|

| By Gavin Magor |

Believe it or not, exchange-traded funds are sort of a newer phenomenon for the stock market … but their surge in popularity should not surprise you.

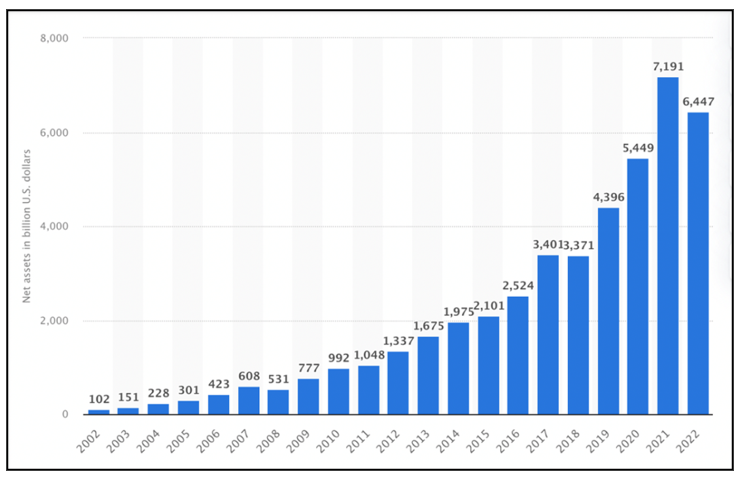

The first ETF ever listed in the U.S. was in 1993, and relatively speaking, ETFs have only gained popularity since. In 2010, total ETF investment was around $1 trillion. Within a decade, that number rose to nearly $4 trillion.

It's not difficult to see why they are a great way to invest in the stock market, and if you do invest, I highly recommend adding some ETF exposure to your portfolio.

They’re low cost and hold a variety of stocks bundled into one security, increasing your diversification with ease. They’re a perfect tool for asset allocation.

Don’t just take my word, check out this chart that shows total net asset under management of ETFs in the U.S. from 2002 to 2022, perfectly depicting their surge in popularity:

Click here to see full-sized image.

You may be familiar with some of the more popular ETFs such as the SPDR S&P 500 ETF (SPY), which tracks the performance of the S&P 500, and the Invesco QQQ Trust (QQQ), which tracks the performance of the Nasdaq.

The Invesco QQQ happens to be the “official ETF” of the NCAA, and if you are a March Madness fan, you probably have seen at least one of their many commercials touting how the investment vehicle gives you exposure to the booming new technologies of our time. And I agree that is, for the most part, true — as the ETF is comprised of shares of great forward-looking and highly Weiss-rated technology companies like Microsoft (MSFT), Apple (AAPL) and Broadcom (AVGO).

My All-Weather Portfolio Members especially know how important ETFs are to have as a hedge for both good times and bad.

Here at Weiss Ratings, just like with our stock ratings, and all of our ratings for that matter, we take ETF ratings very seriously. And it’s why I want to point out that ...

ETFs Are Not

All the Same

Each ETF we rate goes through a vigorous assessment test. You can see all our ETF ratings by clicking here.

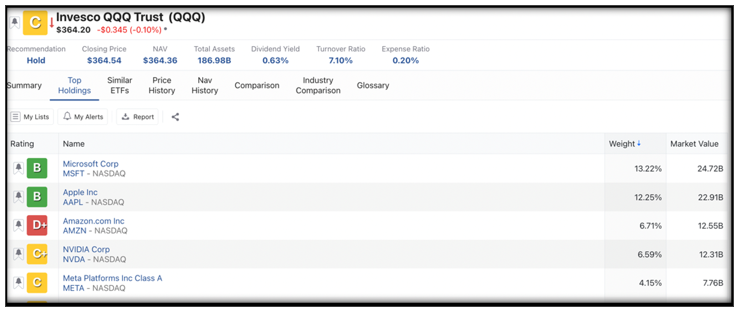

While that’s important, it’s also important to see the ratings of the investments in the ETFs. As in the case of the QQQ, you can see its top holdings on the Weiss Ratings site. Here are its top five:

Click here to see full-sized image.

As shown above, you can see the weight and market value of the stocks that comprise the ETF. Say, for some reason, Amazon.com (AMZN) isn’t your cup of tea and you don’t believe in the prospects of the stock … in that case, perhaps the Invesco QQQ Trust isn’t a good investment for you. Look, that’s your decision, and it’s why we are constantly doing research so that you can make those important decisions.

There are some other great features, which I highly encourage you to check out, such as “Similar ETFs” and “Price History.”

Don’t forget, many ETFs pay dividends, too. A highly popular ETF like the SPYcurrently has a dividend yield of 1.55%. And share prices of the past five years, not including dividends, are up around 61.4%, compared to the S&P 500 in a strikingly similar (and obviously not surprising) 61.6%.

Click here to see full-sized image.

ETFs are a great way to invest in the stock market, and the Weiss ratings are a great asset for you to use in your research.

Be sure to check out our ETF ratings and explore our various features. As the fiscal quarter ends today, some ETF exposure may just be what your portfolio is missing to start the next quarter off right.

Cheers!

Gavin Magor