|

| By Gavin Magor |

We’re finally seeing and feeling the financial pain of 10 interest rate hikes over the past 14 months.

And I’m here to warn you that it’s growing more intense.

The first blowback in March struck regional banks hard and fast. Many of them ignored the impact of higher rates on their held-to-maturity assets (mainly U.S. Treasurys). To make matters worse, investigations exposed industry-wide mismanagement of assets.

As clients withdrew more and more deposits after news of trouble spread like wildfire, three small- to midsize banks holding too many of these assets (Silicon Valley Bank, Signature Bank and First Republic Bank), couldn’t survive digital bank runs.

A few quiet weeks passed until another report of an ailing regional bank — Beverly Hills-based Pacific Western Bank — made fresh headlines. Only this time, the culprit was a loan book with 80% of its obligations tied to commercial real estate-backed loans and residential mortgages.

CRE Lending Risks

Banks that lend to CRE projects face two major risks:

1. There’s a credit risk if borrowers aren’t able to pay back their loans, mostly due to higher vacancies and declining property values.

2. There are ongoing liquidity risks. If a bank has a large exposure to the CRE sector, a decline in values would massively limit its ability to sell collateral.

Which is the reason PacWest is cutting its losses while it can. The bank is selling 74 construction loans worth $2.6 billion to real estate investment firm Kennedy-Wilson Holdings, at a discounted $2.4 billion. And it’s looking to dump even more.

PacWest is not alone by a long shot. The bulk of the $1.2 trillion in office space debt is owed to smaller regional banks. So, this just reeks of further troubles for it.

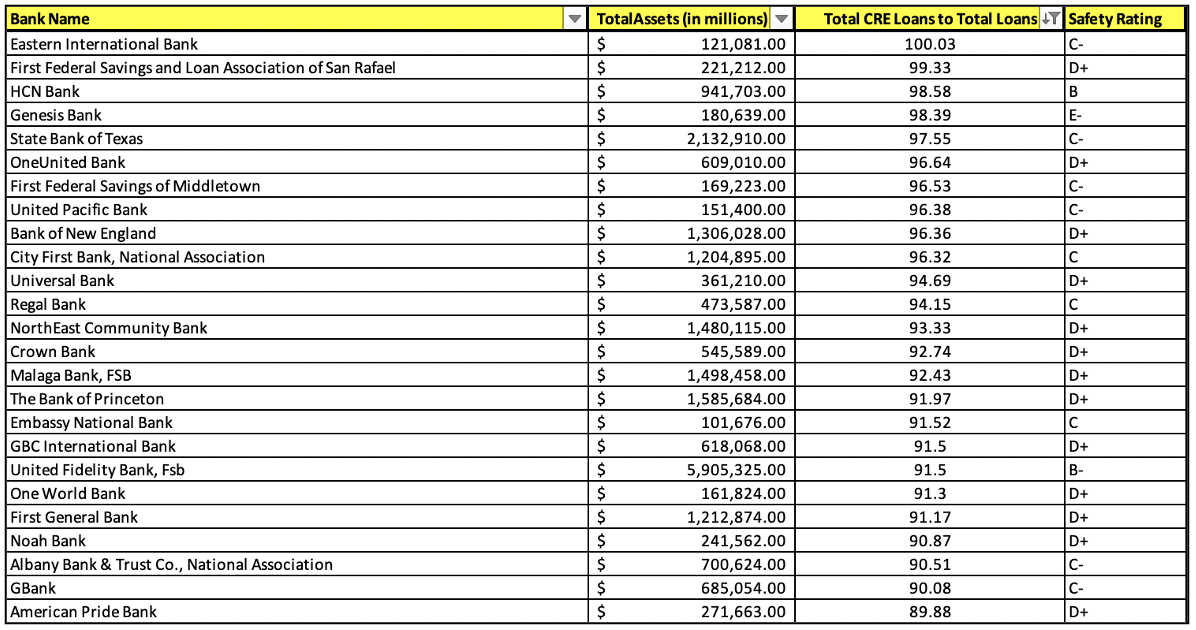

My research team identified banks with high exposure to CRE loans (as calculated by total CRE loans divided by total loans) and without much available liquidity. In other words, these banks are potentially going to be in sticky situations because of their exposure to the CRE industry.

Below is a list of 20 banks with a significant amount of CRE exposure, as calculated by total commercial real estate loans to total loans (represented in the third column).

Click here to see full-sized image.

Office Space Is

Driving CRE Vulnerability

The most vulnerable sector in the CRE industry today is office space. The pandemic turned the work-from-home craze into a way of life. And most people have no interest in going back to the office, even if their jobs depend on it.

Suspicion thatoffice space demand will never be robust again has also led to fewer investments in future projects or stoppages of construction.

