|

| By Jon Markman |

I like to be honest with readers … even painfully honest.

That means letting you in on one of the dirty little secrets of investing.

The truth is, it’s virtually impossible to beat the major market benchmarks over time.

But it’s not the stock picking that gets investors at odds with the broad market indices. Rather, it’s time, math, psychology and a brutal — but inescapable — concept called “cash drag.”

Cash drag refers to the negative impact on investment returns caused by holding uninvested cash in a portfolio.

This term tends to get used in the context of ETFs. But cash drag can just as easily apply to any investment portfolio … even yours.

Here’s How Cash Drag Works

Let’s say that, by the end of the last bear market, you had reduced your investable assets to 60% and kept the remaining 40% in cash.

The problem there is that cash itself doesn’t generate interest or dividends.

So, as the 60% in stocks starts to grow again, the other 40% is not earning any substantial returns.

That 40% in cash is a drag on the overall return of your portfolio because it’s not contributing to growth. So, basically, the cash is dragging down your overall portfolio return.

Now, there are a few reasons to hold cash. You can take advantage of investment opportunities as they arise. You also get peace of mind if you’re worried about the bear market returning.

The latter is all well and good in a skittish or falling market.

But sitting on a big chunk of cash in a rising market can hurt your performance. Being out of the market means there’s no chance of earning a return.

In short, you should always have cash on hand to buy stocks before they take off (or take off again). But having “too much cash is bad for your wealth,” according to UBS Chief Investment Officer Mark Haefele.

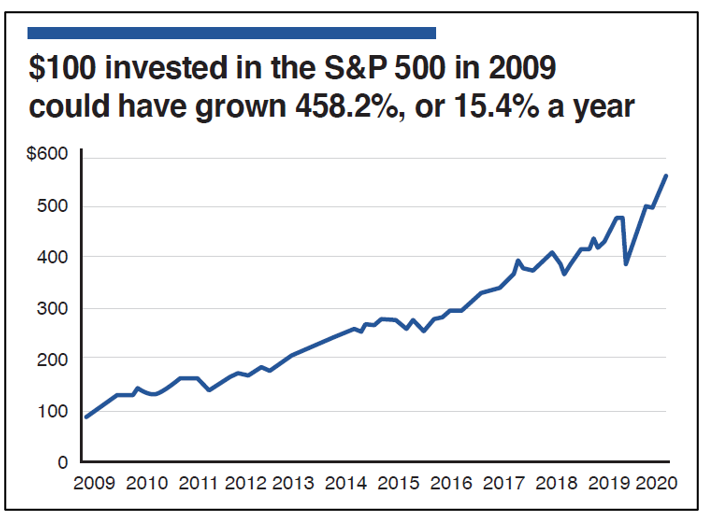

For proof, look at the great bull market that began on March 9, 2009, and continued until the COVID-19 pandemic in 2020. That was around 11 years of robust stock growth …

Yet, millions of individual investors hung onto cash for a vast majority of that time!

They did so out of reflexive fear that the financial crisis would reassert itself and plunge their portfolios into chaos again.

Instead, what happened is their portfolios underperformed dramatically for a decade — all because of that insidious cash drag.

I see this danger playing out again right now.

A vast majority of investors likely missed the sensational 35% advance in the Nasdaq Composite this year.

They got spooked by the series of regional bank failures. They feared a looming recession. And between inflation and rate hikes, it has been tough knowing where to turn.

Those are all real issues and great fodder for debate. But they are irrelevant to the tricky business of growing your investment capital.

How to Combat Cash Drag

As with everything in life, investing should be about moderation and setting expectations.

You can and should have both index-tied investments and individual stocks.

While everyone’s individual financial circumstances are different, consider this rule of thumb …

Keep about 80% of your money in index funds like the SPDR S&P 500 (SPY) and the Invesco QQQ Trust (QQQ).

Use the rest either as your cash cushion or, much better, to invest in high Weiss-rated individual stocks.

Whether you favor game-changing technological trends such as artificial intelligence or safe, income-paying consumer staples, this part of your portfolio can be tapped as your cash reserve … at least in part.

Personally, I usually avoid super-cyclical sectors like commodities, energy and financials, which tend to make fast moves up or down.

Trading has its place. But for the majority of that cash-replacement part of your portfolio, long-term ideas reign large.

Bottom line: It’s incredibly hard to beat the S&P 500 and Nasdaq over the long run … so use them, too.

If you add regularly and substantially to your index funds through dollar-cost averaging, you’ll find yourself well ahead of those who jumped from one fad to another.

You can still play trends and take advantage of these indexes. Most importantly, you can avoid cash drag.

That’s all for today. I’ll be back with more soon.

All the best,

Jon D. Markman

P.S. If you are worried about cash drag, I happen to have the perfect solution. I recently revealed my #1 AI Stock for 2023. Tomorrow, I’ll alert select readers about another AI megastar about to take advantage of this potential $15.7 trillion opportunity. Click here before it is removed from the internet.