|

| By Sean Brodrick |

I expect big things from copper in 2024. That has much broader implications because copper is a bellwether industrial commodity.

They call this metal “Doctor Copper” because it takes the temperature of the global economy. If Doctor Copper says things are heating up, we’d best pay attention.

And I have a way for you to play this. Let’s start by looking at the forces driving the metal …

Copper has the tightest fundamental outlook of all the base metals in 2024. That’s according to analysts at Fast Markets, who add that copper is the only base metal “for which we are forecasting a refined market supply-demand deficit this year.”

They’re looking for a deficit of around 300,000 metric tonnes this year in copper concentrates. That’s not a lot, but it’s enough to see copper prices move higher by an average of 5% this year.

And that is a conservative estimate. Fitch put out a report earlier this month calling for copper to rally 75% over the next two years.

The closure of Cobre Panama lights a fire under copper prices. The government of Panama closed one of the world’s newest copper mines, Cobre Panama, due to environmental reasons.

Cobre Panama supplied 1.5% of the world’s copper. That may not sound like a lot. But remember, resource prices are made on the margins.

Now, many analysts are saying that Cobre Panama will reopen soon. I’d like to know who will do that.

Rumors swirled that Barrick Gold might take over the mine, but Barrick scoffed at that. The company has enough headaches with green activists. Grupo Mexico is also in the rumor mill, but I’ll believe that when I see it.

And whoever takes over Cobre Panama will have to deal with the environmental issues that got it shut down in the first place. Whereas if they DON’T take it over and get it running again, the price of the copper they do produce from other mines becomes more valuable.

There are other disruptions in copper mine production. For example, Anglo American plc (AAUKF) cut its copper output target for the year by nearly 25%, due to surging operation costs.

The demand side also looks bullish for investors.

Green energy transition demands more copper. At the recent COP28 climate change conference, more than 60 countries backed a plan to triple global renewable energy capacity by 2030. Citibank said that “would be extremely bullish for copper,” and would boost copper demand by an extra 4.2 million metric tonnes by 2030.

Citi also expects copper prices to rise about 87% by the end of next year. Now THAT’S bullish!

Energy grid demands more copper. Have you noticed that everything is getting electrified? That’s actually part of the plan for the green energy transition, but it’s more than that — we are using more and more electrical devices all the time. And that means the electrical grids — in America and the world — need to expand and evolve to carry more juice.

In fact, the International Energy Agency, IEA, expects copper demand for electric grids to grow by a factor of two to three times, depending on how quickly the energy transition moves.

China considers ramping up the stimulus. A few days ago, China leaked the news that it is proposing 1 trillion yuan ($139 billion) of new debt issuance under a so-called special sovereign bond plan. This would fund projects related to food, energy, supply chains, and urbanization. China is the world’s biggest copper market, and I’d expect that more energy and urbanization projects would boost copper demand in that country. The plan hasn’t been finalized. If and when it is, expect copper prices to go higher.

How You Can Play It

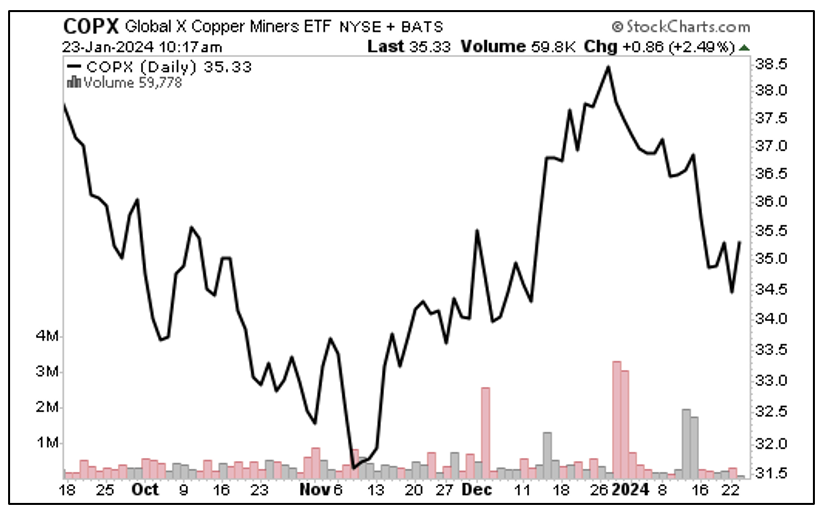

The easiest way to play the copper boom is through the Global X Copper Miners ETF (COPX). This fund holds a basket of copper miners. It has a Weiss rating of “C,” an expense ratio of 0.65% and a nice dividend yield of 2.36%.

Looking at a chart, you can see that COPX is well off its highs despite the parade of fundamentals lining up. Though, it recently began to turn higher.

I’d say this pullback is a buying opportunity. I expect it to go back to its old highs … and much higher from there.

Doctor Copper is giving a prescription for profits. Smart investors will heed his advice.

All the best,

Sean