|

| By Gavin Magor |

There’s no denying it, as of late, the bulls have been on the loose, both in the markets, and quite literally!

I’m not one who dives too much into symbolism, but late last week, a bull escaped and was running on the train tracks of the New Jersey transit system, only miles away from Wall Street.

Check this out from ABC News:

Quite a sight, and probably a major reason some commuters were late to work, but it’s a funny coincidence given where the markets are currently at right now. The bull was eventually safely caught, but traders are the ones still on the loose.

And last week, we received more positive economic data, showing more signs of a soft landing.

Fed Inflation Fight Pivots Toward Cuts

Last Wednesday, Federal Reserve Chair Jerome Powell presented us with more of the same rhetoric at the December FOMC meeting.

But less than an hour after the Fed’s statement was released, Powell stated this on rate cuts: “There’s a general expectation that this will be a topic for us, looking ahead. That’s really what happened in today’s meeting,” he said.

That further ignited the market rally we’ve been seeing recently. Powell was playing the role of Santa, and he gifted investors by rocketing up the markets nearly 1.5% from midday trading to market close on Wednesday.

That said, let’s not get too carried ahead here. Sure, there is a much greater sense of optimism with declining inflation rates, strong consumer spending and hints of interest rate cuts next year … but we have a long way to go, with a lot of uncertainty.

Right now, I am predicting around three rate cuts next year, with the first coming most likely in March 2024, based on what I am seeing at the moment.

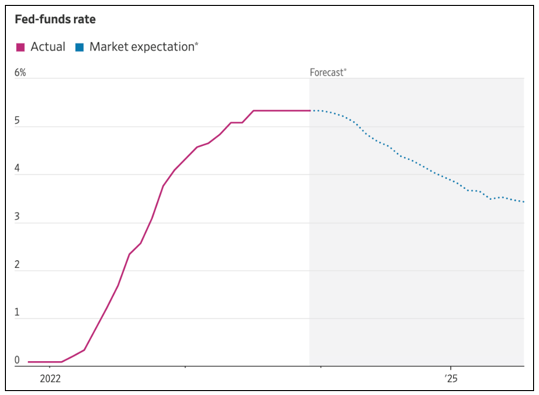

Source: Federal Reserve

The Federal funds rate is still in the 5.25% to 5.50% range. When rate cuts are enacted next year, it will unquestionably have a strong impact on our investment ratings.

Whilst it’s a crazy economic time, there is a bubble of sanity and safety — the Weiss Ratings.

Today, I want to show you some of the incredible tools investors can use when doing exchange-traded fund research.

E-T-F Research Made E-A-S-Y

I hear investors having trouble deciding which exchange-traded funds to be looking at, and I always say start with the Weiss Ratings. Currently, we rate 2,746 ETFs.

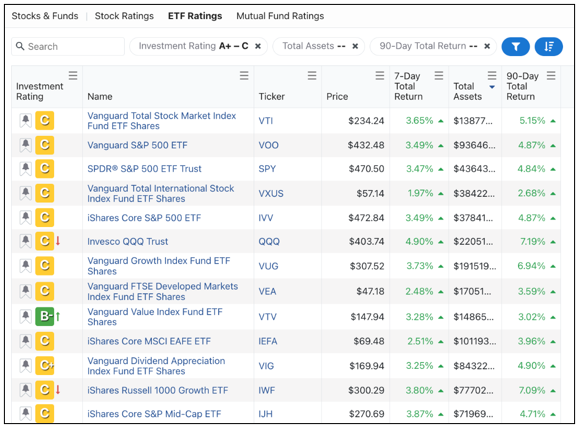

For example, let’s say you’re looking for a large ETF, with a stable Weiss Rating of “C” or higher and a strong return recently.

What you could do is head to the Weiss Ratings ETF Screener, and enter in your information. Here’s what populated for that criteria, after sorted by total assets:

Every investor is going to have different needs and wants to benefit from adding an ETF to their portfolios, such as adding bear or bull exposure with double-leveraged ETFs or with inverse ETFs that rise as the market falls … but what we have above are some solid ETF names that may be worthy of consideration for you.

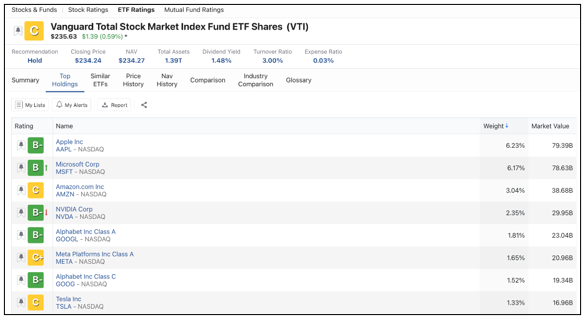

For example purposes, and because it’s the top on the list above, let’s take a closer look at the Vanguard Total Stock Market Index Fund ETF Shares (VTI).

You can conveniently see items such as top holdings, similar ETFs, total assets, dividend yield and much more.

Let’s take a look at some of its top holdings:

As you can see, it’s currently holding Apple (AAPL) and Microsoft (MSFT) as its two top stocks. Perhaps you want to further explore VTI or some of the other ETFs we rate.

This can all easily be found on our ETF screener page. I encourage you to explore our research, and all of our ratings for that matter.

Cheers!

Gavin Magor