We’ve already seen capital raising in CRE decrease by nearly 71% in Q1 2023, and vacancies have experienced the largest-ever increase recorded in North America of 15.3%, according to JLL, a global CRE company.

In fact, nearly 20% of office spaces — many sitting on prime real estate — are just empty (money-sucking) spaces dropping quickly in value. That percentage exceeds the vacancy rate during the Great Recession of 2008 and is worse in big cities.

The biggest problem for banks is that many office buildings are financed with short-term loans. Morgan Stanley (MS) estimates that approximately $1.5 trillion will be due by the end of 2025, potentially leading to a wave of loan defaults … which have already begun.

Brookfield Properties, one of the largest public real estate companies in the world, just defaulted on its second loan for two of its office towers in downtown Los Angeles.

On top of dropping occupancy rates, monthly mortgage payments soared from $300,000 to $880,000 over the past 12 months due to rising interest rates.

The combined loans were worth nearly $800 million, and according to Forbes, were provided by Citi Real Estate Funding, Morgan Stanley and an entity linked to Principal Financial Group.

Prior to that, Pacific Investment Management defaulted on $1.7 billion in office mortgages in major cities like Boston, New York and San Francisco, sending shockwaves through the commercial office industry.

Is the company insolvent? Not at all.

Now, I’m not saying that Pacific Investment did this, but it’s not out of the question for CRE owners/companies to strategically default on short-term loans that either need to be paid in full or refinanced at a higher rate than the original. Especially when you consider that office property values are down 25% over the past year.

It may not be the ethical thing to do, but it’s definitely the less costly option.

We’ll have to wait and see as risk of defaults grows. Forbes reported that five to 10 more office towers each month become at risk of defaulting because of low occupancy or maturing debt that would have to be refinanced at a higher rate.

So, banks with high exposure to these loans have a couple of options: follow in PacWest’s footsteps and sell loans now to cut their losses and reduce risk. Or ignore the risks as they did with devalued U.S. Treasurys and hope for the best. But you should …

Prepare for the Worst

If you do business with any of the above banks, it’s not time to panic. This list was made so that you can be aware and do additional research on the banks that you do business with.

What’s far more important is checking the Weiss Safety Ratings, as they are one of the best barometers you can use to see if your bank is in danger.

Sure, high CRE exposure is concerning, but if your bank has strong management and is doing business with stronger companies within the CRE industry, they may be OK.

However, there’s nothing OK about owning office-related REITs or stocks as the industry faces some very stiff headwinds that aren’t letting up anytime soon.

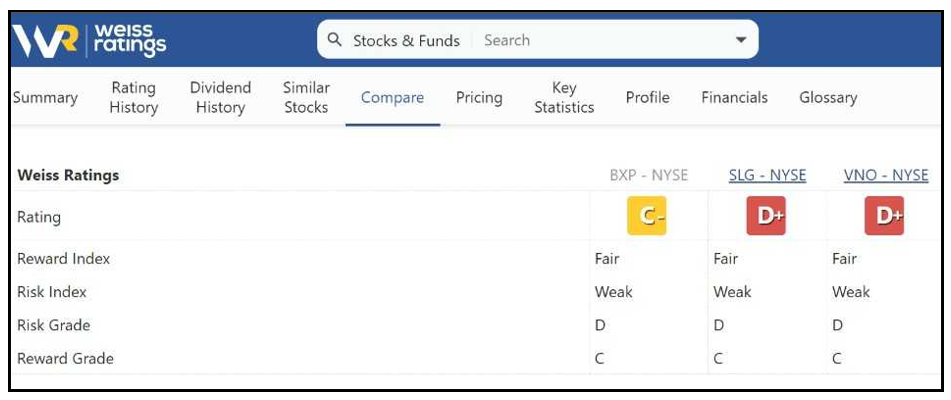

We’re already seeing the fallout. Some of the biggest office REITs, such as Boston Properties (BXP), SL Green Realty (SLG) and Vornado Realty (VNO), have fallen between 60% and 70% over a year. Based on Weiss ratings, none are worthy of your money.

Click here to see full-sized image.

I always say investors are the biggest losers when banks fail or companies go out of business. The FDIC doesn’t replenish your portfolio after a REIT or stock collapse in value.

If you do own shares of a REIT or company vulnerable to the latest bank- and CRE-related crisis, be sure to use Weiss Ratings to monitor their financial health and exposure to risk.

If you don’t like what you see, dump your shares.

You can thank me later.

Until next time,

Gavin

P.S. Another way to prepare for the worst is by joining my colleague Nilus Mattive’s service, Safe Money Report. Members of that service are in safety-rating positions in a range of asset classes all hedging against more market turmoil. Click here now to see how you can further protect your wealth.