income.

To that end, I have seen firsthand how the current system punishes middle-class retirees like my own parents.

OK, but how do we pay for this change?

We make another adjustment I have been talking about for many years …

Change No. 2: Married people who did not contribute into Social Security should no longer receive benefits until they are widowed.

Social Security was originally designed as a simple “pay as you go” system.

Indeed, it didn’t even originally cover large swaths of working Americans.

But over time, expansions and new provisions were added in … many of which are based on good intentions but don’t make logical or financial sense.

The most glaring example is the fact that married people can receive an extra 50% of their spouse’s benefits even if they never worked or contributed to the system themselves.

In case you don’t know how it works: Once they reach retirement age, they can start receiving money — which amounts to as much as an extra 50% of their spouse’s full benefit — as long as their spouse has begun claiming.

That means married couples usually get 150% of the benefits they put in.

Was this a nice gesture — and a wildly popular change — during a time when many wives stayed home to raise families while their husbands went off to work?

Absolutely.

But a pay-as-you-go system can’t pay out 150% of what it brings in.

Moreover, the policy unnecessarily punishes people who don’t get married for whatever reason.

To be clear: I believe widows and widowers can and should continue receiving the same benefits their deceased spouses originally qualified for.

They simply shouldn’t get any extra money before that point … especially not while other people who actually contributed are getting less than what they were promised because of income taxes.

Anecdotally, I know one woman who takes her spousal benefits from Social Security and gambles them at the local casino for fun because she views it as “free money.”

Have you heard stories like this? I’d love if you share them here.

Which brings me to a third change … a reversal to a new law that just went into effect as President Biden was leaving office …

Change No. 3: Reinstate the Windfall Elimination Provision and the Government Pension Offset immediately.

At the very least, given Social Security’s massive financial hole, you might think lawmakers wouldn’t be doing anything to make that hole worse.

You’d be wrong.

Although it mostly flew under the mainstream media’s radar, Congress made a substantial change to the system at the end of 2024.

The Social Security Fairness Act aimed to reverse the long-standing Windfall Elimination Provision (WEP) and Government Pension Offset (GPO).

These provisions were originally put in place to prevent people from collecting too much — or anything at all — out of the Social Security system when their employers (or their spouse’s employers) opted out of the program and offered replacement pension plans of their own.

For example, my uncle was a Pennsylvania state trooper. Back in the 1980s, his group voted to opt out of Social Security and create their own retirement system instead.

That system allowed him to retire in his mid-40s, and he has been collecting benefits for more than three decades now.

His wife, now deceased, was a teacher. She was also covered by a separate pension plan outside of Social Security.

Without getting into all the math, the provisions prevented someone like my uncle from collecting a disproportionate amount of money from Social Security either through other jobs he might have held or from his wife’s work record.

This is what he agreed to back in the day. However …

Under the new Social Security Fairness Act several million Americans like him will now start receiving higher benefits than they would otherwise.

At a time like this, when the program is struggling and other larger inequities like the taxation of promised benefits are still happening, this simply doesn’t make sense.

Bottom line?

Even if Social Security is a giant hornet’s nest, there are a few obvious places to start dealing with things.

I can only hope people in Washington find the courage to start somewhere … and soon.

This is a conversation we need to have.

Let me know what you think of these ideas … and any of your own “fixes.” It’ll take just two minutes.

Best wishes,

Nilus Mattive

P.S. I hope you’ll fill out my quick survey so I know what’s on your mind. I also hope you’ll let me know in person at our Weiss Investment Summit, May 4-6, in Boca Raton, Florida.

Our ultimate live event is already at 86% capacity. So, if you haven’t done so already, I urge you to claim your seat now … before we sell out!