|

| By Nilus Mattive |

2024 is going to bring a lot of changes. Not only will U.S. politics be on the forefront of the news cycle … what the Federal Reserve does with rates, what happens with jobs and inflation and more will all be huge drivers.

With two global wars pressing in, China’s slowdown and global energy prices in flux, it doesn’t get any easier to read the tea leaves outside of the U.S. either.

Any of these — or equally likely any others we can’t yet foresee — could cause dramatic ripples through domestic and international economies.

Maybe nothing happens. But maybe something does shake the Earth apart. It’s always good practice to prepare. And one way to do that is to look at how the Fed has acted in previous disaster scenarios.

The main tool it falls back on is always cutting rates. The market may want that right now. We’ll see when the time comes.

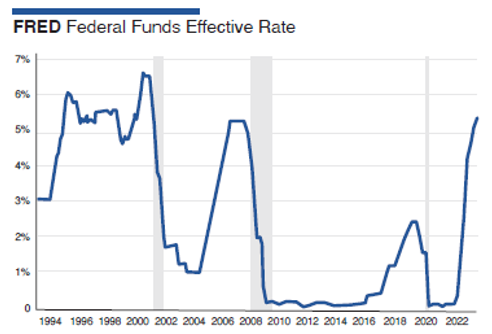

Before we prepare for that, here’s a quick recap of the Fed’s cuts and hikes over the past three decades …

Investors Get Scared, the Fed Acts … and Repeat

Between February 1994 and February 1995, the Fed effectively doubled its Fed funds target from 3% to 6%.

By July 1995, it was already cutting again and continued to do so through January 1996, right after the point when then-Chairman Alan Greenspan asked his audience at the American Enterprise Institute:

“How do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions? And how do we factor that assessment into monetary policy?”

This was after a strong bull run had already begun in the stock market, of course.

Yet after one quick quarter-point hike, the Fed continued lowering rates until they sat at 4.75% in November 1998.

Once it became completely obvious that the tech bubble was getting out of control, the Fed hiked by 1.5 percentage points between June 1999 and May 2000.

The Nasdaq peaked shortly thereafter in February 2000, and the events of Sept. 11 fueled the stock market decline.

The Fed cut rates 4.25 points in 2001 alone … and essentially ushered in two decades of near-zero interest rates.

Only now, after an extremely fast and aggressive series of rate hikes, have we finally come close to that 6% Fed funds rate we saw at the beginning of 2001 …

Think about that: For roughly two decades, the financial markets have become entirely used to virtually “free money.”

What kind of damage has that already done? What systemic risk has been created?

We started to see the possibility this past March, when the banking system began teetering as massive portfolios of Treasury bond reserves sharply plummeted in value. Make no mistake: That trouble is still lurking beneath the surface.

The same bond declines — remember, prices move inversely with yields — have punished plenty of retirement portfolios, too. In fact, U.S. Treasurys suffered their worst implosion in history — declining almost 25% in value since the summer of 2020.

Last year saw the largest annual percentage decline ever. The last time we saw anything remotely close was back in 1860, just before the Civil War broke out. Prices back then fell 18.7%.

This has spelled disaster for everything from bond mutual funds to mortgage rates, which are now hovering at their highest level since the end of the year 2000.

It remains to be seen how much damage to the U.S. economy and financial system has already taken place — that’s because there is a severe lag between higher rates and their effects in the real world.

Likewise, we don’t know how much higher rates can go from here.

While 10-year Treasurys have never posted three consecutive annual declines, they remain fairly close to doing so.

My current belief is that the Fed will continue pushing a “higher for longer” agenda — at least in name — until something seriously breaks.

At that point, we will see a very sharp about-face … just as we’ve seen every other time in modern history.

So how do you play the current situation and position yourself for an uncertain future?

The Smart Way to Hedge Against Future Rate Swings

If rates can go from zero to six in less than a year, then they can go up to 12 or down to zero just as easily.

Bond investors call this “interest rate risk,” because it can wreak havoc on the fixed-income portion of anyone’s portfolio.

That’s why I recommend using a technique known as laddering.

It works like this: You buy bonds (or other fixed-income investments like CDs) with various maturities.

Then, as each one matures, you reinvest the proceeds into new bonds at the highest rung of the ladder — i.e., the longest maturity you originally started with.

The approach allows you to always put some money to work at current rates while protecting other portions of the portfolio.

So if rates are falling, you have some of your money in longer-dated bonds.

If rates are rising, you get to keep buying at higher and higher rates.

Now, perhaps the best option — particularly in your retirement account — is eschewing individual bonds altogether and using mutual funds or exchange-traded funds instead.

While you won’t have a ladder in the traditional sense, you will get good diversification both in length and types of bonds held.

How “tall” should your ladder be?

Only you can decide on the upper limit of the maturities you’re going to purchase, but I wouldn’t hesitate to add some longer-duration investments.

In fact, I think now is a very good time to do so. That’s why I just recommended the final rung of a ladder we’ve been building in Safe Money Report.

Since it is such a fresh recommendation, I can’t share the exact details here. But, if you want to learn more about what exactly to buy to protect against this inevitability and how to structure it, I urge you to click here.

Best wishes,

Nilus Mattive