|

| By Nilus Mattive |

“Rates are too high …

“The Fed needs to cut now …

“We need easier money ASAP …

“Wah, wah, wah!”

So goes the chorus of easy-money crybabies.

Indeed, the minute they heard inflation was running at “only” 3% a year (still 50% above the Fed’s annual target of 2%) …

The minute they saw one single “weak” economic number come across the wire (showing unemployment rising to 4.3%, which is low by historical standards) …

And the minute they felt the stock market “crash” (i.e., a couple days of modest declines followed by a 3% drop on August 5) …

Everyone from Senator Elizabeth Warren to Wharton Professor Jeremy Siegel was out in the media whining that the Fed was already behind the curve and needed to start easing monetary policy immediately.

No, seriously, IMMEDIATELY … as in right now!

They actually wanted Jerome Powell to call an emergency meeting to lower rates on the spot.

Never mind that Powell had just concluded a regular meeting in which he suggested the Fed was leaning toward a cut by September.

Or that emergency rates cuts have only previously happened in the wake of major market shocks like the 9/11 terrorist attacks or the Covid pandemic.

Our financial system has become so dependent on easy money that we now start hearing cries for it at the slightest sign of market discomfort.

I would liken these people to toddlers looking for their binkies except I doubt even pieces of rubber shoved into their mouths would be enough to shut them up.

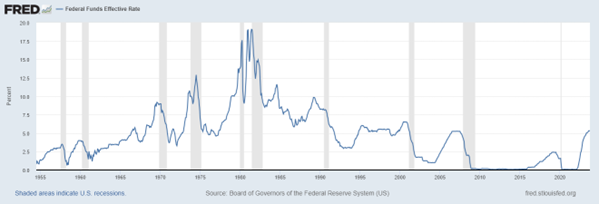

Now, just for a little perspective, here’s a 70-year chart of the Federal Reserve’s target interest rate …

As you can see, interest rates are NOT even high by any historical standard.

Prior to the year 2000, rates were typically in the 5% range. They rarely went much lower than that between 1970 and 2000, in fact.

And there were even times when rates were two or three times higher than they are right now!

Even including the last 20 years of artificially low interest rates, the Fed funds rate has averaged roughly 4.6% since 1954.

That means the current target range of 5.25% to 5.5% is just slightly above the norm.

So, the near-zero-rate environment we’ve been in is the REAL anomaly.

That abnormally easy money is exactly what caused our recent bout of inflation in the first place …

It’s what has driven financial markets into several other rolling bubbles and collapses over the last two decades …

And it’s what reinflated every one of them into something even worse the next time around.

Yet now, the easy-money crybabies don’t even want to wait until we actually see some of the excesses get flushed out of the system.

They want to stay ahead of it all by pumping in more money so we can avoid any type of suffering at all — the so-called “soft landing.”

Well, here’s a lesson from nature.

Forest fires enrich the soil … eliminate invasive species … and clear the way for new growth.

When you try to keep them from happening on a regular cycle, you end up creating conditions for an even bigger fire somewhere down the line.

Sound familiar?

Don’t get me wrong. Rising unemployment is unpleasant. Recessions are unpleasant. Stock market corrections are unpleasant. But they’re all part of the natural economic order.

What we have today is unbridled enthusiasm … resilient consumers still charging away with their credit cards … inflation running hotter than targets … the biggest bubble in asset prices yet … and a belief that pain can be avoided for eternity.

Indeed, stocks have already rebounded quite sharply now that investors expect as many as four rate cuts before the end of the year.

But here’s a little history lesson …

The stock market tends to DROP SHARPLY once the Fed begins cuttingrates.

According to research from Morgan Stanley, there have been nine different interest rate cycles over the past 50 years. And the stock market fell after the first rate cut during seven of them. The average decline was 23%.

What’s more, a closer look at the two periods when stocks didn’t fall after the first rate cut — in 1989 and 1995 — shows that both had normal yield curves.

That means short-term rates were substantially lower than longer-term rates, which is just about the polar opposite of the conditions we’ve been seeing this time around.

Hey, maybe this time really will be different.

And maybe my house will be worth a billion dollars five years from now.

Or …

Maybe there’s a reason that an experienced, level-headed investor like Warren Buffett is sitting on his biggest cash pile since 2004 …

And maybe we’ll still end up with an ACTUAL market crash that brings prices back to more reasonable levels.

That would really give the babies something to cry about.

Best wishes,

Nilus Mattive

P.S. The Fed isn’t the only arm of the U.S. government involved in the economy and the strength of our money. In fact, there are even bigger threats you don’t hear about in the rate-crazy financial media.

Check out this new presentation on the Digital Lockdown coming for your bank account.