|

| By Gavin Magor |

In addition to our stellar stock, bank, ETF, mutual fund and crypto ratings, we rate insurers.

That includes health insurers, life and annuity companies and property and casualty companies.

And we just uncovered a new, troubling situation among property and casualty insurers.

Many insurers are not paying claims that they should be paying.

Our latest findings were recently reported in both the Tampa Bay Times and Miami Herald and on several local TV stations.

Newsweek also covered this story.

Six providers of homeowners insurance policies in Florida failed to make any payment on over 40% of their claims closed in 2023.

And one state-sponsored entity, holding the single largest share of homeowners’ policies in Florida, failed to submit data requested by insurance commissioners regarding claims closed.

“The big-picture conclusion is that the insurers in Florida are stiffing their customers,” says Dr. Martin D. Weiss.

Although this shocking news focuses on Florida, homeowners in most other states are also getting stiffed.

And we plan to release that data as soon as we can.

So, while the insurance industry faces some major problems with insurers unfairly treating consumers, our insurance ratings are one of the best places consumers can go to for research.

Always an ‘A’ for Weiss Ratings Research

When it comes to insurance, many consumers just go to the big names like Liberty, State Farm and Geico.

But I encourage you to always shop around … or at the very least, compare using the Weiss insurance ratings.

When it comes to our insurance ratings, we always look at the strength of the companies, we take a deep dive into their financials and, most importantly, we see if they can withstand a catastrophic scenario.

I don’t need to tell you that this is expected to be another very busy hurricane season in the coming months, with Hurricane Beryl already churning up the warm Atlantic Ocean waters.

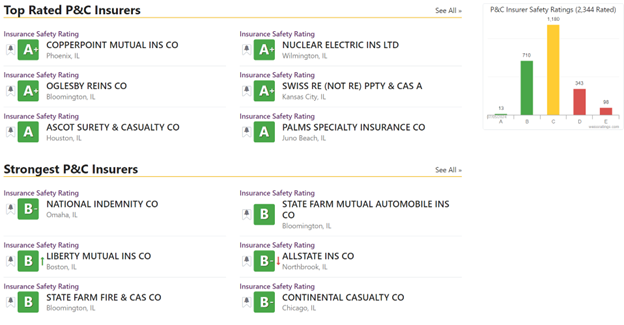

Insurers with a “C” rating are stable, but something could happen that might ruffle their financials a little.

Insurers that are rated as “B” and “A” generally signify that they could withstand everything that comes their way.

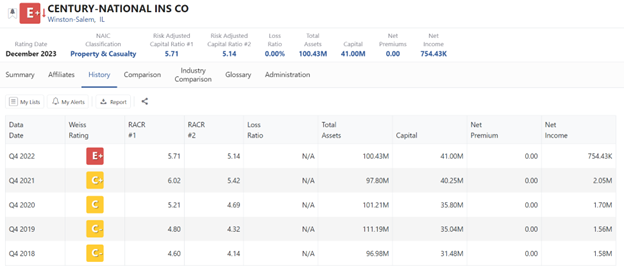

Insurers rated as a “D” or “E” probably don’t have enough capital. When you see insurers rated this low, be sure to especially check their history tab to see if this is a recent downgrade or if they have been rated low for a while.

Unlike our stock ratings, which are updated daily, our insurance ratings are updated quarterly, as you can tell from the above image. This is to ensure accuracy.

2 Things to Do Right Away

The first thing I recommend you do is check your insurers on Weiss Ratings just to be sure. At the very least, it should give you some peace of mind.

Secondly, I recommend you check out this new interview with Dr. Martin Weiss. He will unveil a game-changing trading strategy that has beat the S&P 500 by 51-to-1.

Cheers!

Gavin