|

| By Gavin Magor |

NFL training camp has just started, and with that, a massive selection process is coming down to its final stages for many great athletes that have worked their entire lives for this moment.

Each year, around 16,000 college football players are NFL draft eligible, but only around 259 get drafted. Then, players who’ve been drafted or signed a contract as an undrafted free agent go through a strenuous training camp and intense competition to see who ultimately makes the team come September.

Many fans don’t watch pre-season games, but for me, these are some of the most exciting because I watch college football, and I get to see who steps up and makes their respective teams.

I’m no NFL coach, but I completely understand that having the best and getting the most out of your talent pool is vital for success.

Here at Weiss Ratings, we share that same sentiment when it comes to our Stock Ratings process, and our entire ratings system for that matter. After going through a very rigorous screening process, only a few stocks — if any — claim a “A” rating or higher at any particular time.

We have a reputation for being very strict with our ratings, and that’s important when you have a strong bias for safety in your ratings like we do.

Out of the 13,022 stocks we currently rate, only five are currently rated “A” or “A+.”

Our Only “A”-rated Stocks at the Moment

An “A”-rated Weiss stock has an excellent track record for providing strong performance with minimal risk, and trading at a price that represents good value relative to the company’s earnings prospects.

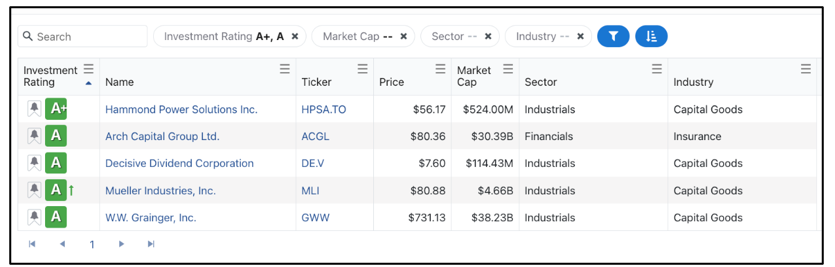

Here’s a look at our current “A”-rated stocks as of July 27, 2023:

Click here to see full-sized image.

Our Stock Ratings are updated daily, and right now, these names are at the top of our list. Be sure to always do your own research, but with that said, I strongly encourage you to consider our stock ratings in your stock analysis.

In the above image, I included Sector and Industry because I often feel like it’s important to see if there are trends in our ratings with top names. Interestingly, four out of the five names come from the Industrials sector.

One of those “A”-rated names, W.W. Grainger (GWW), is one that I particularly have my eye on, and not just because my All-Weather Portfolio Members have been able to grab two rounds of double-digit gains on it this year.

It’s been rated a “Buy” by our rating system since November 2021, and is a leader in its industry.

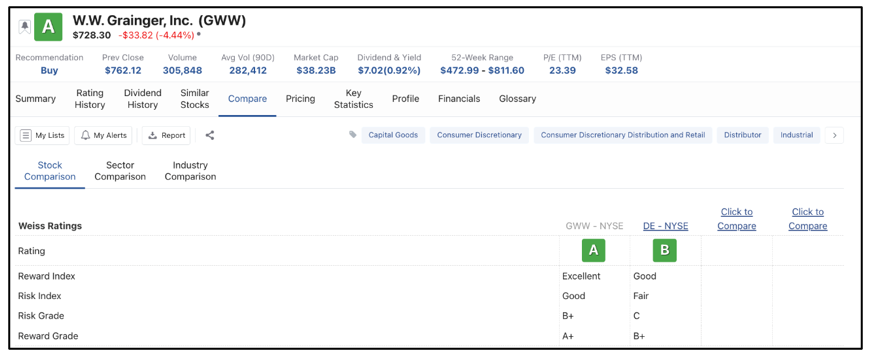

One feature conveniently listed on our site that I’d like to show you is our “Stock Comparison” tool. Say, for example, you wanted to compare GWW to another strong stock in the Industrials sector, say Deere (DE).

Simply type in John Deere’s ticker, “DE,” and you can easily see how it compares in many respects:

Click here to see full-sized image.

In fact, you can enter up to four tickers at one time, which is extremely convenient when you want to take a quick look at four different names.

Weiss Ratings, Ratings Factors, beta and standard deviation, price history, valuation and many other comparison tools are neatly presented, making this tool very ideal for your investment research.

Here is a comparison of price history:

Click here to see full-sized image.

And this feature is not just for stocks, but you can also use it to compare ETFs and mutual funds.

These are just a few of the tremendous tools our Weiss Ratings site offers for your investment research. Please use them and highly consider trusting the Weiss Ratings to be your first destination when it comes to your investing decisions. And remember, the Weiss Ratings are unbiased and always free.

We strive to make your important, and sometimes difficult, investment decisions as easy as possible, and the Weiss Ratings are here and ready for your needs.

Whether you’re a football fan or not, there’s a lot to be excited about. A new season is knocking at our doorsteps, and so, too, are new ratings for stocks in our database, which are being updated daily as earnings season rolls on.

Cheers!

Gavin Magor